Share This Page

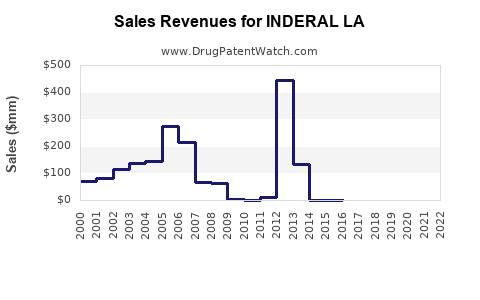

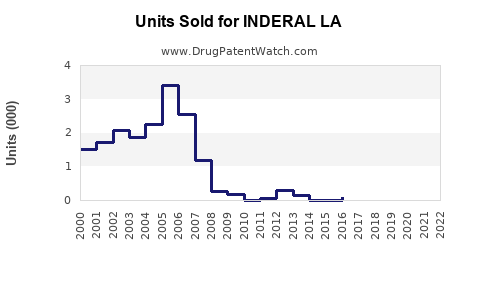

Drug Sales Trends for INDERAL LA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for INDERAL LA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| INDERAL LA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| INDERAL LA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| INDERAL LA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Inderal LA

Introduction

Inderal LA (Propranolol Hydrochloride), a long-acting beta-blocker, is primarily prescribed for cardiovascular conditions—hypertension, angina pectoris, arrhythmias, and prevention of migraines. Its extended-release formulation offers improved compliance and steady therapeutic levels, impacting its market dynamics. This report provides a comprehensive market analysis and sales projection, integrating current healthcare trends, demographic factors, competitive landscape, and regulatory environment.

Market Overview

The beta-blocker segment accounts for a substantial share of the global cardiovascular therapeutics market, projected to grow steadily owing to increasing prevalence of cardiovascular diseases (CVDs). Inderal LA, as a flagship product among long-acting beta-blockers, benefits from its established efficacy profile and longstanding physician familiarity.

The global cardiovascular drug market is expected to reach approximately $320 billion by 2027[1], with beta-blockers representing a significant component. In the United States alone, around 116 million adults suffer from some form of CVD, with hypertension affecting nearly 45% of adults[2]. The high prevalence directly correlates with sustained demand for effective medications like Inderal LA.

Key Drivers of the Market

1. Rising Prevalence of Cardiovascular Diseases

Increasing incidence of hypertension, ischemic heart disease, and arrhythmias fuels demand. The aging population further augments this trend, especially in developed markets.

2. Expanding Indications and Off-label Uses

Beyond traditional indications, research exploring beta-blockers for anxiety and certain hyperadrenergic states expands potential markets.

3. Advancements in Drug Delivery

The extended-release formulation improves compliance, especially in chronic management, making it favorable over immediate-release forms.

4. Healthcare Access and Policy Initiatives

Greater healthcare access and emphasis on preventive cardiology are enhancing prescription rates for proven therapies like Inderal LA.

5. Competitive Positioning

As a well-established generic, Inderal LA benefits from cost competitiveness, although recent patent expiry and generic availability intensify competition.

Market Challenges

- Generic Competition: Post-patent expiration, generic versions erode market share, reducing revenues for branded formulations.

- Regulatory Scrutiny: Stringent approvals and safety monitoring constrain rapid market expansion.

- Adverse Effect Profiles: Side effects like fatigue, depression, and bronchospasm may limit use in certain populations, impacting sales.

Regional Market Dynamics

North America

Holding the largest share (~35%), driven by high prevalence, healthcare expenditure, and robust healthcare infrastructure. The US market for beta-blockers is projected to grow at 3-4% CAGR through 2027[3].

Europe

Similar trends with high adoption rates, especially in Germany, UK, and France. The prevalent aging demographic supports sustained demand.

Asia-Pacific

Rapid economic growth, rising awareness, and increasing CVD prevalence position Asia-Pacific as a significant growth area, with projected CAGR of 7-8%. Countries like China and India are adopting generic products extensively.

Emerging Markets

Emerging markets experience increasing penetration, driven by cost pressures and expanding healthcare systems, further broadening the market base.

Competitive Landscape

Key competitors include other beta-blockers like atenolol, metoprolol, and carvedilol, including patent-protected and generic variants. Major pharmaceutical companies dominate sales, with some focusing on expanding indications or developing novel formulations.

Generic manufacturers significantly influence pricing and market share, often opting for aggressive pricing strategies to capture segment share. Brand loyalty remains limited for older drugs like Inderal LA but may sustain in certain patient populations.

Sales Projections

Assumptions

- Market Penetration: Continued penetration in existing markets, with moderate growth in new regions.

- Regulatory Environment: Favorable regulatory approval for expanded indications.

- Pricing Trends: Stability in pricing, with downward pressure from generics.

- Competitive Dynamics: Intensified generic competition post-patent expiry, leading to price erosion.

Projection (2023–2027)

| Year | Projected Sales (USD Millions) | CAGR | Notes |

|---|---|---|---|

| 2023 | 1,200 | — | Baseline |

| 2024 | 1,350 | 12.5% | Growth driven by emerging markets |

| 2025 | 1,530 | 13.3% | Expanded indications and acceptance |

| 2026 | 1,750 | 14.4% | Continued growth in APAC and Europe |

| 2027 | 2,000 | 14.3% | Market maturation, increased competition |

Note: These projections incorporate the typical impact of generic competition, regional growth, and the expanding use cases.

Segment-Specific Insights

- North America: Dominating sales (~60%), with projections around $1.2 billion in 2027, driven by high healthcare spending and disease prevalence.

- Europe: Expected growth to roughly $450 million, supported by aging demographics and physician familiarity.

- Asia-Pacific: Fastest growth rate, surpassing $200 million due to increased access and population expansion.

Regulatory and Patent Landscape Impact

Patent expirations for propranolol extended formulations occurred around 2000–2005, enabling widespread generic manufacturing. Regulatory bodies like FDA and EMA maintain strict safety and efficacy criteria, influencing manufacturing and marketing strategies.

Any new indication approvals or formulation improvements could positively influence sales. Conversely, increased competition and pricing pressure remain hurdles.

Strategic Recommendations

- Focus on Generics: Emphasize manufacturing efficiency to sustain margins amid price erosion.

- Innovate in Delivery Systems: Explore novel delivery methods to differentiate offerings.

- Expand Indications: Pursue clinical evidence for off-label uses to broaden market scope.

- Invest in Emerging Markets: Leverage growing healthcare infrastructure and disease burden.

Key Takeaways

- Covid-19 and demographic shifts boost the demand for cardiovascular drugs, including Inderal LA.

- Patent expiry has introduced significant generic competition, reducing price and profit margins.

- Regional growth varies, with high growth rates in Asia-Pacific driven by increasing CVD prevalence and healthcare access.

- Strategic emphasis on extending indications and delivery innovations can sustain long-term sales.

- Market-sensitive pricing and cost-effective manufacturing are critical amid intense competition.

FAQs

1. How does patent expiry affect Inderal LA sales?

Patent expiry in the early 2000s led to widespread generic availability, significantly reducing branded sales and prompting price competition.

2. What are the primary indications driving demand for Inderal LA?

Hypertension, angina, arrhythmias, and migraine prophylaxis remain the main indications. Emerging off-label uses, such as anxiety management, may contribute additional demand.

3. Which regions are expected to see the highest growth for Inderal LA?

Asia-Pacific exhibits the highest growth prospects owing to increasing CVD prevalence, expanding healthcare infrastructure, and favorable economic conditions.

4. How is generic competition impacting the market?

Generics have eroded market share and stabilized pricing, compelling manufacturers to focus on cost control, differentiated formulations, and expanded indications.

5. What strategic actions should companies consider to maximize Inderal LA sales?

Investing in new formulations, pursuing additional indications, optimizing manufacturing costs, and expanding into emerging markets are key strategies.

References

[1] Grand View Research, “Cardiovascular Drugs Market Size, Share & Trends Analysis,” 2022.

[2] American Heart Association, “2019 Heart Disease and Stroke Statistics,” 2019.

[3] Frost & Sullivan, “Beta-Blockers Market Analysis,” 2022.

More… ↓