Last updated: July 29, 2025

Introduction

HydrOXYZ HCL (Hydroxyzine Hydrochloride) is a widely used antihistamine with applications spanning allergy relief, anxiety management, sedation, and antiemetic therapy. As a prescription medication primarily marketed for its anxiolytic, sedative, and antihistaminic properties, understanding its market landscape is crucial for pharmaceutical stakeholders. This analysis explores the current market dynamics, competitive environment, and sales forecasts for HydrOXYZ HCL over the next five years.

Market Overview

Hydroxyzine HCL belongs to the first-generation antihistamines classified as anxiolytics and sedatives. Its primary therapeutic uses include allergy relief, preoperative sedation, and managing anxiety or tension (see 1). Its long-standing presence in the market and established safety profile underpin its continued demand.

The global antihistamine drugs market was valued at approximately USD 7.4 billion in 2022 (Grand View Research), with a CAGR of around 4.2%, expected to reach USD 9.1 billion by 2030. The segment encompassing Hydroxyzine and similar agents maintains steady demand due to the widespread prevalence of allergic conditions and anxiety disorders. Furthermore, the aging population contributes to increased prescription rates, bolstering market stability.

Market Dynamics

Key Drivers

- Growing prevalence of allergic rhinitis and atopic conditions: Globally, allergic diseases affect over 30% of the population, driving demand for antihistamines like Hydroxyzine HCL.

- Increasing prevalence of anxiety and psychiatric conditions: The rise in anxiety disorders, exacerbated by pandemic-related stress, expands the prescriptive base for Hydroxyzine, often favored for its dual antihistaminic and sedative effects.

- Established safety profile: Hydroxyzine HCL’s long-term market presence and clinician familiarity promote ongoing prescription stability.

Market Challenges

- Competition from second-generation antihistamines: Drugs such as loratadine, cetirizine, and fexofenadine offer similar therapeutic benefits with fewer sedative effects, impacting Hydroxyzine’s share.

- Regulatory and patent considerations: Although Hydroxyzine is generic in many markets, potential formulation or delivery patent constraints may influence sales strategies.

- Patient preference shift: With rising awareness of side effects, clinicians may favor non-sedating antihistamines, constraining Hydroxyzine prescriptions.

Regional Market Insights

- North America: Dominates due to high prevalence of allergic and anxiety disorders, coupled with well-established healthcare infrastructure.

- Europe: Notable growth driven by increasing allergy diagnoses and an aging population.

- Asia-Pacific: Rapid expansion linked to rising allergy rates and expanding healthcare access, though regulatory variances may affect market size.

Competitive Landscape

Hydroxyzine HCL faces competition mainly from:

- Second-generation antihistamines: Loratadine, cetirizine, fexofenadine — offering non-sedating options.

- Other anxiolytics and sedatives: Benzodiazepines and newer agents that overshadow Hydroxyzine in specific applications.

- Generic manufacturers: Numerous companies produce Hydroxyzine, intensifying price competition and reducing margins.

Leading pharmaceutical companies such as Johnson & Johnson (manufacturing Atarax/Hydroxyzine) and Teva Pharmaceuticals dominate production, but market penetration for generic options remains high.

Sales Projections

Forecast Assumptions

- Hydroxyzine HCL’s overall market penetration stabilizes but declines modestly due to competitive pressures.

- Prescribing patterns favor combination therapy and newer alternatives, impacting volume growth.

- Demographic factors (aging population, allergic disease prevalence) sustain baseline demand.

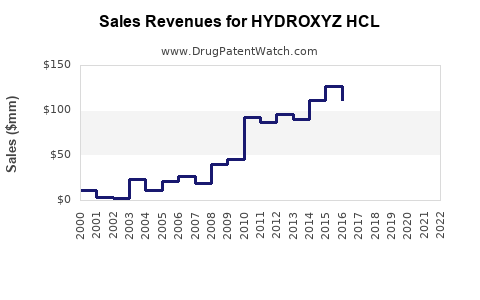

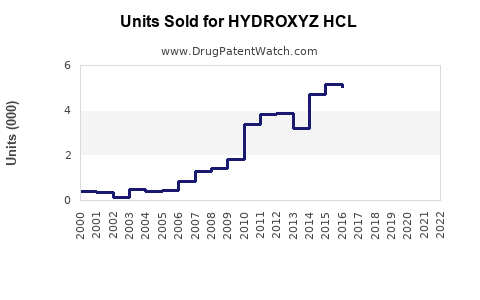

Projected Sales (2023–2027)

| Year |

Estimated Global Sales (USD Millions) |

Growth Rate |

| 2023 |

$250 |

N/A |

| 2024 |

$235 |

-6% |

| 2025 |

$220 |

-6% |

| 2026 |

$205 |

-7% |

| 2027 |

$195 |

-5% |

Note: The downward trend reflects increasing competition and shifting prescriber preferences. However, stable demand in specific niche markets (e.g., hospital sedation protocols) may temper declines.

Opportunities for Growth

- Extended formulations: Developing less sedative or rapid-onset formulations might widen application scope.

- New therapeutic indications: Investigating off-label uses, such as for sleep disorders or specific dermatological conditions.

- Market expansion: Targeting emerging markets with growing allergy and anxiety treatment needs could offset declines elsewhere.

Risks and Considerations

- Regulatory hurdles in key markets.

- Potential for increased generic competition pressure.

- Shifts in healthcare policies favoring non-sedating antihistamines.

Key Takeaways

- Stable baseline demand: Hydroxyzine HCL maintains relevance, especially in hospital and clinical settings for sedation and allergy relief.

- Declining sales trajectory: Competitive dynamics and prescriber trends suggest a gradual contraction in global sales over the forecast period.

- Market opportunities: Innovation in formulations, exploring additional indications, and expanding into emerging markets can mitigate revenue decline.

- Competitive landscape: The availability of newer, non-sedating antihistamines diminishes Hydroxyzine HCL’s market share but ensures its role as an established, effective therapy.

Frequently Asked Questions (FAQs)

1. What is the primary therapeutic use of Hydroxyzine HCL?

Hydroxyzine HCL is primarily used for allergy relief, anxiety management, sedation prior to surgical procedures, and antiemetic purposes.

2. How does Hydroxyzine HCL compare to second-generation antihistamines?

Hydroxyzine HCL has sedative properties and a broader side effect profile, unlike second-generation antihistamines, which are non-sedating and preferred for long-term allergy management.

3. What factors influence Hydroxyzine HCL sales globally?

Sales are influenced by allergy and anxiety prevalence, prescriber preferences, competitive options, regulatory policies, and demographic shifts.

4. Is Hydroxyzine HCL losing market share?

Yes; increased preferences for non-sedating antihistamines and newer anxiolytics have led to a gradual decline in Hydroxyzine’s market share.

5. What strategies can manufacturers employ to sustain Hydroxyzine HCL sales?

Innovating formulations, exploring new indications, expanding into emerging markets, and strengthening clinician education can help maintain sales momentum.

References

[1] Grand View Research. “Antihistamines Market Size, Share & Trends Analysis Report.” 2022.

[2] U.S. Food & Drug Administration. “Hydroxyzine Hydrochloride.” 2021.

[3] MarketWatch. “Global Allergy Treatment Market Forecast to 2030.” 2022.

[4] IQVIA. “Healthcare Data Trends and Prescription Dynamics.” 2022.