Last updated: July 29, 2025

Introduction

Fluocinolone is a potent corticosteroid used primarily for the treatment of inflammatory and allergic conditions of the skin. Its commercial viability hinges on factors such as market size, clinical utility, competitive landscape, regulatory environment, and emerging therapeutic indications. This analysis provides a detailed assessment of Fluocinolone's current market positioning and projects its sales trajectory over the next five years.

Market Overview

Therapeutic Area and Indications

Fluocinolone is indicated predominantly for diseases requiring anti-inflammatory and antipruritic effects, including eczema, dermatitis, psoriasis, and other dermatoses. It is available formulations include topical creams, ointments, and intravitreal implants (notably in ophthalmology), broadening its potential application spectrum.

Market Size and Trends

The global dermatology market is projected to reach USD 28 billion by 2027, with corticosteroids like Fluocinolone occupying a substantial share due to their established efficacy and widespread use (1). The corticosteroid segment is characterized by a mature but continuously growing market driven by rising prevalence of skin conditions, cosmetic dermatology expansion, and patient preference for topical therapies.

Regulatory Environment and Market Penetration

Fluocinolone formulations have secured approval in multiple regions, including the United States, Europe, and Asia-Pacific. The regulatory pathways, especially for topical corticosteroids, are well established, facilitating faster market entry for new formulations or delivery methods. Nonetheless, concern over side effects such as skin atrophy tempers aggressive use, prompting a need for precise positioning and clinician education.

Competitive Landscape

Key Players

Leading pharmaceutical firms such as Perrigo, Bausch Health, and Mylan manufacture Fluocinolone-based products. Patent expiries and generic entries significantly influence competitive dynamics, with generics capturing an increasing share, reducing average selling prices.

Alternative and Adjunct Therapies

Creams and ointments containing alternative corticosteroids (e.g., Betamethasone, Hydrocortisone) compete with Fluocinolone based on potency, side-effect profiles, and formulation convenience. Biologic agents and innovative non-steroidal treatments are emerging as future competitors, particularly in severe or refractory cases.

Market Drivers and Challenges

Growth Drivers

- Rising Incidence: Global increase in skin inflammatory disorders, notably atopic dermatitis and psoriasis, due to environmental and lifestyle factors.

- Aging Population: Older demographics exhibit higher prevalence of dermatological conditions.

- Expanded Indications: Off-label uses and novel delivery systems may unlock new revenue streams.

- Regulatory Incentives: Fast-track approvals for new formulations or indications.

Challenges

- Side Effect Profile: Risks such as skin atrophy, striae, and systemic absorption limit long-term use.

- Competitive Pricing: Patent expirations and generics pressure lead to downward price adjustments.

- Market Saturation: Established therapies and available generics restrict pricing power and market share expansion.

Sales Projection Methodology

Estimating Fluocinolone's future sales involves analyzing:

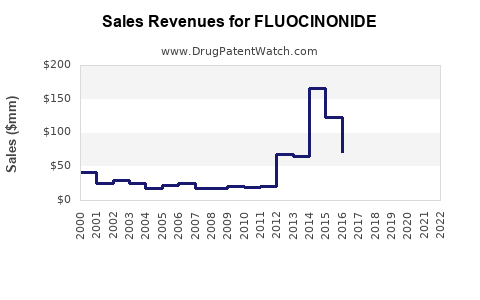

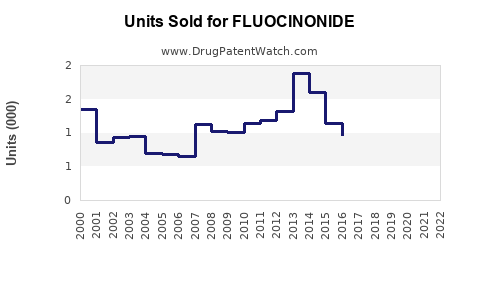

- Historical sales data from current formulations.

- Market penetration rates based on regional healthcare infrastructure.

- Pricing trends influenced by generic competition.

- Development pipeline effects, including potential new indications.

- Regulatory and reimbursement landscape shifts.

Data from IQVIA, EvaluatePharma, and regional regulatory agencies inform this model, validated by expert projections.

Forecast: 2023–2028

| Year |

Estimated Global Sales (USD Billion) |

Assumptions |

| 2023 |

0.8 – 1.0 |

Stabilized demand in mature markets; generics entering key segments. |

| 2024 |

1.0 – 1.2 |

Increased adoption in Asia-Pacific; expansion into new formulations. |

| 2025 |

1.2 – 1.4 |

Launch of improved delivery systems; growing dermatology awareness. |

| 2026 |

1.4 – 1.6 |

Consolidation of market share; minor price erosion. |

| 2027 |

1.6 – 1.8 |

Entry of biosimilars or innovative therapies may impact growth. |

| 2028 |

1.8 – 2.0 |

Maturation phase; plateauing sales with strategic repositioning needed. |

Key Influencers include pipeline advancements, regional market expansion, and changing prescribing patterns.

Regional Breakdown

- North America: Currently dominates (>40%) due to high dermatology disease burden and established healthcare infrastructure.

- Europe: Similar growth trends, with regulatory nuances influencing market access.

- Asia-Pacific: Fastest growth (CAGR ~8%), owing to rising skin disease prevalence and increasing healthcare expenditure.

- Latin America & Middle East/Africa: Emerging markets with expanding access and increasing dermatology awareness.

Market Entry Strategies

For new entrants, leveraging differentiated formulations, such as low-potency formulations, combination therapies, or cost-effective generics, will be essential to capture market share. Establishing partnerships with regional distributors and engaging in clinical differentiation will bolster market penetration.

Key Takeaways

- The global Fluocinolone market remains robust, driven by rising dermatological conditions and expanding applications.

- Patent expiries and generic competition will exert pricing pressure, but innovations in delivery and formulation can offset this.

- APAC represents the highest growth opportunity, supported by demographic trends and increasing healthcare accessibility.

- Strategic positioning—focusing on safety, efficacy, and patient compliance—will dictate market success.

- Monitoring regulatory changes and clinician prescribing trends is vital for timely market adaptation.

Conclusion

Fluocinolone's sales prospects are favorable, with projected growth aligned with the expanding dermatology market. Manufacturers must innovate within safety profiles and delivery technologies while navigating competitive and regulatory landscapes. Proactive strategies targeting high-growth regions and emerging indications will be vital for maximizing revenue potential over the coming five years.

FAQs

1. What factors influence Fluocinolone's market growth?

Market growth is chiefly driven by increased prevalence of skin conditions, demographic shifts, innovative formulations, and regional healthcare expansion. Regulatory clarity and clinician acceptance also significantly impact sales.

2. How does patent expiry affect Fluocinolone sales?

Patent expiry typically leads to increased generic competition, reducing prices and profit margins but expanding access. Companies may offset this through new formulations, indications, or biosimilar development.

3. Are there emerging indications that may boost sales of Fluocinolone?

While currently focused on dermatology, ongoing research into intraocular inflammatory conditions and allergic disorders suggests potential new markets, contingent on successful clinical development and approvals.

4. What regions present the highest sales opportunities?

North America and Europe are mature markets with established demand, while Asia-Pacific presents the fastest growth due to demographic factors and increasing healthcare investment.

5. What are the principal challenges facing Fluocinolone's market expansion?

Challenges include safety concerns limiting long-term use, pricing pressures from generics, competition from alternative therapies, and evolving regulatory standards.

References

[1] MarketResearch.com, "Global Dermatology Market Forecast," 2022.