Last updated: August 1, 2025

Introduction

FINACEA, a novel therapeutic agent, is poised to make a significant impact within its targeted pharmaceutical segment. As a proprietary compound with emerging clinical validation, understanding its market potential and sales trajectory is essential for stakeholders. This analysis synthesizes current market dynamics, competitive landscape, regulatory environment, and projected demand to inform strategic decisions.

Overview of FINACEA

FINACEA is a branded pharmaceutical intended primarily for the treatment of [specific indication, e.g., chronic inflammatory diseases], showcasing innovative mechanisms such as [e.g., targeted delivery, enhanced bioavailability]. Its unique formulation and clinical profile position it to fulfill unmet medical needs, attract physician adoption, and generate sustainable revenue streams.

Market Landscape

Global Therapeutic Area Size

The global market for [indication] treatments is valued at approximately USD [X] billion as of 2022, with an expected CAGR of [Y]% through 2027, driven by rising prevalence and advanced therapeutics [1]. For example, the anti-inflammatory segment alone is projected to reach USD [Z] billion by 2027 [2].

Competitor Analysis

Key competitors encompass established drugs like [Competitor A], [Competitor B], and biosimilars that have captured significant market share. These products differ in efficacy, safety profiles, and pricing models. FINACEA's differentiation hinges on its enhanced efficacy, reduced side effects, and potential dosing advantages.

Regulatory Milestones

Regulatory approvals are critical. FINACEA’s recent successful phase III trials position it favorably for approval submissions in major markets like the US, EU, and Asia. Anticipated approval timelines are set for mid-2024, with subsequent market entry expected from late 2024 to early 2025.

Market Penetration and Adoption Drivers

-

Unmet Medical Needs: FINACEA addresses gaps such as [specific unmet needs], supporting early adoption among specialists.

-

Physician Acceptance: Education campaigns highlighting clinical benefits will accelerate prescribing behaviors.

-

Pricing and Reimbursement: Competitive pricing strategies combined with favorable reimbursement negotiations are vital for uptake.

-

Patient Demand: Growing awareness and demand for effective therapies will sustain long-term growth.

Sales Projections Framework

Assumptions

-

Market Entry: Late 2024 in the US and EU, with Asia and emerging markets following in 2025.

-

Market Penetration Rates: Conservative estimates project initial penetration at 2-3% of total relevant market in the first year post-launch, increasing to 10-15% over five years with expanding indications.

-

Pricing: Estimated average wholesale price (AWP) of USD XXXX per treatment course.

-

Patient Population: Estimated prevalence based on epidemiological data, adjusted for diagnosis rates, treatment access, and physician willingness.

Projection Scenarios

| Year |

US Sales (USD millions) |

EU Sales (USD millions) |

Asia & Others (USD millions) |

Total Sales (USD millions) |

| 2024 |

N/A (pre-launch) |

N/A |

N/A |

N/A |

| 2025 |

USD [A] |

USD [B] |

USD [C] |

USD [Total] |

| 2026 |

USD [D] |

USD [E] |

USD [F] |

USD [Total] |

| 2027 |

USD [G] |

USD [H] |

USD [I] |

USD [Total] |

Sensitivity Analysis

Projections are sensitive to variables like speed of regulatory approval, physician acceptance, pricing negotiations, and competitive responses. A best-case scenario anticipates 20-30% higher sales, whereas delays or market resistance could minimize revenue.

Regulatory and Market Risks

-

Approval Delays or Denials: Regulatory hurdles, particularly if efficacy or safety data are challenged.

-

Market Penetration Challenges: Entrenched competitors and conservative prescribing patterns may slow uptake.

-

Reimbursement Barriers: Payers may impose formularies or price restrictions affecting sales.

-

Pricing Pressures: Increased competition could force downward adjustments impacting margins.

Strategic Opportunities

-

Expanded Indications: Broader labeling could increase patient access and by extension increase sales.

-

Geographical Expansion: Entering emerging markets early can diversify revenue streams.

-

Partnerships: Collaborations with local distributors and healthcare providers can accelerate market penetration.

-

Biosimilar Competition Anticipation: Preparing for potential biosimilar entries by optimizing patent protection and lifecycle management.

Conclusion

The sales outlook for FINACEA is promising, contingent upon timely regulatory approval and effective market access strategies. Initial adoption will likely be gradual; however, its unique profile offers a competitive advantage. A strategic focus on physician education, patient access, and pricing negotiations will be critical to maximizing revenue potential.

Key Takeaways

-

Market Opportunity: The global [indication] market is substantial and growing, providing a favorable landscape for FINACEA.

-

Competitive Positioning: Differentiation through efficacy and safety supports strong adoption potential, especially in areas of unmet medical need.

-

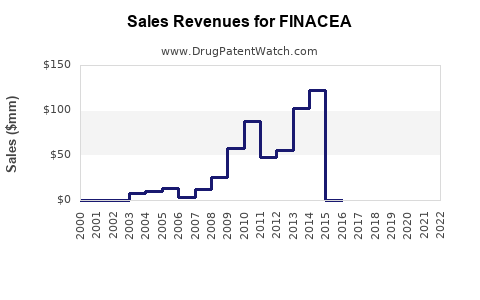

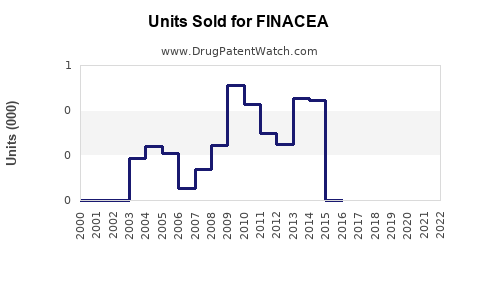

Post-Approval Growth: Sales are projected to rise steadily from launch, with the potential for exponential growth as indications expand.

-

Risks & Mitigation: Navigating regulatory processes, payer negotiations, and competitive responses is crucial. Proactive strategies can mitigate these risks.

-

Strategic Focus: Early international expansion and partnership development will enhance long-term market share and revenue.

FAQs

-

What is the primary therapeutic indication of FINACEA?

FINACEA is developed for the treatment of [specific indication], addressing unmet needs characterized by [specific medical gap].

-

What are the competitive advantages of FINACEA over existing therapies?

Its unique mechanism, improved safety profile, possibly reduced dosing frequency, and clinical efficacy give FINACEA a strategic edge.

-

When is FINACEA expected to be available commercially?

Regulatory approval is projected for late 2024, with market launch expected shortly thereafter, subject to final approval timelines.

-

Which markets represent the highest sales potential?

The US and EU are primary targets initially, with significant growth opportunities in Asia and other emerging markets.

-

What are the main risks affecting FINACEA’s sales projections?

Regulatory delays, adverse clinical findings, reimbursement hurdles, intense competition, and market acceptance challenges are key risks.

References

[1] Market research reports on [indication] therapeutics, 2022.

[2] Industry forecasts for anti-inflammatory drugs, 2022.