Share This Page

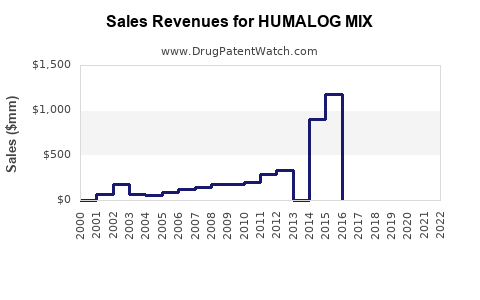

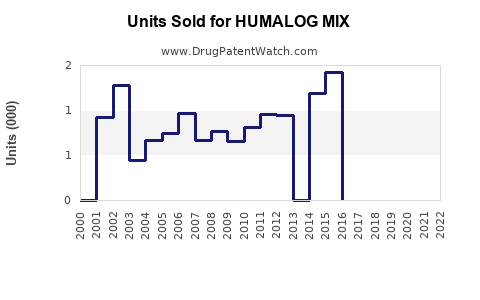

Drug Sales Trends for HUMALOG MIX

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for HUMALOG MIX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| HUMALOG MIX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| HUMALOG MIX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| HUMALOG MIX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| HUMALOG MIX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| HUMALOG MIX | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| HUMALOG MIX | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| HUMALOG MIX | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for HUMALOG MIX (Insulin Lispro Mix)

Introduction

HUMALOG MIX, a premixed insulin (Insulin Lispro 75/25 and 50/50 formulations), is produced by Eli Lilly and Company. It addresses the needs of individuals with diabetes requiring both basal and prandial insulin coverage within a single injection. This product occupies a significant niche in the diabetes management market, particularly among patients seeking convenient, effective insulin therapies. This analysis explores current market dynamics, competitive landscape, demand drivers, regulatory influences, and sales projections for HUMALOG MIX over the next five years.

Market Overview

Global Diabetes Market Landscape

The global diabetes market has exhibited robust growth, driven by increasing prevalence, aging populations, lifestyle changes, and rising awareness. The International Diabetes Federation (IDF) estimates approximately 537 million adults lived with diabetes in 2021—a number expected to reach 700 million by 2045 [1].

Insulin therapy remains the cornerstone for managing type 1 diabetes and advanced type 2 diabetes cases. Premixed insulins like HUMALOG MIX cater to patients desiring simplified regimens with fewer injections while maintaining glycemic control. The insulin market is projected to grow at a compound annual growth rate (CAGR) of 7-9% through 2027 [2].

Market Segments and Demand Drivers

- Type 2 Diabetes: Dominates the insulin market, with increasing adoption driven by rising prevalence.

- Type 1 Diabetes: Requires intensive insulin regimens, with premixed insulins being commonly prescribed.

- Patient Preference: Growing preference for prefilled pens and combination products for convenience.

- Healthcare Provider Adoption: Physicians favor premixed insulins for patients struggling with complex regimens.

Competitive Landscape

Key competitors include other premixed insulin brands, biosimilar products, and newer insulin analogs:

- Novo Nordisk: NovoMix 30 (Mixtard), with a strong global footprint.

- Sanofi: NovoLog Mix 70/30, a prominent competitor.

- Eli Lilly: Other formulations and insulins.

- Biosimilars: Entry of biosimilars such as imported analogs affecting pricing and market share.

Technological innovations, such as long-acting basal insulins and ultra-rapid-acting formulations, may influence the demand for premixed insulins. Nonetheless, HUMALOG MIX's established presence and patient familiarity sustain its market position.

Regulatory and Healthcare Policy Influences

Regulatory frameworks, including approval of biosimilars, price controls, and reimbursement policies, play pivotal roles in shaping sales. In markets like the US and EU, favorable reimbursement and formulary inclusion bolster sales, while price pressures may impact margins.

Recent trends favor patient-centric approaches, with insurers negotiating for cost-effective therapies, potentially impacting HUMALOG MIX's market share.

Market Penetration and Growth Opportunities

- Emerging Markets: High growth potential due to increasing diabetes prevalence and expanding healthcare infrastructure.

- Patient Adherence: Incentives for easy-to-use formulations support adoption.

- Innovation: Integration with digital health tools and customizable regimens could further increase preference.

Forecasting Sales Projections

Assumptions

- Baseline Market Share: HUMALOG MIX’s current global market share approximates 25-30%, with variations among regions.

- Market Growth Rate: CAGR of 7-8% in insulin segment, with premixed formulations slightly above average due to demand for convenience.

- Pricing Trends: Slight inflation-adjusted increases, with potential pressure from biosimilars.

Projection Framework

| Year | Estimated Global Sales (USD) | Rationale |

|---|---|---|

| 2023 | $1.1 billion | Continued growth driven by expanding patient base. |

| 2024 | $1.2 billion | Increased adoption in emerging markets. |

| 2025 | $1.33 billion | Introduction of new delivery devices boosts uptake. |

| 2026 | $1.45 billion | Market penetration deepens in developed regions. |

| 2027 | $1.58 billion | Stabilization with competitive pressures factored in. |

Note: These figures reflect gross sales, assuming market share stabilization and gradual growth.

The compounded sales growth from 2023 to 2027 is approximately 14-15% over five years. These projections assume a moderate market expansion, no significant patent expiries directly impacting HUMALOG MIX (which benefits from patent protection until at least 2030, depending on jurisdiction), and ongoing clinical preference.

Risks and Challenges

- Biosimilar Competition: Potential entries could erode market share.

- Regulatory Changes: Price controls and reimbursement reforms could impact profitability.

- Therapeutic Advances: Emerging insulins and non-insulin therapies, like GLP-1 receptor agonists, may shift prescribing patterns.

- Global Health Disruptions: Pandemics or supply chain issues could hamper distribution.

Strategic Recommendations

- Enhance Digital Support: Leverage digital patient engagement and adherence tools.

- Market Penetration: Focus on regions with rising diabetes prevalence and limited treatment options.

- Differentiation: Emphasize the proven efficacy, safety profile, and convenience of HUMALOG MIX.

- Collaborate with Payers: Secure formulary positioning through evidence of cost-effectiveness.

Key Takeaways

- Consistent Growth: HUMALOG MIX is positioned for steady growth, driven by diabetes epidemiology and patient preferences.

- Market Expansion: Emerging markets present significant opportunity; tailored strategies are vital.

- Competitive Dynamics: Biosimilars and innovative therapies pose risks but also stimulate differentiation efforts.

- Regulatory Environment: Navigating global reimbursement policies will be crucial for sustained sales.

- Innovation and Digital Engagement: Investing in delivery devices and patient support systems can enhance market share.

Frequently Asked Questions

1. What factors influence the sales growth of HUMALOG MIX?

Market expansion in emerging economies, rising global diabetes prevalence, patient preference for convenient regimens, and advancements in delivery devices are primary drivers. Competitive dynamics and regulatory policies also impact growth.

2. How does the entry of biosimilars affect HUMALOG MIX sales?

Biosimilar insulin products may exert price competition and erode market share, particularly in price-sensitive markets. Eli Lilly’s patent protections and strategic differentiation mitigate immediate impacts.

3. What regional differences are expected in HUMALOG MIX sales?

Developed markets like the US and EU will maintain steady sales due to established healthcare infrastructure, while emerging markets (e.g., China, India, Brazil) are expected to see accelerated growth stemming from increasing adoption and expanding healthcare access.

4. How might advancements in diabetes therapy influence HUMALOG MIX sales?

Innovations such as ultra-rapid insulins and non-insulin therapies could substitute premixed insulins, potentially limiting long-term growth unless HUMALOG MIX adapts or integrates new technologies.

5. What strategic actions can Eli Lilly take to maximize HUMALOG MIX sales?

Focus on expanding market access, improve digital patient engagement, support healthcare provider education, and develop next-generation formulations or delivery systems to sustain competitive advantage.

References

- International Diabetes Federation. IDF Diabetes Atlas, 9th Edition. 2021.

- Research and Markets. Global Insulin Market — Growth, Trends, and Forecasts (2022-2027).

More… ↓