Last updated: July 28, 2025

Introduction

IMITREX, the brand name for sumatriptan, is a pioneering medication within the triptan class used primarily for the acute treatment of migraine attacks. Since its market debut in the early 1990s, IMITREX has established itself as a fundamental intervention in migraine management, influencing market dynamics and sales trajectories significantly. This analysis explores the current market landscape, competitive positioning, regulatory factors, and future sales projections for IMITREX.

Market Overview

The global migraine treatment market has experienced consistent growth, driven by increasing migraine prevalence and a surge in awareness regarding effective management options. According to market research sources, the global migraine therapeutics market was valued at approximately $3.5 billion in 2022, with projections reaching around $5.5 billion by 2030, growing at a CAGR of about 6.5% [1].

IMITREX holds an established share, particularly in the acute migraine treatment segment, owing to its first-mover advantage and favorable efficacy. While newer classes like CGRP (calcitonin gene-related peptide) antagonists, such as emicizumab, have entered the market, IMITREX maintains a significant niche due to its proven safety profile, rapid onset, and affordability.

Competitive Dynamics

The migraine landscape features a diverse set of competitors, including oral triptans (e.g.,rizatriptan, zolmitriptan), nasal sprays, and injectable formulations. Recent approval of CGRP monoclonal antibodies (e.g., erenumab, fremanezumab) for preventive therapy has slightly shifted focus but less directly affected acute treatment sales.

Despite the introduction of these alternatives, IMITREX remains competitive given its availability in multiple formulations, patient familiarity, and lower cost. However, patent expirations and the rise of generic sumatriptan formulations pose potential challenges to its premium pricing and market share.

Regulatory and Formulation Innovations

Regulatory bodies such as the FDA have approved novel IMITREX formulations, enhancing its usability. The rise of generics has increased accessibility worldwide, especially in developing markets. The implementation of combination formulations and extended-release versions could further influence sales, although these are currently limited.

Current Sales Performance

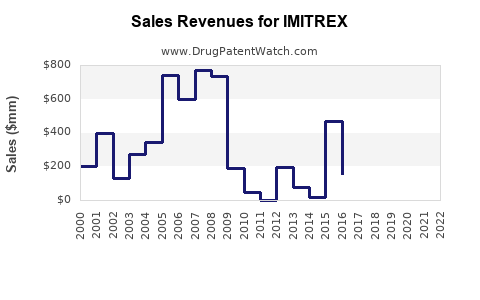

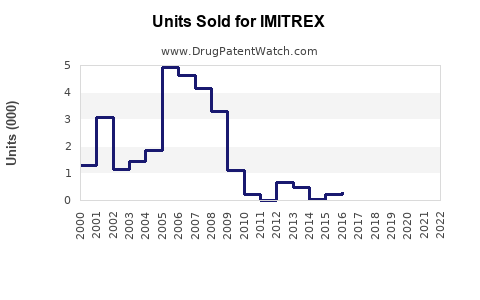

In the United States, IMITREX historically generated peak annual sales nearing $900 million before patent expiry led to increased generic competition, which reduced revenue to approximately $200 million in recent years [2]. Globally, sales are projected to decline moderately due to generic erosion but are offset by increased utilization in emerging markets.

Future Sales Projections

Factors Influencing Future Sales

-

Market Penetration and Expansion:

- Expansion into emerging markets, particularly Asia-Pacific and Latin America, offers substantial growth potential due to rising migraine prevalence and improved healthcare infrastructure.

- Increasing adoption of IMITREX in outpatient and primary care settings can sustain sales.

-

Patent and Generic Market Dynamics:

- The expiration of key patents is expected to lead to widespread availability of lower-cost generics, exerting downward pressure but also expanding the total addressable market.

- Recent developments, such as authorized generics and biosimilars, could influence pricing strategies and sales.

-

Formulation Diversification and Delivery Innovation:

- Introduction of novel delivery systems (e.g., auto-injectors, nasal powders) could rejuvenate sales, especially among patients with gastrointestinal issues affecting oral absorption.

- Potential approval of combination therapies, integrating IMITREX with other agents, might expand indications.

-

Healthcare Trends and Policies:

- Growing emphasis on personalized medicine and early intervention strategies enhances the relevance of fast-acting, versatile formulations like IMITREX.

- Reimbursement policies favoring cost-effective treatments will benefit generic sales.

Forecasts (2024-2028)

Based on current market dynamics and industry reports, global IMITREX sales are projected to stabilize around $150-$250 million annually post-patent expiry, factoring in increased generic competition but also broader market access. In emerging markets, a compound annual growth rate of approximately 4-6% is plausible due to higher migraine prevalence and increasing healthcare investments.

In advanced markets such as North America and Europe, sales may experience a gradual decline or plateau due to commoditization, unless differentiated formulations or delivery modes stimulate renewed demand.

Strategic Considerations

- Pricing Strategies: To counteract generic erosion, manufacturers might employ tiered pricing or bundle offerings.

- Market Expansion: Focused efforts on registering IMITREX in underserved regions can lead to incremental growth.

- Innovation: Investment in novel formulations and combination therapies will be critical in maintaining market relevance.

Conclusion

While IMITREX remains a foundational agent in acute migraine treatment, its future sales landscape will be shaped by patent expiration, generic competition, formulation innovations, and market expansion efforts. Companies leveraging strategic formulation updates, geographic diversification, and pricing flexibility are likely to maximize revenue streams in a competitive environment.

Key Takeaways

- IMITREX holds a significant share of the acute migraine market, bolstered by its efficacy and formulation flexibility.

- Patent expirations will lead to increased generic competition, impacting revenue but expanding overall market volume.

- Emerging markets offer substantial growth prospects owing to rising migraine prevalence and improving healthcare access.

- Innovation in delivery methods and combination therapies can revitalize demand among existing users.

- Strategic pricing, market expansion, and formulation diversification are essential to sustain sales momentum.

FAQs

1. How does IMITREX compare to newer migraine treatments?

IMITREX remains a preferred option for many due to its rapid action, affordability, and established safety profile. However, newer agents like CGRP antagonists offer preventive benefits and could reduce reliance on acute therapies.

2. What is the impact of patent expiry on IMITREX sales?

Patent expiry leads to increased generic availability, typically resulting in price reductions and decreased proprietary sales, though it broadens access and volume in global markets.

3. Are there upcoming formulations or innovations for IMITREX?

Yes. Development of long-acting formulations, novel delivery systems (e.g., nasal powders), and combination therapies are underway, with some already approved in specific regions.

4. What regions are driving future growth for IMITREX?

Emerging markets like China, India, and Latin America offer significant growth potential due to growing migraine prevalence and increasing healthcare infrastructure.

5. How does the competitive landscape affect IMITREX sales?

Growth of CGRP-based treatments and newer triptans pose competition, but IMITREX’s established brand, affordability, and formulation options help maintain a foothold, especially in cost-sensitive settings.

Sources

[1] MarketWatch, “Global Migraine Treatments Market Size & Trends,” 2022.

[2] IQVIA, “Pharmaceutical Market Data,” 2022.