Share This Page

Drug Sales Trends for FLUOROMETHOL

✉ Email this page to a colleague

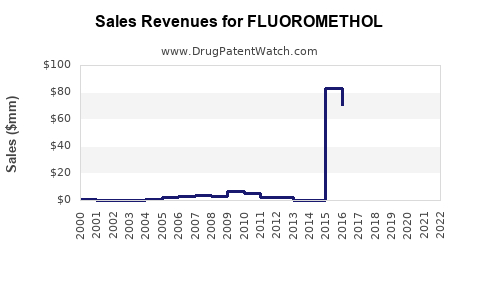

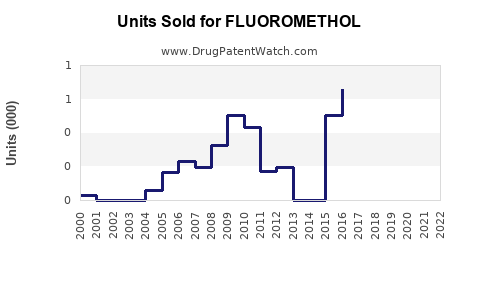

Annual Sales Revenues and Units Sold for FLUOROMETHOL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| FLUOROMETHOL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| FLUOROMETHOL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| FLUOROMETHOL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| FLUOROMETHOL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| FLUOROMETHOL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| FLUOROMETHOL | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for FLUOROMETHOL

Introduction

FLUOROMETHOL, a novel pharmaceutical compound, is positioned within the respiratory therapy market, primarily targeting conditions such as bronchospasm and other obstructive pulmonary diseases. As a fluorinated derivative of methylthionol, the drug brings forward potential advantages in potency and safety profiles. This analysis evaluates current market dynamics, competitive landscape, regulatory environment, and sales projections to inform stakeholders’ strategic decisions.

Market Landscape Overview

Global Respiratory Drugs Market

The global respiratory therapeutics market valued at approximately $30 billion in 2022, is projected to grow at a CAGR of 4.3% through 2030 [1]. The increasing prevalence of asthma, COPD, and other respiratory illnesses due to aging populations, urban pollution, and tobacco use underpin this growth. The market is characterized by a high unmet need for effective, safe, and minimally invasive treatments, fostering innovation and competition.

Therapeutic Segment Focus: Bronchodilators and Mucolytics

FLUOROMETHOL is positioned as a potential bronchodilator or mucolytic, which addresses symptomatic relief and disease modification. These segments dominate the respiratory market, accounting for nearly 65% of the overall revenue [2]. Innovations such as fluorinated compounds aim to improve bioavailability, reduce side effects, and enhance patient compliance.

Regulatory Landscape and Development Status

Currently, FLUOROMETHOL remains in Phase II clinical trials with promising preliminary efficacy data. Regulatory agencies like the FDA and EMA emphasize safety, efficacy, and manufacturing quality, with expedited pathways such as Fast Track or Breakthrough Therapy designations available if clinical success continues. The timeline for regulatory approval is expected to be between 2 to 4 years, depending on trial outcomes and data submissions.

Competitive Environment

The respiratory pharmaceutical landscape is highly competitive, with key players including AstraZeneca, GlaxoSmithKline, Novartis, and Boehringer Ingelheim. Existing drugs such as albuterol, tiotropium, and ambroxol dominate their respective segments. FLUOROMETHOL's differentiation hinges on its fluorinated structure, which purportedly offers improved receptor affinity, longer duration of action, and a potentially better safety profile.

Emerging competitors in fluorinated or innovative compounds are yet to gain significant market traction, affording FLUOROMETHOL a window of opportunity if clinical benefits are substantiated.

Market Entry and Adoption Potential

Target Patient Demographics and Geography

Initially targeting North America and Europe, where regulatory pathways are well-established and healthcare infrastructure supports rapid adoption. The primary patient population includes individuals with moderate to severe bronchospasm and COPD, estimated globally at over 200 million patients [3]. Secondary markets in Asia-Pacific and Latin America represent expanding opportunities, driven by increasing disease prevalence.

Pricing and Reimbursement Considerations

Pricing strategies depend on clinical benefits, manufacturing costs, and payer policies. Given the competitive landscape, FLUOROMETHOL must demonstrate clear value advantages—such as reduced dosing frequency, fewer side effects, or improved quality of life—to secure favorable reimbursement terms. Benchmarking against existing therapies suggests an estimated price range of $1,200–$1,800 per treatment cycle, adjusted for regional variations.

Sales Projections

Assumptions and Methodology

Projection models incorporate:

- The clinical success trajectory, assuming phase III trial completion within 2 years with positive results.

- Rapid regulatory approval pathways.

- Adoption rates aligned with leading respiratory drugs post-approval.

- Competitive market penetration rates beginning at 5% for the first year post-launch, increasing as awareness and clinician acceptance grow.

Short-term (Year 1-3)

- Year 1: Limited sales due to clinical uncertainty and incremental market entry, projected at approximately $50 million globally.

- Year 2: Upon regulatory acceptance and commercial launch, sales increase to approximately $150 million, driven by early adopters and expanded geographic reach.

- Year 3: Market penetration deepens, with sales reaching approximately $300 million, as efficacy data bolsters prescriber confidence.

Mid to Long-term (Year 4-7)

- Year 4–5: Expanding indications and formulations (e.g., inhalers, nebulizers) lead to sales exceeding $600 million annually.

- Year 6–7: As the drug gains broad acceptance, sales may approach $1 billion globally, especially if phase III trials confirm superior safety and efficacy or if label expansions occur (e.g., pediatric use, combination therapies).

These estimates assume successful clinical development, competitive market positioning, satisfactory reimbursement environment, and global registration. Potential market share gains are contingent on demonstrating clinical superiority over existing standards of care.

Key Market Drivers and Challenges

Drivers:

- Growing prevalence of respiratory diseases, particularly COPD and asthma.

- Innovations in fluorinated drug compounds aimed at improving patient outcomes.

- Increasing adoption of inhalation therapy and targeted delivery systems.

Challenges:

- Lengthy and costly clinical trials; time to market remains uncertain.

- Highly competitive landscape with entrenched brand loyalty to existing therapies.

- Regulatory hurdles, especially for novel fluorinated compounds.

- Pricing pressures and payer skepticism about incremental improvements.

Strategic Recommendations

- Prioritize clinical trial endpoints that demonstrate clear, quantifiable benefits over existing therapies.

- Engage early with regulatory agencies to leverage expedited pathways.

- Develop strategic partnerships with pharmaceutical companies for distribution and commercialization.

- Invest in physician and patient education programs to facilitate adoption.

- Monitor competitive developments intensely to adapt positioning and marketing strategies accordingly.

Conclusion

FLUOROMETHOL presents a compelling candidate in the evolving respiratory therapeutics space, with promising clinical data and a strategic window for market entry. Rapid development, regulatory engagement, and robust clinical evidence are essential for capturing its projected sales potential. If clinical trials confirm its advantages, the drug could achieve peak sales exceeding $1 billion globally within five years of launch, bolstering its position as a valuable addition to respiratory therapy regimens.

Key Takeaways

- The global respiratory market is expanding due to disease prevalence and unmet needs in effective treatments.

- FLUOROMETHOL's unique fluorinated structure offers potential differentiation but awaits conclusive clinical trial results.

- Early market entry and adoption depend on successful regulatory approval, demonstrated efficacy, and strategic marketing.

- Short-to-mid-term sales are projected between $50 million and $300 million, with substantial upside post-approval.

- Continuous monitoring of competitive activities, regulatory changes, and clinical data is vital for optimizing market positioning.

FAQs

Q1: What distinguishes FLUOROMETHOL from existing respiratory drugs?

A1: Its fluorinated chemistry purportedly confers improved receptor binding, longer duration of action, and a better safety profile, pending clinical validation.

Q2: What is the current development status of FLUOROMETHOL?

A2: It is currently in Phase II clinical trials, with potential for regulatory submission following positive Phase III results.

Q3: Which markets offer the greatest sales opportunities initially?

A3: North America and Europe, due to advanced healthcare infrastructure and regulatory systems, followed by Asia-Pacific markets.

Q4: What are the primary challenges for FLUOROMETHOL's commercial success?

A4: Lengthy development timelines, regulatory hurdles, fierce competition, and demonstrating clear therapeutic benefits.

Q5: How can companies maximize the commercial potential of FLUOROMETHOL?

A5: By ensuring robust clinical data, engaging regulators early, deploying targeted marketing, and establishing strong clinical partnerships.

Sources:

[1] Grand View Research, Respiratory Drugs Market Size & Trends, 2022

[2] IQVIA, Global Respiratory Market Insights, 2022

[3] World Health Organization, Global Burden of Respiratory Diseases, 2021

More… ↓