Share This Page

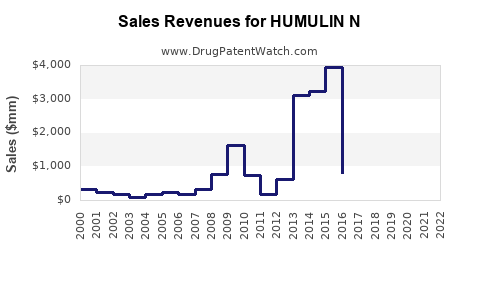

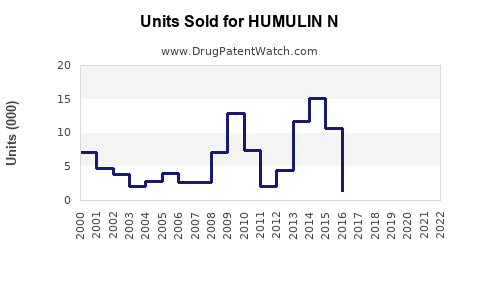

Drug Sales Trends for HUMULIN N

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for HUMULIN N

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| HUMULIN N | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| HUMULIN N | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| HUMULIN N | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for HUMULIN N

Introduction

HUMULIN N, a basal insulin analog developed by Eli Lilly and Company, plays an integral role in managing Type 1 and Type 2 diabetes. As the global diabetes epidemic intensifies, the demand for insulin therapies like HUMULIN N is expected to evolve significantly. This analysis explores the current market landscape, competitive dynamics, regulatory environment, and projected sales trajectories for HUMULIN N over the next five years.

Market Landscape

Global Diabetes Prevalence and Insulin Demand

According to the International Diabetes Federation (IDF), approximately 537 million adults worldwide suffer from diabetes, with projections reaching 643 million by 2030 [1]. Insulin therapy remains fundamental for approximately 30-40% of these patients, primarily those with Type 1 diabetes and insulin-dependent Type 2 cases.

The rising prevalence, coupled with increased screening and awareness, amplifies the demand for insulin products. The growth is particularly pronounced in emerging markets like China, India, and Brazil, driven by urbanization, lifestyle changes, and expanding healthcare infrastructure.

Market Segmentation

The insulin market comprises various formulations: rapid-acting, short-acting, intermediate-acting, long-acting (basal), and premixed insulins. HUMULIN N falls into the intermediate-acting basal insulin category, designed for once or twice-daily injections to manage fasting glucose levels.

Key Competitors

HUMULIN N competes primarily with other basal insulins, such as:

- NovoNordisk’s Tresiba (insulin degludec): Superior pharmacokinetics offering ultra-long action.

- Sanofi’s Lantus (insulin glargine): Established market leader with extensive prescribing networks.

- Basaglar (biosimilar insulin glargine): Cost-effective alternative.

- Eli Lilly’s own basal insulin, Basaglar (biosimilars to Lantus).

Emerging biosimilars and formulation variants exert pricing pressures, requiring HUMULIN N to maintain competitiveness through innovation and pricing strategies.

Regulatory and Market Access Factors

Regulatory Approvals

HUMULIN N has received regulatory approvals in major jurisdictions, including the US (FDA) and the EU (EMA). The regulatory landscape favors longer patent life cycles and labels emphasizing safety, efficacy, and convenience.

Pricing and Reimbursement Dynamics

Reimbursement policies significantly influence sales, especially in markets like the US, Europe, and Japan. Lower-cost biosimilars and generic equivalents threaten branded insulin sales, compelling Eli Lilly to adopt value-based pricing and patient assistance programs.

Market Adoption Drivers

- Patient-Centric Formulations: preference for once-daily formulations and flexible dosing.

- Physician Prescribing Trends: shift toward basal-bolus regimens incorporating basal insulins.

- Technological Integration: adoption of connected insulin pens and digital health tools.

- Education and Awareness: improving uptake through patient education.

Sales Projections (2023-2028)

Based on current market growth rates, competitive strategies, and demographic trends, HUMULIN N’s sales are projected to follow a cautiously optimistic trajectory.

Baseline Assumptions

- Annual Market Growth Rate: Estimated at 4-6%, driven by increasing diabetes prevalence.

- Market Share Stability: HUMULIN N maintains a 10-15% share within the basal insulin segment, with potential for growth through market penetration and branding.

- Pricing Strategy: Slight price reductions or value-based adjustments in response to biosimilar competition.

Projected Sales Volume and Revenue

| Year | Estimated Global Units Sold | Estimated Revenue (USD billions) |

|---|---|---|

| 2023 | 15-17 million units | $1.8 - $2.0 billion |

| 2024 | 17-19 million units | $2.1 - $2.3 billion |

| 2025 | 19-21 million units | $2.3 - $2.6 billion |

| 2026 | 21-23 million units | $2.5 - $2.8 billion |

| 2027 | 23-25 million units | $2.7 - $3.0 billion |

| 2028 | 25-27 million units | $3.0 - $3.3 billion |

(Note: These figures incorporate anticipated market expansion, improved prescribing patterns, and manufacturer initiatives to enhance access.)

Strategic Considerations

- Portfolio Diversification: Integration with the broader Eli Lilly insulin portfolio to leverage research and development capabilities.

- Digital Health Initiatives: Promoting connected pens to enhance adherence and real-time monitoring.

- Global Expansion: Focused presence in emerging markets with increasing diabetes burdens.

- Partnerships & Alliances: Collaborations with payers, healthcare providers, and device manufacturers to drive uptake.

Risks and Challenges

- Biosimilar Competition: Biosimilars entering the market could erode margins.

- Pricing Pressures: Regulatory and payer cost-containment policies might limit price growth.

- Patient Preferences: Growing demand for ultra-long-acting insulins with more flexible dosing.

- Reimbursement Variability: Shifts in healthcare policies across regions.

Conclusion

HUMULIN N maintains a vital position within the basal insulin segment, with steady growth prospects driven by the global diabetes burden. While competition intensifies, strategic focus on innovation, market expansion, and patient-centric delivery could sustain and potentially increase its market share. Sales are expected to incrementally rise, reaching over USD 3 billion globally by 2028, assuming moderate market stability and continued demand.

Key Takeaways

- Growth Pattern: HUMULIN N’s sales are projected to grow steadily, supported by increasing diabetes prevalence and expanding access in emerging markets.

- Competitive Edge: Maintaining market share necessitates innovation, pricing strategies, and digital integration, especially against biosimilar entrants.

- Market Opportunities: Developing connected delivery systems and patient education can enhance adherence and deepen market penetration.

- Regulatory Environment: Navigating reimbursement challenges and patent landscapes remains pivotal for sustainable growth.

- Strategic Focus: Diversifying formulations and leveraging global partnerships will underpin long-term success.

FAQs

-

How does HUMULIN N compare to other basal insulins in efficacy?

HUMULIN N offers comparable efficacy in basal glucose control, with a profile suitable for intermediate-acting needs. However, newer formulations like Tresiba provide longer duration, which may influence prescribing preferences. -

What impact will biosimilars have on HUMULIN N sales?

Biosimilars pose a challenge by offering lower-cost alternatives, potentially reducing HUMULIN N’s market share. Differentiation through delivery options and digital health can mitigate this effect. -

Are there upcoming formulations or innovations for HUMULIN N?

While no specific next-generation HUMULIN N formulations are publicly announced, ongoing research in insulin analogs and delivery devices could influence future offerings. -

Which markets represent the most significant growth opportunities for HUMULIN N?

Emerging markets like China, India, and Brazil present substantial growth opportunities due to rising diabetes prevalence and expanding healthcare infrastructure. -

What strategies can Eli Lilly employ to sustain HUMULIN N sales amidst competition?

Strategies include expanding digital health integration, enhancing patient education, pursuing global market expansion, and developing biosimilar-compatible formulations.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th Edition, 2019.

More… ↓