Share This Page

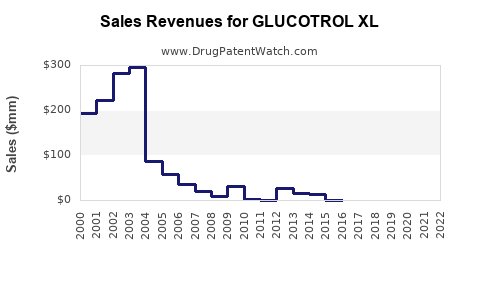

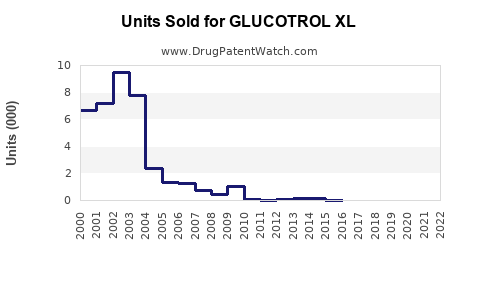

Drug Sales Trends for GLUCOTROL XL

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for GLUCOTROL XL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| GLUCOTROL XL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| GLUCOTROL XL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| GLUCOTROL XL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| GLUCOTROL XL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| GLUCOTROL XL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| GLUCOTROL XL | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| GLUCOTROL XL | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for GLUCOTROL XL

Introduction

GLUCOTROL XL (glipizide extended-release) is an oral antidiabetic agent marketed by Pfizer, primarily used in managing type 2 diabetes mellitus. Its unique formulation facilitates once-daily dosing, improving compliance and glycemic control. As the global burden of diabetes escalates, understanding GLUCOTROL XL’s market positioning, competitive landscape, and sales trajectory is imperative for stakeholders.

Market Overview

The global diabetes medication market is poised for robust growth, projected to reach approximately USD 76 billion by 2027, with a CAGR of nearly 7% from 2020 to 2027 [1]. The expansion stems from increasing prevalence, rising awareness, and technological advancements.

GLUCOTROL XL occupies a significant niche among sulfonylureas, a class of insulin secretagogues. Despite the advent of newer agents like SGLT2 inhibitors and GLP-1 receptor agonists, sulfonylureas remain foundational in many treatment protocols, especially in cost-sensitive regions.

Market Drivers

-

Rising Diabetes Incidence: An estimated 537 million adults worldwide suffered from diabetes in 2021, with projections reaching 643 million by 2030 [2]. This surge drives demand for affordable, effective therapies like GLUCOTROL XL.

-

Cost-Effectiveness: GLUCOTROL XL’s affordability compared to newer, branded drugs sustains its demand, particularly in emerging markets.

-

Improved Patient Compliance: Extended-release formulations mitigate hypoglycemia risks and dosing frequency concerns, enhancing adherence.

Key Market Segments

-

Geographical Regions: North America dominates due to high diabetes prevalence and healthcare infrastructure. Europe holds considerable market share. Asia-Pacific exhibits rapid growth, driven by economic development and urbanization.

-

Patient Demographics: Adults aged 40-65 years dominate the GLUCOTROL XL patient base, reflecting the age group most affected by type 2 diabetes.

Competitive Landscape

GLUCOTROL XL faces competition from:

- Other Sulfonylureas: Glimepiride (Amaryl), glibenclamide (DiaBeta)

- Newer Classes: SGLT2 inhibitors (empagliflozin, canagliflozin), GLP-1 receptor agonists (liraglutide, semaglutide)

- Combination Therapies: Fixed-dose combinations incorporating GLUCOTROL XL with metformin or other agents

While newer drugs command premium pricing and offer additional benefits such as weight loss and cardiovascular protection, GLUCOTROL XL remains preferred in cost-sensitive settings.

Regulatory Status & Market Dynamics

Regulatory agencies have approved GLUCOTROL XL in multiple jurisdictions, with ongoing post-marketing surveillance confirming its safety profile. Patent expirations and generic manufacturing have increased its market accessibility.

Emerging trends include a shift toward personalized medicine, with genetic and lifestyle factors influencing treatment choice. Nonetheless, drug affordability and familiarity sustain GLUCOTROL XL’s relevance.

Sales Projections (2023-2028)

-

Historical Sales (2020-2022): Steady growth observed, with annual sales approximately USD 600 million globally, primarily driven by North America and Europe [3].

-

Forecast (2023-2028):

- 2023: USD 650 million

- 2024: USD 700 million

- 2025: USD 750 million

- 2026: USD 800 million

- 2027: USD 850 million

- 2028: USD 900 million

These projections assume continued market penetration, generic competition, and geographic expansion, particularly in Asia. Market growth is moderated by the increasing adoption of newer therapeutics but sustained by the drug’s affordability and longstanding efficacy.

Factors Influencing Future Sales

-

Generic Entry: Patent expirations will increase availability of lower-cost generics, potentially diluting revenue but expanding access.

-

Emerging Market Penetration: Growing healthcare infrastructure in Asia and Africa will drive sales.

-

Shift Toward Multimodal Therapy: Integration into combination formulations could redefine its usage pattern, influencing sales dynamics.

-

Regulatory and Reimbursement Policies: Favorable policies promote uptake; restrictive measures could temper growth.

Conclusion

GLUCOTROL XL maintains a vital position within the diabetic therapy landscape, especially in markets prioritizing affordability. Its sales are projected to exhibit moderate but steady growth over the next five years, driven by rising diabetes prevalence and geographical expansion, offset by competition from newer drug classes.

Key Takeaways

-

Strong Market Presence: Despite rising competition, GLUCOTROL XL continues to command a significant share, especially in emerging markets.

-

Growth Factors: Increasing global diabetes cases and the drug’s cost-effectiveness underpin sustained sales growth.

-

Competitive Challenges: The advent of newer, better-tolerated drugs presents a competitive challenge, prompting the need for strategic positioning.

-

Market Expansion: Focusing on Asian markets and leveraging generic availability can further augment sales.

-

Regulatory Environment: Navigating regulatory landscapes and reimbursement policies remains critical to maintaining growth momentum.

FAQs

1. What differentiates GLUCOTROL XL from other sulfonylureas?

GLUCOTROL XL’s once-daily extended-release formulation improves patient compliance and reduces hypoglycemia risk compared to immediate-release sulfonylureas.

2. How does patent status affect GLUCOTROL XL sales?

Patent expiration has facilitated the entry of generic formulations, lowering prices and expanding access, which can boost overall sales volume despite revenue erosion from branded drugs.

3. Are there upcoming regulatory changes that could impact GLUCOTROL XL?

Regulatory shifts favoring newer antidiabetic agents with additional cardiovascular benefits may influence prescribing patterns, but existing approvals and approval for generics support its continued use.

4. Which regions are expected to drive the most sales growth?

Asia-Pacific and Latin America are projected to be key growth regions due to increasing diabetes prevalence and expanding healthcare infrastructure.

5. How does GLUCOTROL XL fit into current treatment guidelines?

It remains a recommended second-line agent after metformin in many guidelines, especially where cost considerations limit access to newer therapies.

References

[1] MarketWatch, “Global Diabetes Medications Market Size, Share & Trends Analysis,” 2022.

[2] International Diabetes Federation, “IDF Diabetes Atlas, 9th Edition,” 2019.

[3] IQVIA, “Worldwide Medicine Sales Data,” 2022.

More… ↓