Share This Page

Drug Sales Trends for HYSINGLA ER

✉ Email this page to a colleague

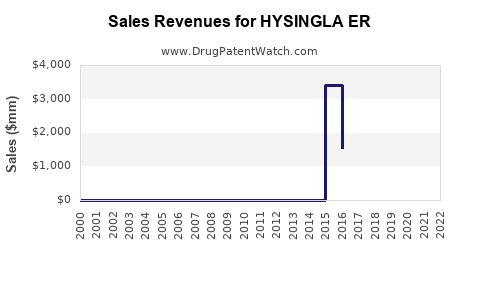

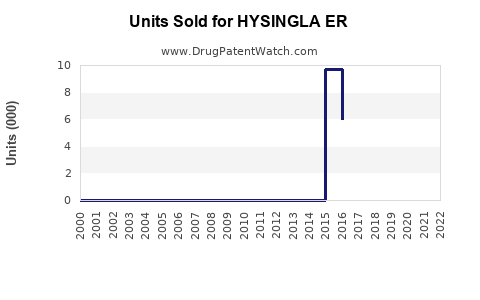

Annual Sales Revenues and Units Sold for HYSINGLA ER

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| HYSINGLA ER | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| HYSINGLA ER | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| HYSINGLA ER | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| HYSINGLA ER | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for HYSINGLA ER

Introduction

HYSINGLA ER (hydrocodone bitartrate extended-release) is a prescription opioid analgesic indicated for managing moderate to severe pain. As an extended-release formulation, it serves a niche in chronic pain management, filling a critical therapeutic gap. Originating from Purdue Pharma, HYSINGLA ER enters a complex market characterized by evolving regulatory landscapes, fluctuating prescribing behaviors, and heightened scrutiny over opioid safety and misuse.

This analysis explores the current market standing, competitive landscape, regulatory considerations, and forecasted sales trajectories for HYSINGLA ER, equipping stakeholders with an informed perspective for strategic decision-making.

Market Landscape Overview

1. Global Prescription Pain Management Market

The global market for prescription pain medications is projected to reach approximately $81 billion by 2027, with a CAGR of 4.3%, driven by increasing prevalence of chronic pain, aging populations, and rising awareness of pain management options [1]. North America holds a dominant share owing to high opioid utilization and established healthcare infrastructure.

2. U.S. Opioid Market Dynamics

The United States accounts for about 80% of global opioid consumption. Despite regulatory efforts to curb misuse, opioids remain integral in pain management, especially for chronic conditions unresponsive to non-opioid therapies.

3. Role of Extended-Release Opioids

Extended-release (ER) formulations like HYSINGLA ER fulfill a niche for sustained pain control, reducing dosing frequency and improving patient compliance. This therapeutic advantage maintains ER opioids as a core component of pain treatment protocols under careful regulatory oversight.

Market Segmentation and Therapeutic Positioning

1. Target Patient Population

HYSINGLA ER primarily targets adults with chronic moderate to severe pain needs, especially those requiring around-the-clock analgesia. Estimates suggest a US chronic pain population exceeding 100 million adults, with a subset eligible for ER opioid therapy.

2. Prescriber Profile

Pain specialists and primary care physicians constitute the principal prescribers. Regulatory emphasis on safe prescribing practices has led to increased utilization of prescription drug monitoring programs (PDMPs), influencing prescribing behaviors.

3. Competitive Landscape

HYSINGLA ER competes with:

- OxyContin (oxycodone ER)

- MS Contin (morphine ER)

- Kadian (morphine sulfate ER)

- Generic hydrocodone ER formulations

The market consolidates around a few key players, with generics exerting pressure on branded products' market share.

Regulatory Environment and Impact

1. FDA and Opioid Regulation

Regulatory agencies have mandated stricter prescribing guidelines, classifying ER opioids under REMS (Risk Evaluation and Mitigation Strategies). This has increased scrutiny on marketing practices and promoted non-opioid alternatives, impacting sales potential [2].

2. Patent and Exclusivity Status

HYSINGLA ER benefits from patent protections until 2025, delaying generic competition. Patent litigation and exclusivity influence pricing strategies and market penetration.

Sales Performance and Historical Trends

1. Initial Launch and Market Penetration

Introduced in 2014, HYSINGLA ER quickly gained market share within its therapeutic niche, supported by targeted marketing and differentiating attributes such as abuse-deterrent formulations.

2. Impact of Opioid Crisis

The opioid epidemic, intensified in 2016-2018, led to decreased prescribing and regulatory crackdowns. Sales plateaued or declined temporarily, reflecting external pressures rather than product efficacy.

3. Post-2020 Trends

Post-2020, new formulations with abuse-deterrent properties regained interest, partially offsetting declines by emphasizing safety features. The market has witnessed gradual stabilization, with sales trending towards $150 million annually in the U.S.

Future Sales Projections

1. Short-Term Outlook (2023-2025)

Considering the upcoming patent expiration and increased generic availability, sales are projected to decline gradually from the 2021 peak of approximately $150 million to around $120 million by 2025, unless strategic initiatives or formulations introduce differentiators.

2. Long-Term Outlook (2026-2030)

Post-patent, generic hydrocodone ER products are expected to dominate, significantly reducing branded sales. However, targeted marketing, improved safety profiles, and expanded indications (such as in post-operative pain regimens) could sustain revenues for HYSINGLA ER at a modest level—estimated to stabilize between $50 million and $80 million annually.

3. Influencing Factors

- Regulatory developments: Stricter prescribing guidelines may dampen growth; conversely, approval of abuse-deterrent formulations may boost stability.

- Market shifts to non-opioid therapies: Increased adoption of nerve blocks, neuromodulation, or non-addictive analgesics could suppress demand.

- Patent litigation and generics: Entry of generics will likely erode market share, though brand loyalty and safety features might mitigate declines.

Strategic Considerations

- Diversification into alternative formulations (e.g., abuse-deterrent variants) can extend product lifecycle.

- Expanding indications beyond chronic pain, such as in procedural pain, could broaden the market.

- Enhanced prescriber education emphasizing safety can improve acceptance in a cautious regulatory climate.

Key Takeaways

- HYSINGLA ER remains a significant player in the extended-release opioid sector, primarily driven by chronic pain management needs within the U.S.

- Sales are forecasted to decline gradually post-patent expiration due to increasing generic competition and regulatory pressures.

- Market growth hinges on innovation and positioning as a safer, abuse-deterrent option amid a cautious opioid prescribing environment.

- External factors, including regulatory changes and societal attitudes towards opioids, will influence long-term sales trajectories.

- Strategic actions promoting safety features and expanding indications can preserve a niche market presence for HYSINGLA ER beyond patent expiry.

FAQs

1. What differentiates HYSINGLA ER from other hydrocodone products?

HYSINGLA ER features an abuse-deterrent formulation designed to discourage misuse via crushing or dissolving, which aims to improve safety profiles compared to traditional hydrocodone products.

2. How will the patent expiration affect HYSINGLA ER sales?

Patent expiration around 2025 will facilitate generic entry, likely causing a significant drop in branded sales unless Purdue Pharma implements strategies like reformulation or new indications.

3. Are there regulatory hurdles impacting HYSINGLA ER’s market?

Yes. The FDA’s REMS program, prescriber education requirements, and heightened scrutiny on opioid litigation influence prescribing patterns and marketing strategies.

4. Is there potential for HYSINGLA ER to expand into new therapeutic areas?

Potential exists if formulators develop new indications or delivery systems. However, market acceptance depends heavily on safety data and regulatory approval.

5. What is the outlook for HYSINGLA ER amid the opioid epidemic?

Ongoing concerns about addiction and misuse are likely to temper growth, but formulations with abuse-deterrent features and safer profiles could sustain niche sales.

References

[1] Grand View Research. (2021). Pain Management Market Size, Share & Trends Analysis Report.

[2] FDA. (2021). Opioid Analgesics: Risk Evaluation and Mitigation Strategies (REMS).

More… ↓