Last updated: July 28, 2025

Introduction

Ketoconazole is an azole antifungal agent first introduced in the 1980s, widely used for treating systemic and topical fungal infections. Over the years, its application has expanded from dermatological conditions to systemic fungal diseases, albeit with some limitations due to safety concerns. With an evolving pharmaceutical landscape, understanding the market dynamics and future sales projections for ketoconazole is pivotal for stakeholders, including pharmaceutical manufacturers, investors, and healthcare policymakers.

Market Overview

Historical Market Performance

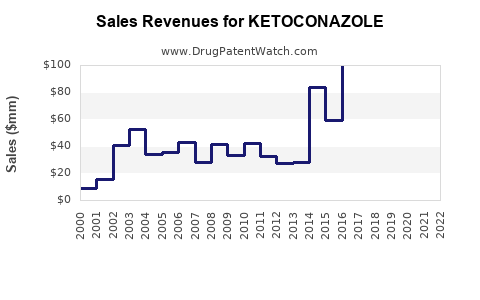

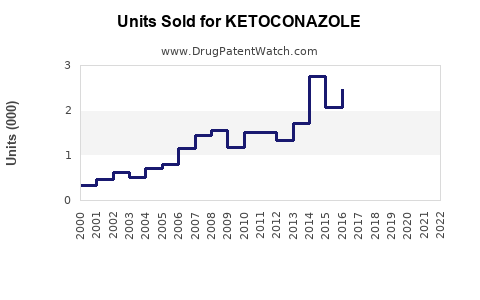

Initially, ketoconazole dominated the antifungal market for both topical and systemic applications. Its broad-spectrum antifungal activity and oral formulation led to extensive utilization, especially in dermatophyte infections, candidiasis, and certain systemic mycoses. However, its market share declined sharply following the withdrawal or restriction of oral formulations in several regions, primarily due to safety issues like hepatotoxicity and drug interactions (e.g., CYP3A4 inhibition leading to adverse effects).

Despite this, topical formulations maintain a steady presence owing to their favorable safety profile. The global antifungal market was valued at approximately USD 11 billion in 2022, with ketoconazole representing a significant segment before the decline of systemic formulations.

Regulatory Landscape and Impact

Regulatory agencies such as the US FDA and EMA have imposed restrictions on oral ketoconazole, citing risks of liver injury. In 2013, the FDA issued a warning against oral use, leading to a shift in prescribing practices towards alternative antifungals like fluconazole and itraconazole. This regulatory shift has caused a notable decline in systemic ketoconazole sales but has not severely impacted topical formulations, which are deemed safer.

Current Market Dynamics

Therapeutic Repositioning and Innovator Strategies

While sales of oral ketoconazole have diminished, pharmaceutical companies have repositioned the drug primarily as a topical antifungal agent, with products available as creams, gels, and shampoos. Notable brands such as Nizoral and Ketodan continue to command market share due to their efficacy, affordability, and established brand recognition.

Emerging formulations, including combination topical products and over-the-counter (OTC) variants, are expanding the reach of ketoconazole in self-care markets, especially in developing regions where OTC availability drives sales.

Market Segments

- Topical Dermatological Market: Dominant segment with consistent growth driven by increasing prevalence of dermatophyte infections, seborrheic dermatitis, and candidiasis.

- Over-the-Counter (OTC) Market: Growing due to consumer demand for accessible treatments.

- Prescription Market: Now limited mainly to specialized cases or resistant infections, with sales impacted by alternative antifungals.

Geographical Distribution

- North America & Europe: Mature markets with declining systemic use, stable topical sales.

- Asia-Pacific: Rapidly expanding market driven by rising dermatological conditions, increasing OTC sales, and developing healthcare infrastructure.

- Latin America & Africa: Emerging markets with higher OTC adoption, though constrained by regulatory and supply chain challenges.

Sales Projections (2023-2030)

Assumptions and Methodology

Projections are based on current trends, regulatory environment, demographic shifts, and technological advancements in antifungal therapies. Market data from sources like GlobalData, IQVIA, and industry reports informs these forecasts, complemented by expert analysis of regional dynamics.

Forecast Overview

| Year |

Predicted Global Topical Ketoconazole Sales (USD Millions) |

CAGR (Compound Annual Growth Rate) |

Notes |

| 2023 |

$1,200 |

— |

Baseline year, primarily topical |

| 2024 |

$1,290 |

7.5% |

Growth driven by OTC expansion and emerging markets |

| 2025 |

$1,390 |

7.7% |

Increased penetration in Asia-Pacific |

| 2026 |

$1,495 |

7.6% |

Continued growth; product diversification |

| 2027 |

$1,605 |

7.4% |

Market stabilization |

| 2028 |

$1,720 |

7.2% |

Incremental growth as newer formulations enter market |

| 2029 |

$1,840 |

7.0% |

Steady expansion, channels diversify |

| 2030 |

$1,970 |

6.8% |

Peak forecast; market maturation |

Key factors influencing sales projections:

- Rising dermatological conditions: Increase in fungal skin infections globally, especially in tropical and developing regions.

- OTC availability: Growing consumer preference for OTC antifungal products, boosting sales.

- Regulatory stability: Continued restrictions on systemic use should maintain a focus on topical formulations.

- Competitive landscape: Entry of new antifungal molecules or combination therapies could modulate sales dynamics.

Market Drivers and Barriers

Drivers

- Increasing prevalence of dermatophyte infections: Conditions such as athlete's foot and seborrheic dermatitis are on the rise, propelling demand.

- Cost-efficiency and accessibility: Ketoconazole remains affordable compared to newer antifungals, appealing to emerging markets.

- Brand loyalty & physician preference: Established formulations have entrenched market positions.

Barriers

- Safety concerns and regulatory restrictions: Limiting systemic use, reducing overall sales potential.

- Emergence of alternative antifungals: Improved safety profiles of drugs like terbinafine and fluconazole are attracting prescribers.

- Shift towards OTC products: Market saturation may limit further sales growth.

Future Outlook & Opportunities

The future of ketoconazole hinges on its repositioning within the antifungal spectrum. Key opportunities include:

- Development of novel topical formulations: Enhanced penetration, reduced side effects, and combination products with anti-inflammatory agents.

- Expanding OTC distribution channels: Capitalizing on self-care trends, especially in developing countries.

- Regional market penetration: Targeted marketing in Asia-Pacific, Latin America, and Africa.

- Research into new indications: Exploring potential synergies in combination therapies or alternative uses.

However, the market will remain constrained by safety concerns and competition from newer antifungal modalities.

Key Takeaways

- Market contraction in systemic formulations due to safety issues has shifted ketoconazole’s focus primarily to topical applications with stable and growing sales.

- Global sales are projected to grow modestly at approximately 6.8%–7.8% CAGR through 2030, driven by rising dermatological infections and OTC product expansion.

- Emerging markets present substantial growth opportunities, especially with increasing healthcare access and consumer demand for affordable OTC antifungals.

- Safety regulations and competitive pressures necessitate ongoing innovation and strategic repositioning for sustained market presence.

- Stakeholders should monitor regulatory policies continually, as restrictions on systemic use may further influence market dynamics.

FAQs

1. What factors are contributing to the decline of systemic ketoconazole sales?

Regulatory agencies like the FDA and EMA have restricted the use of oral ketoconazole due to hepatotoxicity risks. This significantly reduced systemic prescriptions, shifting focus toward topical formulations.

2. How is the ketoconazole market expected to evolve in developing countries?

The growth is promising due to increasing dermatological disease prevalence, rising healthcare infrastructure, and the accessibility of OTC products, particularly in regions like Asia-Pacific and Latin America.

3. What are the main competitors to ketoconazole in the antifungal market?

Azoles such as fluconazole and itraconazole, and allylamines like terbinafine, provide alternative systemic options. Topically, drugs like clotrimazole and miconazole also compete with ketoconazole.

4. Is there any ongoing research on new indications for ketoconazole?

Research primarily focuses on optimizing topical formulations and combination therapies. There is limited exploration of new indications due to safety limitations of systemic use.

5. Can ketoconazole regain its market share in systemic antifungals?

Unlikely, given the safety profile concerns. The focus remains on safer, newer antifungals with better systemic safety profiles, further constraining ketoconazole's systemic market revival.

References

- GlobalData. Antifungal Market Report, 2023.

- US Food and Drug Administration (FDA). Warnings and Precautions for Ketoconazole, 2013.

- IQVIA. Pharmaceutical Market Analysis Reports, 2022.

- European Medicines Agency (EMA). Safety Review of Oral Ketoconazole, 2012.

- Market Intelligence Reports. Dermatophyte Infections & Antifungal Market Trends, 2023.

By understanding the nuanced shifts in the ketoconazole market landscape, stakeholders can make informed strategic decisions, capitalize on regional growth opportunities, and navigate the regulatory environment effectively.