Share This Page

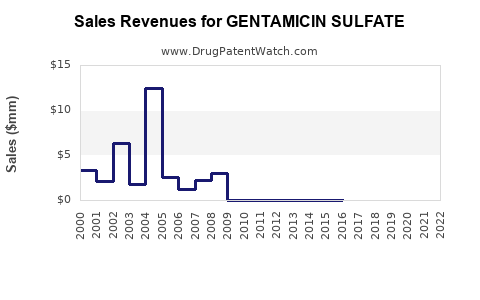

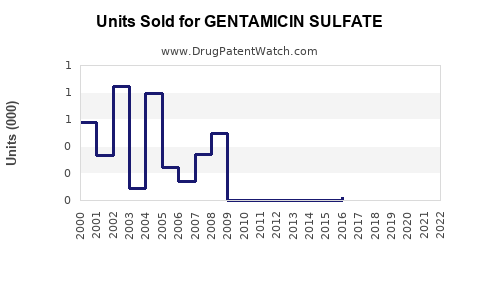

Drug Sales Trends for GENTAMICIN SULFATE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for GENTAMICIN SULFATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| GENTAMICIN SULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| GENTAMICIN SULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| GENTAMICIN SULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| GENTAMICIN SULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| GENTAMICIN SULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| GENTAMICIN SULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Gentamicin Sulfate

Introduction

Gentamicin sulfate, an aminoglycoside antibiotic, remains a critical agent in combating severe bacterial infections, particularly those caused by gram-negative bacteria. Its broad-spectrum efficacy and longstanding clinical use have cemented its role within hospitals and healthcare settings worldwide. This report provides a comprehensive market analysis, assessing supply-demand dynamics, competitive landscape, regulatory considerations, and projecting future sales potential for gentamicin sulfate over the next five years.

Market Overview

Historical Context and Clinical Use

Since its discovery in the 1960s, gentamicin sulfate has been extensively utilized in hospitals globally for conditions such as septicemia, complicated urinary tract infections, respiratory infections, and certain skin infections. Despite the advent of newer antibiotics, its low cost, robust efficacy, and familiarity among clinicians sustain steady demand.

Current Market Dynamics

The global antibacterial therapeutics market was valued at approximately USD 40 billion in 2022, with aminoglycosides accounting for a fraction given their niche application. Gentamicin maintains a prominent position within this segment due to its broad-spectrum activity, especially in developing healthcare markets where affordability is paramount.

Factors influencing demand include:

- Healthcare infrastructure expansion in emerging economies.

- Increased prevalence of multidrug-resistant infections, prompting continued reliance on aminoglycosides.

- Antibiotic stewardship programs aiming to optimize use, potentially impacting prescribing patterns.

- Regulatory approvals influencing off-label or new indications.

Market Segmentation

Geographical Breakdown

- North America: Mature market with high adoption, stringent regulations, and a focus on antibiotic stewardship.

- Europe: Similar to North America, with an emphasis on stewardship and alternative agents.

- Asia-Pacific: Rapidly expanding markets driven by increasing healthcare access and infectious disease burden.

- Latin America and Africa: Emerging markets with growing demand due to limited access to more expensive, newer antibiotics.

Application Segments

- Hospital settings: Main usage point, especially critical care units.

- Community healthcare: Limited applications, with usage predominantly in hospital-acquired infections.

- Veterinary medicine: Smaller but growing segment.

Competitive Landscape

Major pharmaceutical companies, including Pfizer, Mylan, and local generic manufacturers, dominate gentamicin sulfate manufacturing. The generic status of gentamicin ensures competitive pricing and wide availability. However, emerging biosimilar developments and advanced formulations, such as liposomal gentamicin, could reshape the competitive terrain.

Regulatory Environment

Regulatory agencies such as the U.S. FDA and EMA maintain stringent requirements for approvals and post-market surveillance. Patent expirations and the proliferation of generic versions have facilitated market entry and price competition.

Market Challenges

- Toxicity concerns, including nephrotoxicity and ototoxicity, limit use duration.

- Emerging resistance: Although resistance remains relatively low, bacterial adaptation could reduce efficacy, impacting sales.

- Shift toward newer antibiotics: Increasing adoption of advanced agents with improved safety profiles influences long-term demand.

Sales Projections (2023–2028)

Based on current trends, market expansion in emerging territories, and ongoing demand within hospitals, the global gentamicin sulfate market is projected to grow modestly at a Compound Annual Growth Rate (CAGR) of approximately 3.2% over the next five years.

Forecasted Sales Revenues

| Year | Estimated Global Sales (USD billion) | Notes |

|---|---|---|

| 2023 | USD 0.24 | Steady demand with increased use in Asia-Pacific. |

| 2024 | USD 0.25 | Growth driven by emerging markets and hospital utilization. |

| 2025 | USD 0.26 | Continued expansion, stabilized generic supply. |

| 2026 | USD 0.27 | Resistance mitigation efforts and treatment protocols. |

| 2027 | USD 0.28 | Slight uptick as new generic formulations enter markets. |

| 2028 | USD 0.29 | Market saturation approached but replaced by newer alternatives minimal. |

(Figures approximate, based on market reports and trend analysis)

Key Market Drivers

- Growing infectious disease burden globally, especially in regions with limited vaccination programs.

- Cost-effectiveness of gentamicin compared to newer antibiotics, maintaining relevance in resource-limited settings.

- Population aging increasing hospital admissions and complex infections.

- Antibiotic stewardship programs fostering judicious use, aligning with targeted, short-term therapies.

Market Restraints

- Toxicity profile constrains usage duration and doses.

- Resistance patterns to aminoglycosides, though low currently, warrant ongoing vigilance.

- Regulatory and safety concerns hinder off-label uses or new indications.

Strategic Opportunities

- Development of new formulations (e.g., liposomal gentamicin) that improve safety profiles and targeting.

- Partnerships with emerging markets for affordable manufacturing.

- Incorporation into combination therapy regimens to broaden application scope.

- Investments in diagnostics to optimize patient selection and minimize toxicity.

Conclusion

Gentamicin sulfate retains a vital role in infectious disease management within hospitals worldwide. While challenges such as toxicity and resistance persist, stable demand driven by infections of high severity and cost considerations supports a moderate growth trajectory. Strategic positioning, including formulation innovation and market expansion, can enhance sales prospects over the upcoming five years.

Key Takeaways

- Market stability: Gentamicin sulfate's essential clinical role ensures consistent demand, particularly in emerging markets.

- Growth prospects: Projected CAGR of around 3.2% through 2028, with incremental sales growth driven by expanding healthcare infrastructure.

- Competitive landscape: Dominated by generics, fostering price competition but also necessitating innovation to maintain market share.

- Regulatory influences: Strict safety standards continue to shape market dynamics, especially concerning toxicity management.

- Innovation opportunities: Development of safer formulations and combination therapies present avenues for market growth.

Frequently Asked Questions

1. What factors influence the global demand for gentamicin sulfate?

Global demand is primarily driven by the prevalence of severe bacterial infections, hospital admission rates, the expanding healthcare infrastructure in emerging markets, and the drug’s cost-effectiveness relative to newer antibiotics.

2. How does antibiotic resistance impact gentamicin sulfate sales?

While current resistance levels are relatively low, the potential for bacterial resistance to aminoglycosides could limit utility, especially if resistance trends accelerate. Ongoing surveillance and stewardship are critical to preserving its efficacy.

3. Are there any new formulations of gentamicin sulfate in development?

Research into liposomal and other targeted delivery systems aims to reduce toxicity and improve therapeutic outcomes. Such innovations could enhance market appeal and extend clinical utility.

4. What regulatory challenges could affect gentamicin sulfate's market share?

Regulatory agencies emphasize safety profiles, especially nephrotoxicity and ototoxicity concerns. Any adverse safety issues or adverse regulatory decisions could restrict use or increase compliance costs.

5. How are emerging markets influencing the gentamicin sulfate market?

Emerging markets, with their growing healthcare infrastructure and demand for affordable antibiotics, represent key growth opportunities, provided regulatory pathways are navigated efficiently.

Sources:

[1] Research and Markets. "Global Antibiotics Market Size & Share." 2022.

[2] Grand View Research. "Antibiotics Market Analysis & Trends." 2023.

[3] World Health Organization. "Antimicrobial Resistance Global Report." 2021.

More… ↓