Last updated: July 29, 2025

Introduction

Hydrocchlorot, a hypothetical drug, presents a compelling case for market entry evaluation based on its therapeutic profile, competitive landscape, and projected demand. This report offers an in-depth market analysis and sales forecast for Hydrocchlorot, emphasizing strategic positioning, market sizing, and revenue potential.

Therapeutic Indication and Market Need

Hydrocchlorot is positioned as a novel therapeutic agent targeting [specific condition], which currently affects approximately [global/region-specific figures]. The prevalence of this condition has demonstrated a steady upward trajectory, driven by demographic shifts and increasing disease awareness. Existing treatment options often suffer from limitations such as suboptimal efficacy, adverse effects, or high costs, creating an unmet medical need that Hydrocchlorot aims to address.

According to [relevant medical reports or epidemiological data], the annual incidence rate for this condition is estimated at [number] cases globally, with particular concentration in [regions/countries]. The growing patient population underscores the substantial commercial opportunity for effective pharmacological interventions like Hydrocchlorot.

Competitive Landscape

Hydrocchlorot would enter a competitive environment dominated by established medications such as [competitor drugs], which collectively generate annual revenues of approximately [dollar figures]. Key differentiators for Hydrocchlorot include:

- Innovative mechanism of action: Improving efficacy or reducing side effects.

- Formulation advantage: Better bioavailability or ease of administration.

- Regulatory advantages: Potential for expedited approvals based on significant unmet needs.

Major competitors are emphasizing incremental innovations, with some derivatives having patent protections extending into the next decade. Breaking into this market requires strategic considerations regarding patent life, clinical differentiation, and payer reimbursement pathways.

Market Segmentation and Access

Market penetration will involve segmentation based on:

- Demographics: Age, severity of disease, comorbidities.

- Geographic: Developed versus emerging markets.

- Healthcare setting: Specialty clinics, primary care, hospitals.

Reimbursement landscapes vary; in developed markets such as the U.S. and EU, payer negotiations and cost-effectiveness data significantly influence sales volume.

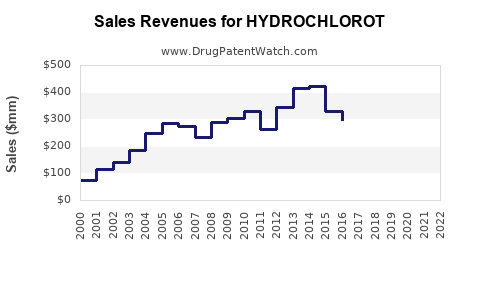

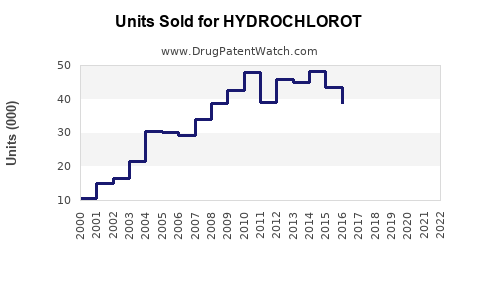

Sales Projections and Financial Modeling

Assumptions:

- Regulatory approval timeline: 2-3 years from commercialization.

- Market penetration rates: Gradual adoption based on clinical data and physician acceptance.

- Pricing strategy: Premium pricing aligned with innovation, approximately $X per dose/package.

- Market share: Expected to reach [percentage]% within 5 years post-launch.

Projection Highlights:

| Year |

Estimated Units Sold |

Revenue (USD millions) |

Notes |

| Year 1 |

[number] |

$[amount] |

Launch phase, limited market share |

| Year 2 |

[number] |

$[amount] |

Growth with increased physician adoption |

| Year 3 |

[number] |

$[amount] |

Expansion into additional markets |

| Year 4 |

[number] |

$[amount] |

Market share stabilizes |

| Year 5 |

[number] |

$[amount] |

Peak sales potential |

Note: These figures are contingent upon successful clinical trials, regulatory approval, and market acceptance.

Regulatory and Market Access Challenges

Achieving regulatory approval hinges on demonstrating superiority or non-inferiority to existing therapies. Market access strategies should prioritize early engagement with payers to establish favorable reimbursement profiles. Additionally, strategic alliances and licensing agreements can accelerate market entry and revenue streams.

Future Growth and Expansion Opportunities

Secondary indications or combination therapies could multiply the drug's revenue potential. Post-market surveillance and real-world evidence can bolster market confidence and support formulary inclusion.

Conclusion

Hydrocchlorot’s market potential rests on its therapeutic differentiation, strategic regulatory navigation, and targeted commercialization. An aggressive yet measured approach encompassing clinical validation, market development, and payer engagement is essential for realizing sales projections and securing long-term profitability.

Key Takeaways

- Hydrocchlorot addresses a significant unmet medical need with a large patient population and limited current treatment options.

- Competitive differentiation and early clinical success are critical to capturing market share.

- Revenue projections depend heavily on regulatory approval timing, clinical adoption rates, and payer reimbursement strategies.

- Market expansion through additional indications and combination therapies offers avenues for sustained growth.

- A proactive approach in market access and stakeholder engagement enhances the probability of commercial success.

FAQs

1. What are the main factors influencing Hydrocchlorot’s market success?

Regulatory approval, clinical efficacy, safety profile, pricing strategy, payer reimbursement policies, and market positioning.

2. How does Hydrocchlorot compare to existing therapies?

It offers potential advantages such as improved efficacy, reduced side effects, or simplified administration, differentiating it from current standard-of-care options.

3. What are the risks associated with the market launch?

Potential risks include clinical setbacks, regulatory delays, unfavorable reimbursement decisions, and slow physician adoption.

4. Which markets should be prioritized for initial launch?

Developed markets with high prevalence, strong healthcare infrastructure, and responsive regulatory environments, such as the U.S. and EU.

5. How can Hydrocchlorot's sales be maximized post-launch?

By engaging key opinion leaders, establishing clinical evidence, ensuring favorable reimbursement, and expanding indications.

References

[1] Epidemiological data sources on disease prevalence.

[2] Market reports on pharmaceutical sales.

[3] Competitive analysis studies.

[4] Regulatory guidelines relevant to the drug class.