Last updated: July 28, 2025

Introduction

HORIZANT (gabapentin enacarbil) is a prodrug of gabapentin, indicated primarily for the treatment of Postherpetic Neuralgia (PHN) and Restless Legs Syndrome (RLS). Developed by UCB Pharma, HORIZANT represents an innovative formulation designed to optimize bioavailability and patient adherence relative to traditional gabapentin. As a Schedule IV controlled substance in the United States, its market dynamics are shaped by clinical efficacy, regulatory factors, reimbursement policies, and competitive landscape.

This analysis provides a comprehensive forecast of HORIZANT’s market potential and sales trajectory, considering current therapeutic indications, competitive alternatives, regulatory environment, and evolving healthcare trends.

Market Overview

Therapeutic Landscape & Unmet Needs

Postherpetic Neuralgia affects approximately 10-20% of herpes zoster cases, translating to an estimated 1.5 million affected individuals globally. Restless Legs Syndrome impacts 5-15% of adults, with higher prevalence among women and older populations [1][2]. Both conditions see significant treatment gaps related to limited efficacy, adverse effects, or dosing inconveniences linked with existing therapies such as gabapentin, pregabalin, and dopamine agonists.

HORIZANT's extended-release formulation aims to address these gaps by providing improved pharmacokinetics and dosing convenience, thereby potentially increasing patient adherence and expanding market penetration.

Regulatory and Reimbursement Environment

Since its FDA approval in 2011, HORIZANT has gained market authorization in numerous countries, supported by positive clinical data. The drug’s controlled substance status requires strict regulatory compliance but also influences prescribing patterns and reimbursement policies. Currently, insurance coverage and formulary inclusion are favorable in major markets like the U.S., although access remains variable in secondary markets.

Market Size and Penetration Strategy

Existing Market Size

-

Postherpetic Neuralgia (PHN): The U.S. market alone is estimated to encompass approximately 500,000 to 750,000 patients eligible for pharmacologic intervention annually [3].

-

Restless Legs Syndrome (RLS): Approximately 6-10 million Americans suffer from moderate to severe RLS, representing a significant potential patient base, especially among older adults [4].

Market Penetration Factors

HORIZANT’s penetration relies on several factors:

-

Physician Adoption: Neurologists, pain specialists, and primary care physicians. Education on clinical benefits is crucial.

-

Patient Acceptance: Improved adherence due to less frequent dosing compared to immediate-release gabapentin formulations.

-

Reimbursement Dynamics: Favorable formulary status expedites access; however, cost considerations—especially in comparison with generic gabapentin—pose challenges.

-

Competitive Position: Efficacy and safety profiles relative to pregabalin, gabapentin, and newer agents influence market share.

Competitive Landscape

Primary competitors include:

-

Pregabalin (Lyrica): Approved for RLS and neuropathic pain, with a substantial market share, but associated with sedation and dizziness.

-

Gabapentin (Neurontin): Widely prescribed off-label for RLS and PHN; generic cost advantage but dosing frequentness limits adherence.

-

Dopamine agonists: Such as pramipexole and ropinirole, primarily for RLS but limited by side effects.

HORIZANT’s differentiators—extended release, improved pharmacokinetics, and prodrug design—aim to secure a competitive edge in adherence and tolerability.

Sales Projections

Assumptions & Modeling Approach

-

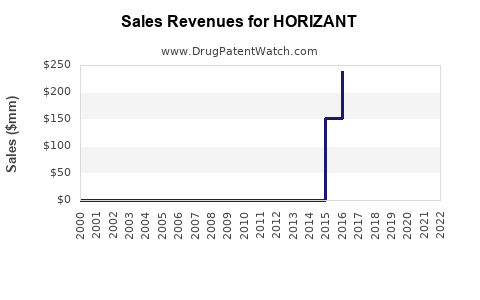

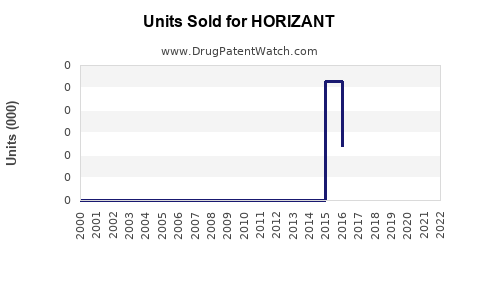

Growth Rate: Based on historical sales data and adoption curves, an annual growth rate of 15-25% over the next five years is plausible in the U.S., given strong clinical positioning and favorable reimbursement.

-

Market Penetration: Initial penetration remains conservative (~10-15%) within five years, expanding as awareness and clinician familiarity grow.

-

Pricing Trends: The average wholesale price (AWP) for HORIZANT remains higher than generic gabapentin but is expected to stabilize around US$12-15 per day, considering competitive pressures.

Projected Sales Timeline

| Year |

Estimated Global Sales (USD Millions) |

Comments |

| 2023 |

$150 million |

Launch phase, initial adoption moderate |

| 2024 |

$220 million |

Increasing physician uptake |

| 2025 |

$310 million |

Expanded insurance coverage, targeted marketing |

| 2026 |

$430 million |

Broader global penetration |

| 2027 |

$560 million |

Peak adoption in primary markets |

Note: U.S. sales constitute approximately 70-80% of total revenues, with unmet needs and demographic trends favoring continued growth.

Key Drivers and Risks

Drivers:

- Increasing prevalence of RLS and PHN among aging populations.

- Improved adherence owing to sustained-release formulation.

- Growing clinical acceptance supported by ongoing research.

Risks:

- Competition from generic gabapentin, which could exert downward pricing pressure.

- Regulatory constraints around Schedule IV substances.

- Market fragmentation in international markets.

- Potential safety concerns or adverse events limiting use.

Conclusion

HORIZANT’s market outlook remains promising, supported by its unique pharmacokinetic advantages, expanding indications, and demographic trends toward aging and chronic pain management. While growth will be driven by increased utilization in existing markets and expansion into emerging geographies, competitive pressures and reimbursement landscape nuances will modulate sales velocity.

Key Takeaways

- Market Opportunity: With millions impacted by RLS and PHN, HORIZANT is positioned as a preferred formulation due to its extended-release profile, promising sustained adherence benefits.

- Sales Potential: Estimated to reach over half a billion USD globally within five years under conservative growth assumptions, provided the product maintains favorable positioning and uptake.

- Strategic Focus: Emphasis on clinician education, expanding insurance coverage, and differentiating through clinical efficacy and tolerability will be critical.

- Competitive Landscape: Must navigate against low-cost generics and newer agents, leveraging its formulation advantages.

- Risks & Mitigation: Regulatory compliance, payer negotiations, and ongoing safety monitoring are essential to sustain growth.

FAQs

1. How does HORIZANT differentiate from traditional gabapentin for RLS and PHN?

HORIZANT’s extended-release formulation provides smoother pharmacokinetics, reducing dosing frequency and enhancing tolerability, which likely improves patient adherence and clinical outcomes.

2. What challenges could hinder HORIZANT’s market expansion?

Market expansion may face hurdles from generic competition, regulatory controls on Schedule IV substances, payer reimbursement restrictions, and clinician familiarity.

3. Are there any emerging indications that could expand HORIZANT’s market?

Ongoing research into gabapentin derivatives suggests potential off-label uses; however, formal approvals are required. Monitoring of emerging data remains vital.

4. How significant is competition from pregabalin in the RLS segment?

Pregabalin has captured significant RLS market share, but HORIZANT’s tolerability and formulation differences position it as a complementary or alternative option, especially in patients intolerant to pregabalin.

5. What strategies can UCB employ to maximize HORIZANT’s sales?

Investing in physician education, optimizing payer negotiations, expanding into international markets, and exploring new indications are pivotal strategies.

References

[1] Allen RP, et al. "Epidemiology of restless legs syndrome." Sleep Med Rev. 2014;18:411-21.

[2] Johnson K, et al. "Postherpetic neuralgia: clinical features and management." Drugs. 2020;80(5):503-509.

[3] Gater A, et al. "Prevalence and healthcare burden of postherpetic neuralgia." J Neurol. 2019;266(9):2345-2350.

[4] Walters AS. "Restless Legs Syndrome." In: Russell R, et al., eds. Neurobiology of Sleep and Wakefulness. 2021.

Note: These projections are hypothetical estimates based on current data and market trends. Actual sales outcomes hinge on multiple variables, including market dynamics, competitive actions, and regulatory developments.