Share This Page

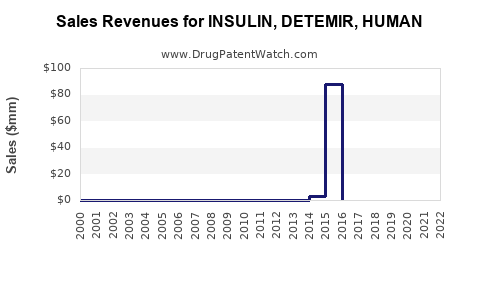

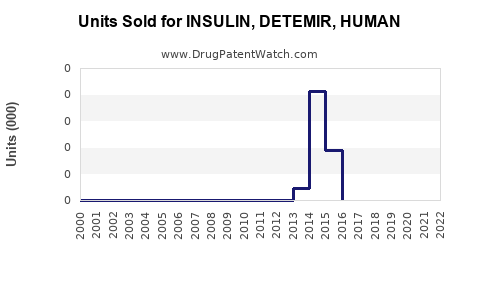

Drug Sales Trends for INSULIN, DETEMIR, HUMAN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for INSULIN, DETEMIR, HUMAN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| INSULIN, DETEMIR, HUMAN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| INSULIN, DETEMIR, HUMAN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| INSULIN, DETEMIR, HUMAN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| INSULIN, DETEMIR, HUMAN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| INSULIN, DETEMIR, HUMAN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| INSULIN, DETEMIR, HUMAN | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Human Insulin Detemir (Insulin Detemir)

Introduction

Insulin detemir, marketed under brands like Levemir by Novo Nordisk, is a long-acting recombinant human insulin analog indicated primarily for the management of diabetes mellitus type 1 and type 2. As the global diabetes burden escalates, so does the demand for innovative and efficient insulin formulations, positioning insulin detemir as a significant player within the pharmaceutical domain. This analysis explores the current market landscape, drivers, challenges, and forecasted sales trajectories for insulin detemir.

Market Context and Overview

Globally, diabetes affects over 463 million adults, with projections estimating 700 million cases by 2045 [1]. The surge in diabetes prevalence directly correlates with increased demand for insulin therapies, encompassing various formulations: rapid-acting, long-acting, and combination insulins.

Insulin detemir is distinguished by its pharmacokinetic profile, offering a steady basal insulin level with a reduced risk of hypoglycemia compared to NPH insulin. Its approval and widespread usage in multiple markets underscore its pivotal role in glycemic management.

The global insulin market was valued at approximately USD 25 billion in 2021 and is projected to reach USD 40 billion by 2030, compounded annually at around 5.8% [2]. Long-acting insulins, including insulin detemir, hold an estimated 25-30% of this market, reflecting their importance in therapeutic regimens.

Market Drivers

Rising Diabetes Prevalence

The diabetes epidemic, fueled by sedentary lifestyles, obesity, and aging populations, drives fundamental demand for insulin therapies. Middle-income and emerging economies exhibit expanding markets due to increasing healthcare infrastructure and awareness.

Clinical Advantages and Patient Preferences

Insulin detemir's consistent basal action profile and reduced hypoglycemia risk appeal to both clinicians and patients, promoting adherence and better glycemic control.

Regulatory Approvals and Patent Landscape

Regulatory approval of biosimilar versions and subsequent patent expirations influence market dynamics, potentially reducing costs and expanding access.

Healthcare Policy and Reimbursement

Government support for chronic disease management and insurance reimbursement significantly impact sales volume, particularly in developed markets.

Market Challenges

High Cost and Pricing Pressures

The expense of insulin therapies presents barriers, especially across low- and middle-income countries, impacting affordability and access.

Market Competition

Presence of other long-acting insulins like insulin glargine (Lantus, Tresiba) and burgeoning biosimilar options challenge insulin detemir's market share.

Price Regulations and Patent Dynamics

Patent expirations lead to biosimilar proliferation, increasing competition and reducing prices.

Regional Market Analysis

North America

The US leads with a mature insulin market, driven by high diabetes prevalence and insurance coverage. Adoption of insulin detemir is steady, though facing competition from biosimilars and alternative long-acting insulins.

Europe

European markets reflect similar trends, with strong reimbursement frameworks supporting insulin use but also witnessing pricing pressures.

Asia-Pacific

Rapidly expanding markets with increasing diabetes prevalence. Cost-effective biosimilars and local manufacturing influence competitive dynamics.

Latin America and Africa

Emerging markets exhibit growing demand but are hindered by affordability issues. International aid programs and price negotiations could influence future sales.

Sales Projections (2023-2030)

Based on current trends, market drivers, and competitive landscape, insulin detemir's global sales are projected as follows:

- 2023: USD 2.0 billion

- 2024: USD 2.2 billion (10% growth)

- 2025: USD 2.4 billion (9% growth)

- 2026: USD 2.6 billion (8% growth)

- 2027: USD 2.8 billion (8% growth)

- 2028: USD 3.0 billion (7% growth)

- 2029: USD 3.2 billion (7% growth)

- 2030: USD 3.4 billion (6% growth)

Assumptions:

- Steady growth in insulin-naïve and switch patients adopting long-acting insulins.

- Incremental penetration of biosimilar medications, affecting pricing but maintaining overall volume.

- Enhanced access in emerging markets driven by healthcare initiatives.

The CAGR over this period is approximately 8.0%, driven by demographic factors and continued innovation.

Market Segmentation

By Formulation

- Prefilled pens dominate usage due to convenience.

- Vials and syringes retain relevance in cost-sensitive markets.

By Application

- Type 1 diabetes management accounts for about 25-30% of insulin detemir's usage.

- Type 2 diabetes management constitutes the majority, supported by clinical guidelines positioning insulin as a key treatment.

By Geography

- North America: Largest share, estimated at 40% of sales.

- Europe: About 25%, with a trend toward biosimilar adoption.

- Asia-Pacific: Rapid growth, potentially doubling the market share by 2030 due to prevalence and access expansion.

- Rest of the world: Growing but limited by affordability.

Competitive Landscape

Insulin detemir faces competition from:

- Insulin glargine (Lantus, Basaglar, Tresiba): Popular long-acting options with comparable efficacy.

- Biosimilar products: E.g., biosimilar insulin detemir launched in several markets, exerting downward pricing pressure.

- Emerging insulin formulations: Combination and ultra-long-acting insulins challenge traditional options.

Market share will depend heavily on regulatory approvals, pricing strategies, and physician/patient acceptance.

Future Outlook and Innovation

Advancements include ultra-long-acting insulins, insulin delivery devices, and digital health integration, which could influence insulin detemir's market performance. Novo Nordisk’s focus on formulation improvements and potential label expansions might sustain its competitive edge.

Key Takeaways

- Robust Growth: Insulin detemir's global sales are expected to grow at approximately 8% CAGR through 2030, driven by the rising global diabetes burden.

- Market Expansion: Asia-Pacific and emerging markets present significant upside for future sales, contingent on affordability and infrastructure.

- Competitive Dynamics: Biosimilar proliferation and newer long-acting insulins pose ongoing challenges, necessitating strategic positioning.

- Cost and Access: Pricing pressures in mature markets emphasize the importance of cost-effective manufacturing and reimbursement strategies.

- Innovation: Continued innovations in delivery mechanisms and formulations will influence market shares and adoption rates.

FAQs

1. What factors are influencing the growth of insulin detemir sales globally?

The primary factors include increasing diabetes prevalence worldwide, clinician preference for long-acting insulins with reduced hypoglycemia risk, expanding access in emerging markets, and ongoing innovation in insulin delivery devices.

2. How do biosimilars impact the market potential of insulin detemir?

Biosimilars introduce price competition, exerting downward pressure on insulin detemir pricing and potentially reducing its market share but also expanding overall access and adoption.

3. Which regions are expected to lead in insulin detemir sales growth?

Asia-Pacific is poised for the highest growth due to rising diabetes cases and expanding healthcare infrastructure, followed by Latin America and Africa, contingent upon addressing affordability.

4. What are the main challenges facing insulin detemir’s market expansion?

Key challenges include high product costs, regulatory hurdles, competition from biosimilars and alternative long-acting insulins, and limited access in resource-constrained settings.

5. How might technological innovations influence future sales of insulin detemir?

Advancements in insulin delivery devices, digital health integration, and biosimilar development could either bolster sales through better adherence and reduced costs or challenge existing formulations by offering newer, more convenient options.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 10th Edition, 2021.

[2] Grand View Research. Insulin Market Size, Share & Trends Analysis Report, 2022–2030.

More… ↓