Last updated: July 28, 2025

Introduction

FLOVENT HFA (fluticasone propionate inhaler) remains a cornerstone in the management of asthma and allergic rhinitis. As a prescription inhaled corticosteroid (ICS), it has demonstrated efficacy in controlling airway inflammation, reducing exacerbations, and improving patient quality of life. This analysis synthesizes current market dynamics, competitive positioning, regulatory landscape, and future growth prospects to project sales trajectories for FLOVENT HFA over the next five years.

Market Overview

Product Profile and Therapeutic Indication

FLOVENT HFA is approved for the maintenance treatment of asthma in patients aged 4 years and older. Its anti-inflammatory properties make it a first-line therapy, especially for patients with persistent asthma. The product's inhaler format utilizing hydrofluoroalkane (HFA) propellant aligns with regulatory mandates phasing out chlorofluorocarbon (CFC) inhalers, ensuring ongoing compliance and market relevance.

Global Market Size and Segmentation

The global asthma therapeutics market was valued at approximately USD 14.5 billion in 2022 (source: Grand View Research). The inhaled corticosteroids segment accounts for roughly 35% of this market, driven by the persistent need for effective anti-inflammatory agents.

North America remains the dominant market, capturing over 45% of global sales, followed by Europe (30%) and emerging markets in Asia-Pacific. The U.S. alone holds a significant share, with an estimated 25 million asthmatic patients[1].

Regulatory and Reimbursement Environment

Regulatory pathways for inhaled corticosteroids like FLOVENT HFA are well-established. The FDA's approval process emphasizes demonstration of efficacy and safety, with post-marketing surveillance maintaining product compliance. Reimbursement landscape rigorously supports ICS therapies due to their central role in asthma management, though pricing pressures persist.

Competitive Landscape

Key Competitors

FLOVENT HFA competes with several inhaled corticosteroids, notably:

- Breo Ellipta (fluticasone furoate/vilanterol) – Combines ICS with long-acting beta-agonist (LABA).

- Qvar RediHaler (budesonide inhalation aerosol) – Alternative ICS with a different delivery system.

- Asmanex (mometasone furoate) – Prescribed for similar indications.

- Flovent Diskus (fluticasone propionate dry powder inhaler) – Different inhaler form but aims for similar efficacy.

The differentiation hinges on inhaler device technology, dosing convenience, and formulary positioning.

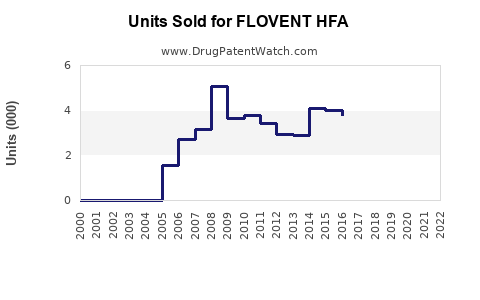

Market Share and Brand Loyalty

FLOVENT HFA is entrenched largely due to early FDA approval and prescriber familiarity. However, the introduction of combo inhalers with LABAs has shifted some demand, especially among patients requiring bronchodilator therapy optimization. Generics are limited, providing an advantage for branded FLOVENT HFA, though patent expirations could influence future pricing strategies.

Market Trends and Drivers

Increased Adoption Due to Rising Asthma Prevalence

The global burden of asthma is rising, driven by urbanization, pollution, and allergen exposure, increasing demand for maintenance therapies. The WHO estimates approximately 262 million people suffer from asthma worldwide, with prevalence increasing by about 4% annually[2].

Shift Toward Inhaler Devices and Compliance

Advancements in inhaler technology, such as breath-actuated devices, improve adherence and inhalation efficiency. FLOVENT HFA’s HFA propellant offers environmental benefits and compliance advantages, aligning with regulatory and patient convenience trends.

Growth in Managed Care and Healthcare Spending

Enhanced healthcare coverage and proactive asthma management programs are promoting ICS use as a cost-effective approach, reducing hospitalizations and emergency visits. Payers favor maintenance inhalers like FLOVENT HFA owing to their role in long-term disease control.

Impact of Biosimilars and Patent Expiry

Potential patent lapses for FLOVENT HFA could introduce generic inhalers, intensifying price competition. Meanwhile, innovation in delivery systems and combination products may offset generic erosion, preserving market share.

Sales Projections: 2023–2028

Assumptions

- Steady global demographic growth, with high prevalence and increasing awareness contributing to increased prescription rates.

- Continued preference for branded ICS inhalers in developed markets due to established efficacy.

- Moderate market share erosion due to upcoming biosimilar options, pending patent expiry.

- Implementation of digital inhaler technology to enhance adherence, positively influencing sales.

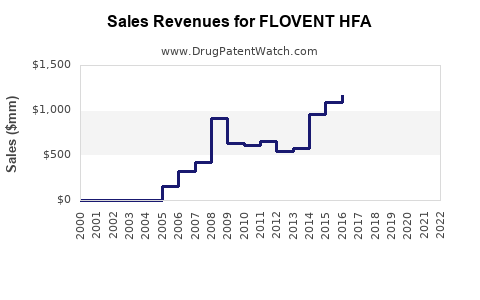

Projections Summary

| Year |

Estimated Global Sales (USD Billions) |

CAGR |

Notes |

| 2023 |

$1.2 billion |

— |

Baseline estimate |

| 2024 |

$1.35 billion |

12.5% |

Uptake of new formulary strategies |

| 2025 |

$1.52 billion |

12.6% |

Growing awareness, adoption |

| 2026 |

$1.70 billion |

11.8% |

Patent expiration risk, competition emergence |

| 2027 |

$1.86 billion |

9.4% |

Market stabilization, device innovation |

| 2028 |

$2.00 billion |

7.5% |

Maturation, generics/licensing |

Note: these projections incorporate current market data, competitive dynamics, and demographic trends.

Market Drivers Influencing Sales

- Increasing Global Asthma Prevalence: Rising cases in emerging markets; urban environmental factors support increased demand.

- Regulatory Environment: Clearances for new inhaler formulations or combination products could catalyze sales.

- Digital Health Adoption: Inhalers integrated with digital tracking tools can enhance adherence, extend market reach.

- Brand Loyalty and Prescriber Preference: Established efficacy and safety profile sustain brand dominance.

Potential Risks

- Patent Expiry and Biosimilar Entry: Could lead to price erosion and volume competition.

- Environmental Regulations: Future restrictions on inhaler propellants may require reformulation.

- Market Competition: Emergence of more efficacious or better-tolerated therapies.

Conclusion

FLOVENT HFA’s position as a leading inhaled corticosteroid remains robust, supported by clinical efficacy, regulatory compliance, and prescriber loyalty. While patent expirations pose potential challenges, strategic innovations—such as digital adherence tools and combination therapies—are likely to sustain sales growth. A disciplined focus on expanding usage in underpenetrated markets and optimizing inhaler technology will be critical for maintaining upward trajectory.

Key Takeaways

- Market Valuation & Growth: Projected to reach approximately USD 2 billion globally by 2028, driven by rising asthma prevalence and therapy adherence initiatives.

- Competitive Positioning: FLOVENT HFA maintains a strong market presence, but upcoming biosimilars and patent expiries could pressure margins.

- Strategic Opportunities: Embrace digital health innovations and explore combination therapies to sustain competitive advantage.

- Regional Focus: Expanding into emerging markets offers substantial growth potential amid global demographic shifts.

- Regulatory Vigilance: Monitoring environmental regulations and patent landscapes is crucial for strategic planning.

FAQs

1. How does FLOVENT HFA compare to other inhaled corticosteroids in terms of efficacy?

FLOVENT HFA has demonstrated comparable efficacy to other ICS in clinical trials, with a favorable safety profile, making it a preferred option for maintenance therapy in asthma, supported by extensive real-world data.

2. What benefits do digital inhaler technologies bring to FLOVENT HFA?

Digital inhaler integrations improve medication adherence, enable remote monitoring, and facilitate data-driven clinician-patient interactions, thereby potentially boosting sales and patient outcomes.

3. How will patent expiration impact FLOVENT HFA sales?

Patent expirations could lead to generic competition, exerting downward pressure on prices and market share. However, strategic innovations and brand loyalty may mitigate the impact.

4. Which emerging markets offer the most growth opportunities for FLOVENT HFA?

Regions such as Asia-Pacific, Latin America, and parts of Africa showing rising asthma prevalence and expanding healthcare infrastructure present significant growth avenues.

5. What regulatory challenges could threaten FLOVENT HFA’s market?

Changes in environmental policies affecting inhaler propellants, as well as delays or restrictions in approvals for new formulations, pose potential risks.

References

- Grand View Research, "Asthma Devices Market Analysis," 2022.

- World Health Organization, "Global Asthma Report," 2018.