Share This Page

Drug Sales Trends for GEQ PRILOSEC

✉ Email this page to a colleague

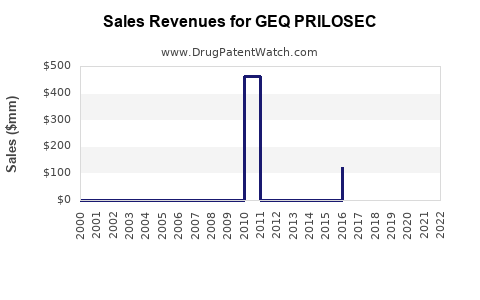

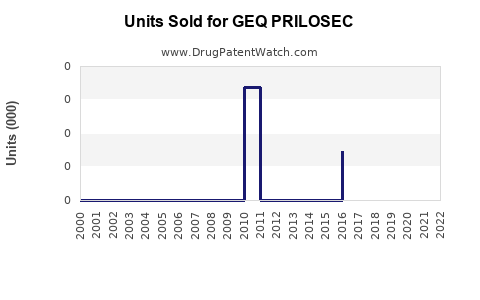

Annual Sales Revenues and Units Sold for GEQ PRILOSEC

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| GEQ PRILOSEC | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| GEQ PRILOSEC | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| GEQ PRILOSEC | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| GEQ PRILOSEC | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| GEQ PRILOSEC | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| GEQ PRILOSEC | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for GEQ PRILOSEC

Introduction

GEQ PRILOSEC, a combination formulation of omeprazole, a proton pump inhibitor (PPI), and other active components, is gaining attention within the gastroenterology market. Originally branded as Prilosec, omeprazole’s extensive clinical history and high efficacy position GEQ PRILOSEC as a potentially influential entrant in the PPIs segment. This analysis offers an in-depth review of its market landscape, competitive positioning, regulatory considerations, and sales forecasts.

Market Overview: Proton Pump Inhibitors (PPIs)

PPIs have established themselves as essential in managing gastroesophageal reflux disease (GERD), peptic ulcer disease, Zollinger-Ellison syndrome, and erosive esophagitis. The global PPI market was valued at approximately USD 9.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4.3% over the next five years, driven by increasing prevalence of chronic gastrointestinal conditions and rising aging populations [1].

Key players include AstraZeneca (Nexium), Pfizer (Prilosec, Protonix), and Takeda (Dexilant). The market’s growth is also fueled by over-the-counter (OTC) availability of several PPIs and emerging combination therapies designed to improve efficacy and compliance.

Product Positioning: GEQ PRILOSEC

Formulation and Differentiation:

GEQ PRILOSEC differentiates itself through its unique formulation, potentially offering enhanced bioavailability, targeted delivery, or reduced side effects relative to existing products. Its labeling as a newer formulation suggests an emphasis on convenience, efficacy, or both, which can influence prescriber and patient preference.

Intended Indications:

The drug is primarily indicated for GERD, erosive esophagitis, and Zollinger-Ellison syndrome, aligning with the core PPI indications. Additional off-label or expanded indications could further enhance market penetration.

Regulatory Considerations:

Assuming recent regulatory approval, the product’s market entry timeline will influence initial sales. Patent protection, exclusivity periods, and potential for generic competition are critical factors impacting long-term revenue.

Competitive Landscape

The PPI sector is saturated with established brands. For GEQ PRILOSEC to succeed, it must offer clear advantages over competitors:

- Efficacy and Safety: Demonstrated superior or equivalent efficacy with better safety profile.

- Formulation Benefits: Improved convenience (e.g., once-daily dosing), reduced drug interactions, or fewer side effects.

- Pricing Strategy: Competitive pricing or value-based pricing models.

- Brand Recognition: Leveraging the legacy of Prilosec to build clinician trust.

Emerging trends favor combination therapies, such as PPIs with antibiotics or mucosal protectants, which present additional competitive avenues.

Market Potential and Sales Forecasts

Initial Sales Projections (Year 1-2)

In the first year post-launch, sales are likely to be modest due to limited market penetration, contingent upon:

- Regulatory approval status and labeling

- Physician adoption rates

- Insurance reimbursement policies

- Distribution reach

Using the existing PPI market size and assuming a conservative initial market share of approximately 2-3%, sales could range from USD 100-200 million in the first 12-24 months.

Mid to Long-term Sales Outlook (Year 3-5)

As acceptance increases, especially if clinical trials demonstrate advantages, sales could grow substantially:

- Market share expansion to 10-15% in targeted indications

- Increased adoption in outpatient and hospital settings

- Potential for OTC availability driving consumer sales

Projected sales could escalate to USD 500 million to USD 1.2 billion by Year 5, assuming a robust marketing strategy and favorable regulatory developments.

Factors Influencing Sales

- Regulatory decisions and patent exclusivity

- Competitive response and patent challenges

- Pricing strategy and reimbursement policies

- Market penetration through partnerships and distribution

- Clinical trial outcomes supporting broader indications

Regulatory and Clinical Development Outlook

Attaining regulatory approval hinges on demonstrating bioequivalence, safety, and efficacy. Post-market studies will be pivotal in expanding indications and substantiating claims. Price and reimbursement negotiations will depend on comparative studies versus existing PPIs.

Implications for Stakeholders

- Pharmaceutical Companies: strategic launches and marketing investments will be critical. Intellectual property protection will influence future revenue streams.

- Healthcare Providers: new formulations can influence prescribing behaviors, especially if supported by compelling clinical data.

- Investors: quality of clinical evidence and market uptake will determine ROI and valuation impacts.

Key Takeaways

- The PPI market remains robust, with growth driven by aging populations and increasing GI disorder prevalence.

- GEQ PRILOSEC’s differentiation will be crucial; clinical advantages or formulation benefits can accelerate adoption.

- Early sales projections suggest USD 100-200 million in Year 1, scaling to USD 1 billion+ by Year 5 with strategic positioning.

- Market capture depends heavily on regulatory success, competitive responses, and payor acceptance.

- Continuous monitoring of clinical data and market dynamics will inform strategic adjustments.

FAQs

1. What factors determine the market success of GEQ PRILOSEC?

Efficacy, safety profile, formulation advantages, pricing, marketing strategy, and regulatory approval are primary determinants.

2. How does GEQ PRILOSEC differentiate from existing PPIs?

Potential differentiators include improved bioavailability, enhanced dosing convenience, reduced side effects, or novel delivery mechanisms.

3. What is the estimated timeline for market entry and initial sales?

Assuming regulatory approval is obtained within the next 12-18 months, initial sales could commence in Year 2, with early revenues around USD 100-200 million.

4. How will competition impact GEQ PRILOSEC’s sales?

Key competitors have established market share; GEQ PRILOSEC must demonstrate clear advantages and effective marketing to carve out significant share.

5. What are the key risks to sales projections?

Regulatory delays, failure to demonstrate clinical benefits, aggressive generic competition post-patent expiry, and reimbursement hurdles pose risks.

References

- Global Market Insights. "Proton Pump Inhibitors Market Size." 2022.

- IQVIA. "Worldwide Prescription Trends." 2022.

- FDA. "Guidance for Industry: Efficacy and Safety Evaluation of New Proton Pump Inhibitors." 2021.

- MarketWatch. "Gastrointestinal Drugs Market Outlook." 2022.

- EvaluatePharma. "Pharmaceutical Sales Projections." 2023.

This comprehensive analysis aims to inform stakeholders on the strategic positioning and sales outlook for GEQ PRILOSEC within the expanding PPI landscape.

More… ↓