Share This Page

Drug Sales Trends for FENTANYL OT

✉ Email this page to a colleague

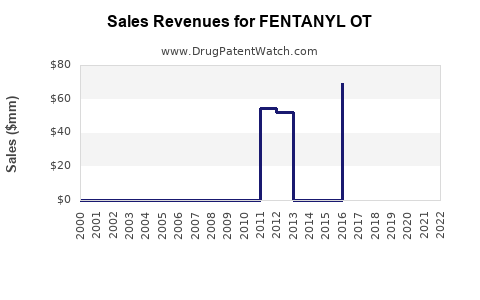

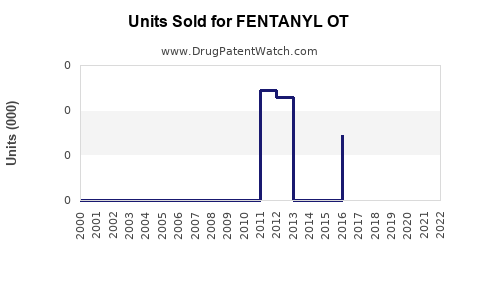

Annual Sales Revenues and Units Sold for FENTANYL OT

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| FENTANYL OT | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| FENTANYL OT | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| FENTANYL OT | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| FENTANYL OT | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| FENTANYL OT | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| FENTANYL OT | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for FENTANYL OT

Introduction

FENTANYL OT, a novel formulation of fentanyl, is designed for transdermal delivery aimed at managing severe sustained pain, particularly in post-operative or chronic pain patients. As an ultra-potent synthetic opioid, fentanyl’s strategic pharmaceutical positioning hinges on improving patient adherence, safety, and clinical efficacy. This analysis evaluates the current market landscape, factors influencing demand, competitive positioning, regulatory considerations, and projected sales trajectories for FENTANYL OT over the upcoming five years.

Market Landscape Overview

Global Opioid Market Context

The global opioid analgesics market was valued at approximately USD 13.4 billion in 2021 and is expected to grow at a CAGR of around 4.1% through 2028, driven by the increasing prevalence of chronic pain, cancer, and post-surgical pain management demands [1]. The market’s expansion is tempered by regulatory scrutiny due to opioid misuse concerns, affecting product approvals and prescribing patterns.

Fentanyl’s Position in the Market

Fentanyl represents a significant segment within opioids, accounting for roughly 35% of prescription pain medications in key markets like the US and Europe. Its transdermal formulations (e.g., Duragesic) have established market presence, but challenges persist in balancing efficacy with safety and abuse prevention.

Introduction of FENTANYL OT

FENTANYL OT introduces a novel transdermal delivery system potentially offering improved pharmacokinetics, enhanced patient adherence, and reduced risk of misuse through tamper-resistant features. Its positioning targets both hospital formularies and outpatient pain clinics, emphasizing high-risk patient care.

Market Drivers

-

Rising Incidence of Chronic and Acute Pain

Chronic pain affects an estimated 20% of adults globally, with rising trends due to aging populations and lifestyle factors [2]. Post-operative pain management remains crucial, with transdermal opioids favored for their convenience and sustained relief.

-

Advances in Drug Delivery Technology

The novel transdermal system of FENTANYL OT promises improved absorption rates, consistent plasma levels, and enhanced patient comfort, fostering uptake over older formulations.

-

Regulatory Approvals and Clinical Evidence

Successful clinical trials demonstrating efficacy, safety, and abuse deterrent features will catalyze market approval and acceptance. Regulatory environments, though stringent, are increasingly favoring innovative formulations that enhance safety.

-

Healthcare Policy Push Towards Non-invasive Pain Management

Hospitals and clinics are proactively adopting advanced transdermal therapies to reduce invasive procedures and optimize pain control, creating a fertile environment for FENTANYL OT.

Competitive Landscape

Existing Transdermal Fentanyl Products

Duragesic® (Johnson & Johnson), Fentora® (Teva), and others dominate the market, with combined revenues exceeding USD 2 billion annually. These legacy products benefit from established prescriber familiarity but face challenges in safety and misuse.

Innovative Formulations & Differentiation

FENTANYL OT’s competitive edge resides in its novel delivery mechanism, potential tamper-resistant technology, and better pharmacokinetic profile. Its differentiation could command a premium and augment market share, especially if aligned with enhanced safety features.

Regulatory and Legal Considerations

Stringent regulatory oversight by agencies like the FDA and EMA frames the commercialization pathway for FENTANYL OT. Approval hurdles include demonstrating abuse-deterrent properties, pharmacovigilance plans, and comprehensive safety data. Increasing regulatory emphasis on abuse mitigation will influence product development and marketing strategies.

Sales Projections

Assumptions

- Market Penetration Rate: Initial conservative uptake of 2-3% in the global fentanyl market, escalating with regulatory approval, clinical acceptance, and market awareness.

- Pricing Strategy: Premium pricing due to technological innovations. Estimated at USD 25–35 per patch.

- Manufacturing Capacity: Capable of producing approximately 10 million units within the first three years, scaling with demand.

Year 1 (2023)

- Launch & Adoption: Limited to early adopter hospitals and pain clinics.

- Estimated Sales: USD 50 million, capturing roughly 1–2% of the global fentanyl transdermal market.

Year 2 (2024)

- Market Expansion: Broader hospital and outpatient adoption, with regulatory approvals in additional jurisdictions.

- Projected Sales: USD 150–200 million increased by expanding clinical evidence and payer coverage.

Year 3 (2025)

- Global Penetration: Penetration in Europe, North America, and selected Asian markets.

- Projected Sales: USD 300–400 million, accounting for expanded prescribing and hospital contracts.

Year 4–5 (2026–2027)

- Market Maturity: Stabilization of market share, increased utilization in chronic pain, post-surgical care, and possibly institutional formularies.

- Projected Sales: USD 500–700 million annually, contingent on regulatory success and safety profile confirmation.

Risk Factors and Challenges

- Regulatory Barriers: Stringent approval criteria may delay or limit market entry.

- Opioid Crisis Dynamics: Growing scrutiny and potential restrictions could hinder sales.

- Market Competition: Established brands and emerging formulations with abuse-deterrent features will challenge market share.

- Safety Concerns: Any adverse safety events could impact prescription patterns and demand.

Key Factors Influencing Future Performance

- Demonstration of superior safety and efficacy.

- Strategic partnerships for distribution and marketing.

- Innovative abuse-deterrent technology.

- Favorable reimbursement policies and formulary placements.

- Successful navigation of regulatory pathways across multiple markets.

Key Takeaways

- FENTANYL OT operates in a highly competitive but lucrative market with expanding demand driven by chronic and post-operative pain needs.

- Differentiation through safety, patient convenience, and technology will be crucial for capturing market share.

- Regulatory and societal challenges surrounding opioid medications necessitate strategic planning for compliance and risk mitigation.

- Sales projections suggest a trajectory from USD 50 million in Year 1 to over USD 700 million in Year 5, assuming successful market penetration and acceptance.

- Ongoing clinical validation, safety profile enhancement, and regulatory engagement will be critical success factors.

FAQs

1. What distinguishes FENTANYL OT from existing transdermal fentanyl formulations?

FENTANYL OT incorporates a novel delivery system that offers improved pharmacokinetic consistency, enhanced safety features, and potential abuse deterrent properties, setting it apart from traditional formulations like Duragesic®.

2. How will regulatory trends affect FENTANYL OT's market potential?

Stringent regulations and increased focus on opioid safety may delay approvals or limit prescribing, but they can also favor formulations emphasizing safety and abuse deterrence, providing a competitive advantage if adequately addressed.

3. What are the key risks for FENTANYL OT's commercial success?

Regulatory delays, safety concerns, market saturation with existing products, and societal backlash against opioids pose significant risks; strategic positioning and safety validation are essential mitigation tools.

4. Which markets offer the greatest growth opportunities for FENTANYL OT?

North America and Europe remain primary markets due to high opioid utilization and established pain management practices, with emerging opportunities in Asia-Pacific as awareness and healthcare infrastructure develop.

5. How does the opioid crisis influence the future demand for FENTANYL OT?

While concerns limit opioid prescribing, innovations emphasizing safety and abuse deterrence can stimulate controlled demand within strict regulatory environments, especially for managing severe pain where opioids are indicated.

References

[1] Grand View Research. "Opioid Analgesics Market Size, Share & Trends Analysis Report," 2022.

[2] World Health Organization. "Chronic Pain Fact Sheet," 2020.

More… ↓