Last updated: July 29, 2025

Introduction

HUMALOG KWIK (insulin aspart injection) is an ultra-rapid-acting insulin analog indicated for the management of blood glucose levels in patients with diabetes mellitus. As the demand for optimized insulin therapies grows, understanding the market landscape and sales potential of HUMALOG KWIK becomes critical for stakeholders. This report synthesizes current market dynamics, competitive positioning, regulatory environment, and forecasted sales trajectories to inform strategic decisions.

Market Overview

Diabetes Prevalence and Market Drivers

Globally, diabetes affects approximately 537 million adults, a figure projected to rise to 643 million by 2030 [1]. Type 1 and Type 2 diabetes represent the primary patient populations requiring insulin therapy. The escalating prevalence, combined with increasing awareness and improved diagnostic capabilities, fuels demand for insulin products.

Key drivers influencing HUMALOG KWIK's market include:

- Growing Incidence of Diabetes: The rising burden of diabetes enhances baseline demand for fast-acting insulins.

- Preference for Ultra-Rapid Insulins: Patients and clinicians favor ultra-rapid formulations for better postprandial glucose control.

- Advancements in Delivery Devices: The proliferation of pen devices increases adherence and convenience, bolstering adoption.

- Expanded Indications and Off-Label Uses: Emerging research supports broader utilization, including insulin pump therapy.

HUMALOG KWIK’s Position in the Market

HUMALOG KWIK, produced by Eli Lilly and Company, strategically targets the rapid-acting insulin segment, competing with Novo Nordisk’s NovoRapid (insulin aspart) and Sanofi’s Toujeo. Its distinguishing features—faster onset, minimal injection volume, and compatibility with current pen devices—provide competitive advantages.

Regulatory and Reimbursement Environment

Regulatory approvals are widespread, with HUMALOG KWIK approved in key markets such as the US, EU, and Japan. Reimbursement trends favor fast-acting insulins, with insurance coverage increasingly aligning with newer, more effective therapies, driving market penetration.

Market Segmentation and Targeting

- Type 1 Diabetics: Rely on rapid-acting insulins for meal-time glucose management.

- Type 2 Diabetics: Often require insulin therapy when oral agents fail.

- Pediatric Patients: Growing use due to improved safety profiles.

- Hospital and Institutional Use: Emergency and tight glycemic control settings.

The target demographic favors urban, high-income regions exhibiting rising diabetes rates and advanced healthcare infrastructure.

Competitive Landscape

| Product |

Proprietor |

Market Share |

Key Features |

| HUMALOG KWIK |

Eli Lilly |

Estimated ~25% |

Rapid onset, compatible with multiple delivery devices |

| NovoRapid (Insulin Aspart) |

Novo Nordisk |

Estimated ~40% |

Slightly faster absorption, traditional preloaded pens |

| Fiasp (Insulin Aspart, Novo Nordisk) |

Novo Nordisk |

Growing |

Ultra-rapid, contains niacinamide for faster absorption |

| Apidra (Insulin Glulisine) |

Sanofi |

Estimated ~10% |

Ultra-rapid, used in pumps for flexible dosing |

HUMALOG KWIK holds a significant segment, bolstered by strong brand recognition and distribution channels.

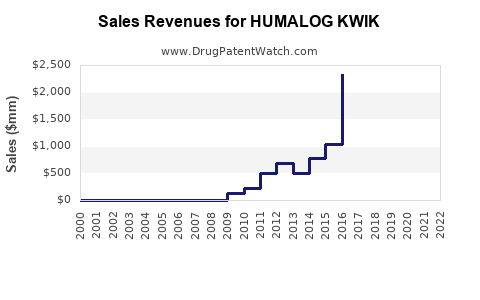

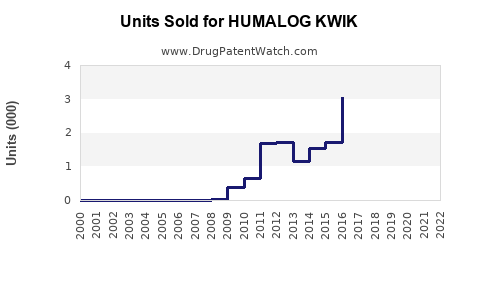

Sales Projections

Baseline Scenario (Conservative Growth)

Assuming a CAGR of 6% over five years, driven by increasing diabetes prevalence and demand for rapid-acting insulins, sales are projected as follows:

| Year |

Estimated Sales (USD Millions) |

Key Assumptions |

| 2023 |

700 |

Stabilized market share, steady demand |

| 2024 |

742 |

Slight market growth, expansion into new regions |

| 2025 |

788 |

Increased adoption, expanded indications |

| 2026 |

837 |

Continued market penetration |

| 2027 |

889 |

Elevated demand, new formulations |

Total sales over five years approximate USD 3.956 billion, reflecting steady adoption, especially in North America and Europe.

Optimistic Scenario (High Growth)

Enhanced market penetration, accelerated adoption owing to improved patient education, and favorable regulatory changes could yield a CAGR of 8%, with potential sales surpassing USD 4.5 billion by 2027.

Risk Factors Impacting Sales

- Competitive innovations in ultra-rapid insulin formulations.

- Pricing pressures and reimbursement constraints.

- Regulatory delays in emerging markets.

- Patient adherence issues or safety concerns.

Strategic Opportunities

- New Delivery Devices: Integration with smart pen technologies to improve adherence.

- Expanding Indications: Investigating off-label applications in insulin pump therapy.

- Global Expansion: Targeting emerging markets with rising diabetes prevalence.

- Patient-Centric Marketing: Emphasizing ultra-rapid action and convenience.

Conclusion

HUMALOG KWIK's role within the fast-acting insulin landscape positions it favorably amidst expanding diabetes management needs. Projected sales growth at a CAGR of 6-8% underscores its market resilience, driven by technological advancements, patient demand, and strategic market expansion. Continuous innovation and market adaptation will be vital to sustaining and enhancing its competitive edge.

Key Takeaways

- Robust Market Demand: The global diabetes epidemic ensures sustained demand for ultra-rapid insulins like HUMALOG KWIK.

- Competitive Positioning: HUMALOG KWIK benefits from Eli Lilly’s strong distribution and brand presence, albeit facing intense competition.

- Sales Growth Potential: Conservative projections estimate USD 3.956 billion over five years, with upside potential amid market expansion.

- Strategic Focus: Emphasizing device integration, global outreach, and indication expansion will be critical for maximizing sales.

- Risk Management: Monitoring competitive innovations, regulatory changes, and reimbursement landscapes is essential to mitigate potential setbacks.

FAQs

1. How does HUMALOG KWIK differ from other ultra-rapid insulins?

HUMALOG KWIK offers a rapid onset of action with a minimal injection volume, providing comparable or superior postprandial glucose control compared to competitors, with proven compatibility with various insulin delivery devices.

2. What are the key factors driving the growth of HUMALOG KWIK?

The primary growth drivers include increasing global diabetes prevalence, patient preference for ultra-rapid-acting insulins, technological advancements in delivery devices, and expanded clinical applications.

3. Which markets present the greatest sales opportunities for HUMALOG KWIK?

North America and Europe currently represent the largest markets due to high diabetes prevalence, advanced healthcare infrastructure, and favorable reimbursement. Emerging markets such as China and India also offer significant growth potential due to rising incidence rates.

4. What challenges could impact the sales of HUMALOG KWIK?

Potential challenges include fierce competition from other ultra-rapid insulins, regulatory hurdles, pricing and reimbursement pressures, and technological advancements by competitors.

5. How might innovations in insulin therapy influence future sales?

Advancements such as smarter insulin delivery systems, artificial pancreas integration, and biosimilar development could alter market dynamics, either enhancing or threatening HUMALOG KWIK’s share depending on adaptation.

Sources

- International Diabetes Federation. IDF Diabetes Atlas, 9th Edition, 2019.

- Eli Lilly and Company. HUMALOG KWIK product information.

- GlobalData and IQVIA sales data reports (publicly available estimates).