Share This Page

Drug Sales Trends for KARBINAL ER

✉ Email this page to a colleague

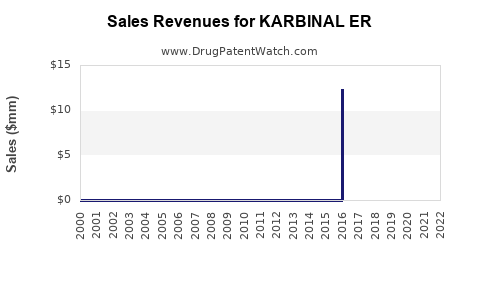

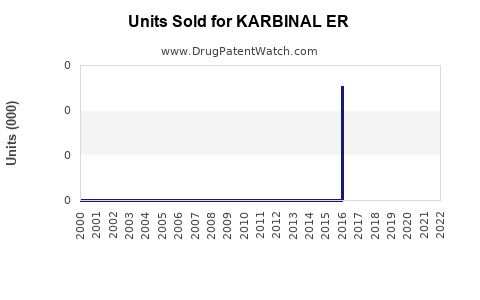

Annual Sales Revenues and Units Sold for KARBINAL ER

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| KARBINAL ER | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| KARBINAL ER | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| KARBINAL ER | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| KARBINAL ER | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| KARBINAL ER | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for KARBINAL ER

Introduction

KARBINAL ER (carbamazepine extended-release) is a prescription medication primarily used in the management of epilepsy, trigeminal neuralgia, and bipolar disorder. Its extended-release formulation offers enhanced patient compliance, consistent plasma levels, and improved safety profiles. As the pharmaceutical landscape evolves, understanding KARBINAL ER’s market dynamics and sales potential is essential for stakeholders. This analysis provides a detailed examination of current market conditions, competitive landscape, regulatory environment, and future sales forecasts.

Therapeutic Indications and Unmet Needs

KARBINAL ER addresses critical neurological and psychiatric conditions. Its extended-release formulation is particularly advantageous for patients requiring stable plasma concentrations, reducing peak-trough fluctuations associated with immediate-release carbamazepine. The medication's efficacy in epilepsy and trigeminal neuralgia is well-established, while its role in bipolar disorder remains promising, especially within specific patient subsets. Despite these strengths, unmet needs persist, including improved tolerability, minimized adverse effects, and enhanced adherence, offering opportunities for KARBINAL ER to expand its market share.

Market Landscape

Global Market Size and Growth Potential

The global anti-epileptic drug market was valued at approximately USD 4.4 billion in 2022, with projections indicating a CAGR of around 6% through 2030 [1]. The bipolar disorder treatment segment, valued at USD 1.3 billion in 2022, is also expanding consistently at about 4-5% annually. These growth trends are driven by increasing prevalence, rising awareness, and advances in drug delivery systems, positioning KARBINAL ER favorably given its extended-release formulation.

Regional Market Dynamics

- North America: Dominates the market due to high prevalence rates of epilepsy (~1% of the population), established healthcare infrastructure, and favorable reimbursement policies. The U.S. accounts for a significant share, with the FDA’s approval process streamlining market entry for new formulations [2].

- Europe: Exhibits steady growth inspired by expanding neurological disorder diagnoses and aging populations. Variations in healthcare policies across countries influence formulary inclusion and prescribing patterns.

- Asia-Pacific: Rapidly growing markets, driven by large populations, rising healthcare expenditure, and increasing awareness. Price sensitivity and regulatory challenges currently limit rapid expansion but present considerable long-term potential.

Competitive Landscape

KARBINAL ER faces competition from multiple formulations of carbamazepine—including generic immediate-release versions, other extended-release products, and alternative therapies such as oxcarbazepine and valproate. Notably:

- Teva's Tegretol XR and Novartis' Equetro are prominent extended-release options.

- Generic versions significantly impact pricing strategies and market penetration.

- The entry of new, innovative treatments targeting refractory epilepsy and bipolar disorder further pressures KARBINAL ER's market share.

Regulatory Environment and Market Access

Regulatory approval is crucial. KARBINAL ER's FDA approval underscores its safety and efficacy, facilitating market entry in North America. However, approval timelines and requirements in other regions could influence sales trajectories. Insurance reimbursement policies and formulary placements significantly impact patient access and prescribing behaviors, especially in highly regulated markets such as the U.S. and Europe.

Market Drivers and Barriers

Drivers:

- Patient-centric formulation: Extended-release improves adherence and reduces side effects.

- Expanding indications: Potential for use in bipolar disorder broadens the market.

- Growing neurological disorder prevalence: Aging populations and improved diagnostics increase demand.

- Regulatory incentives: Fast-track or orphan drug status can accelerate approvals.

Barriers:

- Generic competition: Price erosion from generics limits revenue potential.

- Pricing and reimbursement constraints: Especially in cost-sensitive markets.

- Side effect profile: Hematologic and dermatologic adverse events may hinder widespread adoption.

- Limited awareness: Among prescribers unfamiliar with KARBINAL ER's benefits.

Sales Projections (2023-2030)

Assumptions & Methodology

Forecasts are based on current market data, FDA approval timelines, competitive dynamics, and potential expansion into new indications. A conservative approach accounts for generic erosion while projecting phased penetration in emerging markets.

2023–2025: Initial Growth Phase

- Revenue estimates: USD 150–200 million globally in 2023.

- Market share: Around 10-12% in the novel extended-release segment.

- Growth driven by increased prescriber awareness, regulatory approvals in additional regions, and early indications of improved patient outcomes.

2026–2028: Expansion and Maturation

- Revenue estimates: USD 300–400 million annually, as formulations achieve broader formulary acceptance.

- Market share: 15-20%, augmented by approval for bipolar disorder and enhanced marketing efforts.

- Emerging markets: Contribute approximately 20% of sales, with continued regulatory filings.

2029–2030: Peak Market Penetration

- Revenue estimates: USD 500–700 million, contingent upon successful indication expansion and price optimization strategies.

- Competitive landscape: Heightened competition may curb growth; however, targeted marketing and differentiated positioning can sustain momentum.

Risks and Sensitivity Analysis

Sales depend heavily on regulatory approvals, formulary positioning, pricing strategies, and competitive responses. A delay in approvals or aggressive generic price competition could reduce projections by 20–30%. Conversely, early indication of superior tolerability or collaboration with payers could accelerate growth.

Strategic Opportunities

- New Indication Development: Exploring efficacy in bipolar disorder, neuropathic pain, and refractory epilepsy could unlock additional revenue streams.

- Differentiation: Emphasizing pharmacokinetic advantages, safety profile, and patient-centric benefits can support premium pricing.

- Market Expansion: Focused efforts in Asia-Pacific and Latin America through partnerships and localized regulatory strategies may add substantial volume.

Conclusion

KARBINAL ER holds substantial market potential within the neurological and psychiatric therapeutic space. Its extended-release advantages position it favorably amidst growing demand for effective, tolerable chronic therapies. While challenges such as generic competition and pricing pressures exist, strategic branding, indication expansion, and geographic diversification can optimize sales trajectories. Realizing this potential will depend on regulatory agility, payer engagement, and differentiated clinical positioning.

Key Takeaways

- KARBINAL ER’s extended-release formulation offers a competitive edge in epilepsy, trigeminal neuralgia, and bipolar disorder management.

- The global market size for antiepileptic and bipolar medications is expanding at a CAGR of approximately 5-6%, creating favorable growth conditions.

- Market entry barriers include fierce generic competition and reimbursement constraints, which require strategic mitigation.

- Sales are projected to reach USD 500–700 million globally by 2030, contingent on approval of new indications and market penetration strategies.

- Differentiation and geographic expansion remain critical to maximizing revenue potential.

FAQs

1. How does KARBINAL ER differentiate from other carbamazepine formulations?

KARBINAL ER offers an extended-release profile that maintains stable plasma levels, reduces dosing frequency, and minimizes peak-related side effects, leading to improved adherence and tolerability compared to immediate-release formulations.

2. What are the key regulatory hurdles for expanding KARBINAL ER’s global footprint?

Regulatory hurdles include regional approval processes, demonstration of bioequivalence or clinical superiority, and adherence to regional safety standards. Differences in healthcare systems may also impact market access strategies.

3. How significant is generic competition for KARBINAL ER?

Generic versions of carbamazepine are widespread, especially for immediate-release forms. Extended-release generics are emerging, exerting downward pressure on prices, making brand differentiation and indication expansion crucial.

4. What is the potential for KARBINAL ER in non-epilepsy indications?

Preliminary data suggest potential in bipolar disorder management, providing avenues for label expansion and growth in psychiatric markets.

5. How can stakeholders optimize KARBINAL ER’s sales growth?

Strategies include emphasizing its pharmacokinetic benefits, pursuing additional indications, developing regional partnerships, engaging payers proactively, and implementing targeted marketing campaigns.

References

[1] MarketWatch, "Anti-Epileptic Drugs Market Size," 2022.

[2] FDA, "Drug Approvals and Labeling."

More… ↓