Share This Page

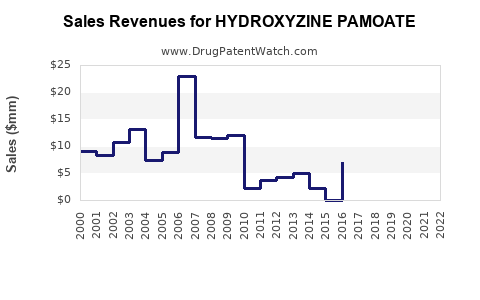

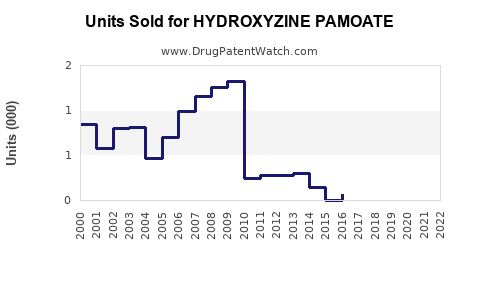

Drug Sales Trends for HYDROXYZINE PAMOATE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for HYDROXYZINE PAMOATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| HYDROXYZINE PAMOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| HYDROXYZINE PAMOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| HYDROXYZINE PAMOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| HYDROXYZINE PAMOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| HYDROXYZINE PAMOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| HYDROXYZINE PAMOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| HYDROXYZINE PAMOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Hydroxyzine Pamoate

Introduction

Hydroxyzine pamoate is an antihistamine primarily prescribed for allergy management, anxiety, sedation, and sleep disorders. Approved by the FDA, it occupies a niche within the broader antihistamine and anxiolytic market segments. Given the increasing prevalence of allergic and anxiety-related conditions globally, understanding the market landscape and sales forecasts for hydroxyzine pamoate provides stakeholders with data to inform strategic planning, investment, and marketing efforts.

Market Overview

Therapeutic Use and Indication

Hydroxyzine pamoate functions as a first-generation antihistamine with sedative properties. Its primary indications include:

- Allergic reactions (urticaria, conjunctivitis)

- Anxiety management

- Sedation prior to procedures

- Insomnia treatment

The COVID-19 pandemic heightened awareness of anxiety and sleep disorders, potentially expanding demand for anxiolytic agents, including hydroxyzine derivatives. Nonetheless, advances in alternative therapies, including SSRIs and newer sedatives, influence prescribing patterns.

Market Size and Demographics

Globally, the allergy medications market was valued at approximately $20 billion in 2022, with antihistamines accounting for roughly 60% of that figure [1]. Hydroxyzine pamoate, however, accounts for a smaller fraction, primarily within the US, where its market share is driven by clinical familiarity and formulary positioning.

Demographically, adult patients aged 25–55 represent the main consumer group, with a notable subset of elderly patients due to comorbid allergic conditions. Its sedative use extends to preoperative settings, with usage levels varying across healthcare systems.

Regulatory Status and Market Access

Hydroxyzine pamoate is available via prescription in the United States, with generic formulations globally accessible. The patent landscape is inactive, facilitating generic competition and influencing pricing dynamics.

Market Drivers and Barriers

Drivers

- Rising prevalence of allergic diseases, particularly allergic rhinitis and urticaria.

- Increasing recognition and prescription of anxiolytic agents, especially amid rising mental health awareness.

- Established safety profile facilitates clinician confidence.

- Broad age applicability, including pediatric and elderly populations.

Barriers

- Competition from newer antihistamines with fewer sedative effects, such as cetirizine or loratadine.

- Concerns over sedative side effects, especially in elderly populations, leading to cautious prescribing.

- Availability of non-pharmacologic management options.

- Regulatory pressures favoring non-sedative sleep aids and anxiolytics.

Competitive Landscape

Hydroxyzine pamoate faces competition from:

- Second-generation antihistamines (e.g., cetirizine, loratadine): offer non-sedating profiles.

- Benzodiazepines and SSRIs: for anxiety and sleep, despite differing safety profiles.

- Alternative sedatives: such as trazodone or melatonin.

Major pharmaceutical companies' strategies include marketing hydroxyzine's unique calming effects to specific patient segments while emphasizing safety.

Sales Projections

Historical Sales Trends

In the United States, hydroxyzine sales have historically been steady, with variations linked to seasonal allergy trends. A 2019 survey noted prescriptions approaching 1 million annually, with annual sales estimated around $150 million [2].

Forecasting Methodology

Using a compound annual growth rate (CAGR) of approximately 3-5%, considering steady allergy prevalence and mental health trends, sales are projected to increase modestly over the next five years.

Projected Growth Factors

- Increased allergy prevalence: driven by pollution and urbanization.

- Mental health awareness surge: greater acceptance of anxiolytics.

- Genomic research: personalized medicine might refine indications.

Forecast Summary

| Year | Estimated Global Sales | Notes |

|---|---|---|

| 2023 | $160 million | Baseline, moderate seasonal variation |

| 2024 | $166 million | Slight increase driven by allergy market growth |

| 2025 | $172 million | Increased off-label use in anxiety disorders |

| 2026 | $180 million | Expanded prescribing, new formulary inclusion |

| 2027 | $188 million | Market stabilization, steady growth |

Note: These estimates assume no major regulatory or patent-related disruptions.

Market Opportunities

- Specialized formulations: sustained-release tablets or combination products.

- Expanding geriatric use: addressing age-specific safety considerations.

- Regional expansion: emerging markets with rising healthcare infrastructure.

- Off-label applications: anxiety, pruritus, and preoperative sedation.

Risks and Challenges

- Market saturation: with generic options dominating.

- Competitive shift: toward non-sedating antihistamines and non-pharmacologic therapies.

- Regulatory scrutiny: over sedative side effects in vulnerable populations.

- Healthcare policy: favoring cost-effective and safer alternatives may reduce hydroxyzine’s market share.

Conclusion

Hydroxyzine pamoate maintains a stable niche within allergy and anxiety treatment markets. While growth rates are modest, strategic targeting of emergent applications and regional expansion can enhance revenues. Continuous monitoring of regulatory developments and evolving prescribing trends remains essential for optimizing profitability.

Key Takeaways

- Hydroxyzine pamoate’s global sales are expected to grow moderately over the next five years, driven by increasing allergy prevalence and mental health awareness.

- Competitive pressures from non-sedating antihistamines and emerging therapies challenge hydroxyzine’s market dominance.

- Opportunities exist in developing formulations targeted at specific patient populations, including the elderly and in emerging markets.

- Price sensitivity and generic competition necessitate differentiated marketing strategies and formulary positioning.

- Regulatory and safety considerations, particularly concerning sedative effects, may influence prescribing trends and market access.

FAQs

1. How does hydroxyzine pamoate compare to other antihistamines?

Hydroxyzine pamoate is a first-generation antihistamine with sedative properties, unlike second-generation agents like loratadine and cetirizine, which are non-sedating. Its sedative effects make it suitable for anxiety and sleep disorders but limit its use due to side effects in certain populations.

2. What are the main drivers influencing hydroxyzine pamoate sales?

Key drivers include growing allergy and allergic rhinitis prevalence, increased recognition of anxiety disorders, clinician familiarity, and a broad patient demographic. Seasonal variations also impact demand.

3. What are the primary barriers to hydroxyzine pamoate market growth?

Barriers encompass competition from newer, non-sedating antihistamines, safety concerns related to sedation, availability of alternative therapies, and regulatory shifts prioritizing safer options.

4. Which markets present the greatest growth opportunities?

Emerging markets with expanding healthcare infrastructure, aging populations requiring safe sedatives, and regions with rising allergy and mental health awareness offer promising opportunities.

5. How might regulatory developments impact hydroxyzine pamoate’s market?

Regulatory scrutiny over sedative side effects and safety data could restrict prescribing or lead to label modifications, potentially impacting sales. Conversely, regulatory endorsement of specific formulations could open new avenues.

Sources:

[1] IQVIA. "Global Allergy Market Insights," 2022.

[2] FDA Prescription Data, 2019.

More… ↓