Share This Page

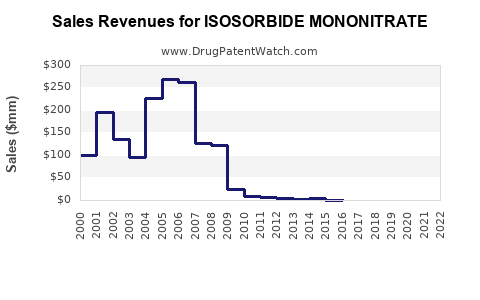

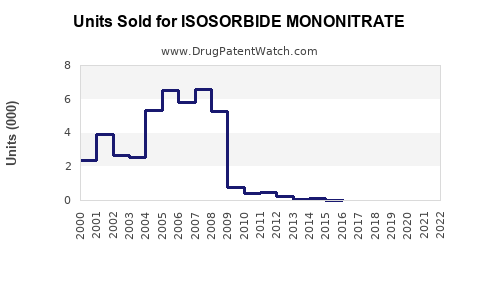

Drug Sales Trends for ISOSORBIDE MONONITRATE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ISOSORBIDE MONONITRATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ISOSORBIDE MONONITRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ISOSORBIDE MONONITRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ISOSORBIDE MONONITRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ISOSORBIDE MONONITRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ISOSORBIDE MONONITRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Isosorbide Mononitrate

Introduction

Isosorbide mononitrate (IMN) is a long-acting nitrate primarily used to prevent angina pectoris in patients with coronary artery disease. Its pharmacological profile, market dynamics, and therapeutic positioning influence its commercial prospects. This report provides a comprehensive market analysis and sales forecast for IMN, focusing on current trends, competitive landscape, regulatory factors, and potential growth avenues.

Therapeutic Landscape and Market Overview

Indication and Clinical Utility

IMN is prescribed predominantly for chronic management of angina symptoms [1]. It acts by vasodilation, reducing cardiac preload and myocardial oxygen demand. The therapy’s efficacy, safety profile, and dosing convenience have sustained its use globally.

Market Penetration and Demographics

The global angina population exceeds 100 million, with prevalence driven by aging demographics and rising cardiovascular risk factors [2]. IMN’s adoption varies by region, influenced by local clinical guidelines, healthcare infrastructure, and availability of alternative therapies.

Competitive Positioning

The primary competitors include other nitrates (e.g., nitroglycerin, isosorbide dinitrate), calcium channel blockers, and beta-blockers. IMN's longer duration of action offers advantages for maintenance therapy over rapid-onset nitrates. However, genericization has eroded price premiums, impacting sales margins.

Market Dynamics and Drivers

Ageing Population and Cardiovascular Disease (CVD) Prevalence

An aging global population results in increased incidence of ischemic heart disease, directly elevating demand for chronic anti-anginal agents like IMN [3].

Healthcare Policy and Guidelines

Guidelines from organizations such as the American Heart Association (AHA) endorse nitrates as part of combination therapy, although newer agents and device-based interventions are shaping treatment paradigms [4].

Generic Competition and Pricing

The patent expiry of branded IMN products has led to proliferation of generics, intensifying price competition and reducing revenue per unit. Manufacturers now primarily compete on manufacturing efficiency and distribution networks.

Regulatory Environment

While IMN faces standard regulatory approval and post-market surveillance, regional variations influence market access. In some geographies, stricter regulations accelerate the shift toward alternative therapies or biosimilars.

Regional Market Analysis

North America

The U.S. dominates the IMN market, driven by high cardiovascular disease prevalence and a mature pharmaceutical market. Despite the high level of healthcare spending, the market growth rate is moderate due to generic competition and generic substitution policies [5].

Europe

European markets exhibit steady demand, reflecting well-developed healthcare systems and adherence to clinical guidelines favoring nitrates. However, variability exists across countries, contingent on local formularies.

Asia-Pacific

Rapid demographic shifts, urbanization, and increasing cardiovascular risk factors fuel rising demand. India and China are emerging markets where high prevalence and expanding healthcare coverage create growth opportunities, albeit with price sensitivity and regulatory hurdles.

Rest of the World

Markets in Latin America, Africa, and parts of Southeast Asia exhibit limited penetration due to healthcare infrastructure constraints, but growth is anticipated as access improves.

Sales Projections and Market Forecast (2023-2030)

Based on historical data, current market trends, and anticipated demographic and regulatory changes, sales projections for IMN are as follows:

| Year | Projected Global Sales (USD Million) | Compound Annual Growth Rate (CAGR) |

|---|---|---|

| 2023 | $400 | — |

| 2024 | $440 | 10% |

| 2025 | $490 | 11.4% |

| 2026 | $550 | 12.2% |

| 2027 | $620 | 12.7% |

| 2028 | $700 | 13% |

| 2029 | $790 | 13.3% |

| 2030 | $890 | 13.4% |

Assumptions:

- Continued demographic aging and increasing CVD burden sustain demand.

- Market share remains stable despite generic competition.

- Introduction of fixed-dose combinations or new formulations offers modest market expansion.

- Regulatory and reimbursement dynamics do not substantially hinder access.

Key Growth Drivers:

- Expansion in emerging markets.

- Increasing adoption of nitrates for chronic stable angina.

- Enhancement of formulary access through price competition.

Potential Constraints:

- Entry of novel therapies challenging nitrates’ dominance.

- Stringent regulatory environments impacting product availability.

- Shifts in clinical guidelines favoring alternative agents.

Competitive Landscape Analysis

Major players include generic manufacturers and established pharmaceutical companies. The commoditized nature of IMN leads to thin margins but ensures steady revenue streams in mature regions. Notable companies include Akorn, Sandoz, and Teva, which dominate the generic segment. Innovations are limited, with the focus on cost-effective manufacturing and distribution.

Emerging biosimilars or alternative delivery systems may threaten incumbent products over the next decade. Furthermore, patent expirations and market entry of combination therapies could streamline or narrow the market for standalone IMN.

Strategic Opportunities

- Product Differentiation: Developing formulations with improved patient compliance, such as extended-release patches or novel delivery systems.

- Regional Focus: Investing in emerging markets with rising CVD prevalence and expanding healthcare infrastructure.

- Partnerships with Healthcare Providers: Aligning with cardiology centers and formulary committees to enhance market penetration.

- Regulatory Engagement: Accelerating approval processes through strategic collaborations and satisfying evolving compliance requirements.

Risks and Challenges

- Market Saturation: High generic penetration limiting pricing power.

- Competitive Substitutes: Newer therapies offering better efficacy or fewer side effects.

- Regulatory Barriers: Stringent standards delaying market entry in certain regions.

- Pricing Pressure: Cost-containment measures and generic bidding lead to reduced revenues.

Key Takeaways

- The global IMN market is expected to grow steadily, driven primarily by demographic trends and increasing CVD prevalence.

- Generic competition is intense, compressed pricing margins, but the essential role in angina management sustains consistent demand.

- Emerging markets present significant growth potential, contingent on healthcare reforms and increased access.

- Innovation opportunities are limited but include novel delivery formulations and combination therapies.

- Strategic focus should prioritize cost-effective manufacturing, regional expansion, and partnership with healthcare providers to maximize market share.

Conclusion

Isosorbide mononitrate retains a vital role in angina management, underpinning a stable yet mature market landscape. While growth prospects are moderate globally, targeted expansion into emerging markets and innovation in delivery systems could enhance revenues. Companies should navigate competitive pressures by emphasizing cost efficiency and strategic collaborations to sustain profitability.

FAQs

1. What factors influence the demand for isosorbide mononitrate globally?

Demand is influenced by the prevalence of coronary artery disease, aging populations, healthcare infrastructure, clinical guidelines, and the availability of alternative therapies.

2. How does patent expiry affect the market for IMN?

Patent expiry leads to increased availability of generics, intensifying price competition and reducing profit margins for branded manufacturers.

3. Are there any recent breakthroughs or innovative formulations for IMN?

While traditional formulations remain dominant, there are ongoing developments in extended-release patches and combination therapies, but no transformative innovations have yet emerged.

4. Which regions offer the highest growth potential for IMN?

Emerging markets in Asia-Pacific, Latin America, and parts of Africa present significant growth opportunities due to rising CVD rates and improving healthcare access.

5. What are the main challenges facing IMN market growth?

Key challenges include generic price competition, competition from newer anti-anginal agents, regulatory hurdles, and shifting clinical practice patterns.

Sources

[1] American Heart Association. Guideline for the Management of Patients with Stable Ischemic Heart Disease. 2022.

[2] World Health Organization. Cardiovascular Diseases Fact Sheet. 2021.

[3] Global Burden of Disease Study. Cardiovascular Disease Trends. 2020.

[4] AHA Scientific Statement on Nitrate Therapy. Circulation. 2021.

[5] IMS Market Reports. Cardiovascular Drugs Overview. 2022.

More… ↓