Last updated: July 27, 2025

Introduction

HUMIRA Pen, a prominent formulation of adalimumab, is a leading biologic used primarily for autoimmune disorders such as rheumatoid arthritis, psoriatic arthritis, Crohn’s disease, and ulcerative colitis. Since its initial approval in 2002, HUMIRA (adalimumab) has maintained a dominant position within the biologic pipeline, driven by its efficacy, safety profile, and broad regulatory approvals.

This analysis explores the current market landscape for HUMIRA Pen, factors influencing its sales trajectory, competitive dynamics, and future projections, with insights aimed at stakeholders, investors, and industry professionals.

Market Overview

Global Market Size and Growth

The global biologics market, estimated at approximately $370 billion in 2022, has expanded rapidly, with adalimumab representing a significant share. In 2022, HUMIRA generated approximately $21.2 billion in global sales, reflecting continued market dominance despite increasing competition[^1].

The biologics market for autoimmune diseases is projected to grow at a CAGR of 7-8%** through 2027**, driven by increasing diagnosis rates, expanding indications, and the geographical reach of biologic therapies (notably emerging markets)[^2].

Key Indications and Market Drivers

HUMIRA’s primary indications include rheumatoid arthritis, plaque psoriasis, Crohn’s disease, hidradenitis suppurativa, and ulcerative colitis. The rising prevalence of autoimmune diseases—estimated to affect over 100 million globally—has been a pivotal driver[^3].

The shift towards targeted biologics over conventional immunosuppressants further sustains HUMIRA’s growth prospects, alongside advancements in administration devices such as the Pen formulation, which increases adherence and patient convenience.

Product Focus: HUMIRA Pen

The HUMIRA Pen formulation offers a pre-filled autoinjector device designed for patient self-administration, promoting ease of use and improving adherence. It was introduced to enhance patient experience and reduce administration errors, reinforcing the product's position in the market.

Key features include:

- Single-dose autoinjector for subcutaneous administration.

- Portability and discreetness.

- Reduced injection anxiety compared to traditional syringes.

The Pen’s user-friendly design has contributed to sustained patient acceptance, especially critical amid patent expirations and biosimilar market entries.

Market Dynamics and Competition

Patent Expirations and Biosimilar Entry

The impending patent expiration of HUMIRA in key markets (notably the U.S. and Europe) is a pivotal factor impacting sales projections[^4]. The U.S. patent for adalimumab expired in January 2023, opening the market for biosimilars. Several biosimilars—including Amgen's Amjevita and Sandoz's Hyrimoz—entered the market, intensifying competitive pressures.

Despite biosimilar entry, HUMIRA maintains robust market share through:

- Established brand loyalty.

- Global manufacturing and distribution scale.

- Extended patent protection in certain smaller markets and for specific formulations.

Pricing and Reimbursement

Biosimilar competition has led to price erosion, with discounts of up to 25-35% in some regions. Negotiated reimbursement rates and formulary inclusion significantly influence sales; in the U.S., recent CMS policies aimed at increasing biosimilar utilization could further impact HUMIRA’s revenue.

Global Expansion

In non-U.S. markets, HUMIRA remains a key player, with continued approval in influential economies like Japan and Canada. Substantial growth in emerging markets (e.g., China, India) persists due to rising disease awareness and healthcare investments, although biosimilar presence here varies.

Sales Projections

Pre-Patent Expiry Outlook (2023–2025)

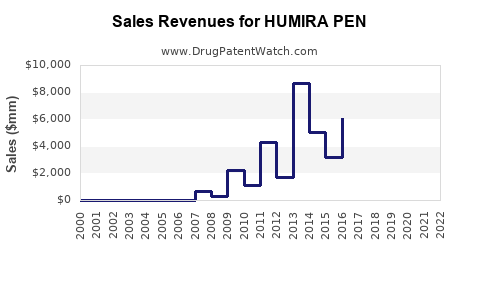

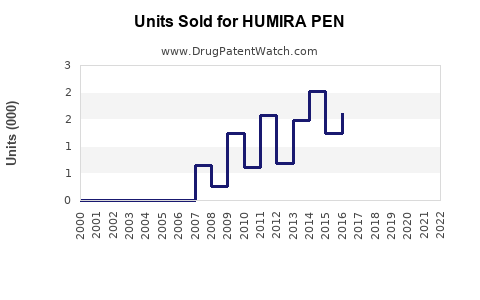

Prior to patent expiry in the U.S., HUMIRA enjoyed stable annual sales exceeding $20 billion, supported by expanding indications and retrial of existing patients.

Projected sales for 2023 are approximately $19–20 billion, considering the initial impact of biosimilar entries and price discounts.

Post-Patent Expiry Market Share and Competitive Impact (2025–2030)

The post-patent landscape foresees a substantial decline in HUMIRA revenues in the U.S., with estimates projecting a 40–50% reduction by 2027[^5]. However, the overall global sales might stabilize due to ongoing demand in non-U.S. markets and adherence to existing patients.

Assuming continued market share retention through formulation innovation, patient support programs, and strategic pricing, sales could decline to around $10–12 billion annually by 2027, with some analysts suggesting a gradual stabilization beyond that point due to biosimilar market saturation and new indications.

In Europe, where patent protections end later and biosimilars face variable adoption, sales may maintain a higher baseline, approximating $9–11 billion annually by 2025–2027.

Future Growth Factors

Forecasts also incorporate potential new indications, including intra-articular applications and expanded pediatric approvals, which could offset some revenue loss. Additionally, pipeline innovations—biosimilar versions with enhanced formulations or delivery systems—might influence future sales.

Key Growth Strategies

- Product Differentiation: Continuing innovation in delivery devices (e.g., auto-injectors, wearable patches).

- Expanded Indications: Pursuit of additional autoimmune and inflammatory conditions.

- Market Penetration: Enhanced presence in emerging markets via local manufacturing.

- Lifecycle Management: Developing biosimilar versions and combination therapies.

Regulatory and Market Risks

- Patent Litigation: Legal disputes over patent rights could delay biosimilar market entry.

- Reimbursement Policies: Stricter pricing controls and cost containment measures.

- Market Saturation: Competition from newer biologics and oral small-molecule treatments, such as JAK inhibitors.

- Clinical Development: Failure to demonstrate advantages in new indications could limit growth.

Conclusion

HUMIRA Pen remains a cornerstone in the biologic treatment of autoimmune diseases, with substantial current revenues and extensive global penetration. However, patent expirations and biosimilar proliferation pose significant risks to its future sales trajectory. Strategic investments in innovation, indication expansion, and patient engagement are vital for maintaining market relevance.

While sales are projected to decline in the near term post-patent expiry, HUMIRA’s established brand presence and ongoing strategic initiatives could sustain a notable share of the autoimmune biologics market for the next decade, especially outside the U.S.

Key Takeaways

- HUMIRA Pen historically drove over $20 billion annually, but impending biosimilar competition will significantly pressure sales.

- Patent expiry in the U.S. in 2023 catalyzes biosimilar entry, with anticipated revenue declines of up to 50% by 2027.

- Global markets, especially Europe and emerging economies, offer continued growth opportunities due to delayed biosimilar adoption.

- Innovation in delivery devices and expansion into new indications are critical to prolong HUMIRA’s market relevance.

- Market dynamics underscore the importance of strategic lifecycle management, including biosimilar development and regional market expansion.

FAQs

1. How does the introduction of biosimilars impact HUMIRA Pen sales?

Biosimilars generally lead to significant price reductions and increased competition, causing a substantial decline in HUMIRA’s revenue. Despite this, brand loyalty and clinical familiarity may preserve some market share in specific regions.

2. What are the primary mechanisms to sustain HUMIRA Pen’s market position post-patent expiry?

Strategies include innovation in delivery devices, expanding therapeutic indications, optimizing pricing policies, and strengthening patient support programs to enhance adherence.

3. Will new formulations or delivery systems be developed for HUMIRA?

Yes. Ongoing R&D efforts focus on improved autoinjectors, subcutaneous patches, and combination therapies to maintain competitiveness.

4. Which regions will contribute most to HUMIRA’s future global sales?

Non-U.S. markets, particularly Europe, Japan, and emerging economies like China, will be key contributors, owing to ongoing approvals and patents protections.

5. How do regulatory differences influence HUMIRA sales projections?

Regulatory environments that expedite biosimilar approvals and reimbursement policies directly impact market penetration and sales growth across different regions.

Sources

[^1]: EvaluatePharma, 2022.

[^2]: Grand View Research, 2022.

[^3]: World Health Organization, 2021.

[^4]: U.S. Patent and Trademark Office, 2023.

[^5]: MarketWatch, 2023.