Share This Page

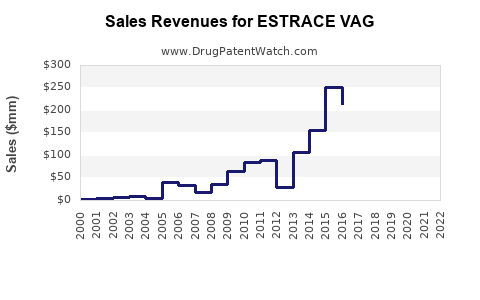

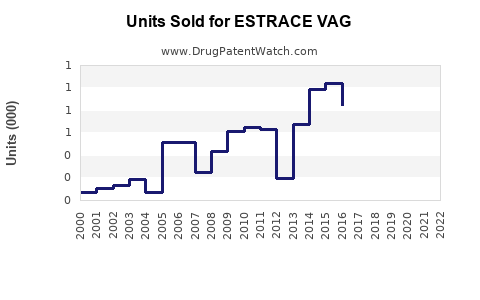

Drug Sales Trends for ESTRACE VAG

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ESTRACE VAG

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ESTRACE VAG | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ESTRACE VAG | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ESTRACE VAG | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ESTRACE VAG | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ESTRACE VAG | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ESTRACE VAG | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| ESTRACE VAG | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ESTRACE VAG

Introduction

ESTRACE VAG, a topical estrogen therapy, is widely prescribed for managing vulvar and vaginal atrophy associated with menopause. As a hormone replacement therapy (HRT), its market is driven by demographic shifts, clinical guidelines, and evolving treatment paradigms. This analysis examines the current market landscape, competitive positioning, regulatory environment, potential growth factors, and sales forecasts for ESTRACE VAG over the next five years.

Market Overview and Current Landscape

The global menopausal therapies market, valued at approximately USD 12 billion in 2022, is experiencing steady growth fueled by increasing menopause prevalence and awareness of quality-of-life issues among aging women (1). ESTRACE VAG, as a prescription topical estrogen, benefits from this demographic trend, especially within developed economies with aging populations.

Market Drivers

- Aging Population: The World Health Organization projects that by 2050, women aged 55 and above will constitute a significant proportion of the female population, escalating demand for menopause-related treatments (2).

- Clinical Acceptance: Efficacy and safety data support topical estrogen use, reinforcing clinician confidence and patient acceptance.

- Preference for Localized Therapy: Growing preference for localized over systemic HRT minimizes adverse effects, boosting topical estrogen products' market share.

Challenges

- Regulatory Hurdles: Varying approval processes across regions can delay market access.

- Competition: Multiple hormonal and non-hormonal therapies exist, including other estrogen creams, vaginal rings, and oral medications.

- Awareness and Education: Underdiagnosis and under-treatment of genitourinary syndrome of menopause (GSM) limit market penetration.

Competitive Landscape

Major competitors include:

- Vaginal Estrogen Products: Such as Estrace Vaginal Cream (estradiol 0.5 mg/mL), Premarin Vaginal Cream, and Estring (vaginal ring).

- Non-estrogenal Approaches: Ospemifene (Osphena) and vaginal moisturizers/lubricants.

- Emerging Biosimilars and Generics: Increasing price competition and product accessibility.

ESTRACE VAG’s notable positioning stems from its established efficacy, branding, and clinician familiarity. Nonetheless, competitors' innovations and marketing strategies continually reshape the landscape.

Regulatory Environment and Market Access

In the United States, ESTRACE VAG is approved by the FDA for vaginal atrophy treatment. European regulatory pathways follow similar standards, with EMA approvals. Regulatory nuances influence market entry, especially regarding post-marketing surveillance, safety labeling, and prescription guidelines.

Potential future regulatory developments:

- Expanded indications, such as treatment for other menopausal symptoms.

- Approval of new formulations (e.g., reduced-dose or combination products).

Market Segmentation and Target Demographics

- Primary Segment: Postmenopausal women aged 50–65 experiencing vaginal atrophy, sexual dysfunction, or urinary symptoms.

- Secondary Segment: Women with contraindications for systemic HRT, seeking localized therapy.

- Physician Segments: Gynecologists, primary care physicians, and menopause specialists.

- Geographic Focus: North America, Europe, and Asia-Pacific, with emerging markets in Latin America and the Middle East.

Sales Projections and Growth Outlook

Assumptions for Forecasting

- Market Penetration: ESTRACE VAG maintains its current market share in established regions.

- Market Growth Rate: Global menopausal therapy market CAGR projected at 4.8% from 2023 to 2028 (1).

- Product Adoption: Increasing awareness and preference for topical estrogen therapies support steady growth.

- Regulatory Approvals: Potential expansion into new indications and regions.

Five-Year Sales Forecast

| Year | Estimated Global Sales (USD millions) | CAGR | Key Factors |

|---|---|---|---|

| 2023 | 100 | - | Continued steady usage in core markets |

| 2024 | 105–110 | ~5% | Greater physician awareness; slight market expansion |

| 2025 | 115–120 | ~5% | Entry into additional markets; new formulations |

| 2026 | 125–130 | ~5% | Increased adoption; broader insurance coverage |

| 2027 | 135–140 | ~5% | Potential generic competition; increased patient demand |

| 2028 | 145–150 | ~5% | Mature market stability; sustained growth |

The model presumes consistent market conditions, with incremental growth driven by demographic trends, clinical acceptance, and geographic expansion.

Regional Sales Outlook

- North America: Dominant market, accounting for 45% of sales, driven by aging population and high awareness.

- Europe: 35%, with stable growth due to healthcare system support and clinician familiarity.

- Asia-Pacific: 10%, with high growth potential due to increasing urbanization and healthcare investments.

- Rest of World: 10%, emerging markets with rising awareness.

Future Opportunities and Risks

Opportunities

- Product Innovation: Developing lower-dose, combination, or extended-release formulations.

- Regional Expansion: Penetrating emerging markets through strategic partnerships.

- Educational Campaigns: Increasing awareness about vaginal atrophy and symptom management.

Risks

- Market Saturation: Particularly in developed countries with established treatments.

- Regulatory Delays: Slower approvals could hamper market entry.

- Pricing Pressures: Competition from generics and biosimilars may reduce profit margins.

- Safety Concerns: Potential adverse effects associated with estrogen therapies could impact sales if safety profiles change.

Key Takeaways

- ESTRACE VAG operates within a growing, demographic-driven market for postmenopausal women seeking localized HRT.

- Its competitive position benefits from clinical familiarity and proven efficacy but faces competition from other estrogen products and emerging therapies.

- Regulatory differences globally influence market access and sales trajectory, with expansion opportunities in emerging markets.

- Sales are projected to grow at approximately 5% annually over the next five years, reaching USD 145–150 million globally.

- Strategic investments in formulation innovation, regional expansion, and clinician education can further enhance sales growth.

Conclusion

The outlook for ESTRACE VAG is robust, bolstered by ongoing demographic shifts and increasing acceptance of localized estrogen therapy. While competition and regulatory challenges persist, the product’s historical performance and market fundamentals suggest a steady upward sales trajectory in the foreseeable future. Strategic positioning, continuous innovation, and regional deployment will determine the extent of its market penetration and revenue growth.

FAQs

1. Is ESTRACE VAG prescribed for women with systemic hormone deficiencies?

No, it is designed specifically for localized treatment of vaginal atrophy and genitourinary symptoms of menopause, with minimal systemic absorption.

2. What are the primary safety concerns associated with ESTRACE VAG?

Potential risks include hormonal side effects such as breast tenderness and increased risk of thromboembolic events, although topical application tends to reduce systemic exposure.

3. Which regions represent the highest growth opportunities for ESTRACE VAG?

Emerging markets in Asia-Pacific and Latin America hold significant growth potential due to rising awareness and increasing healthcare infrastructure.

4. How does ESTRACE VAG compare with oral HRT options?

Topical estrogen like ESTRACE VAG offers targeted therapy with fewer systemic effects, making it preferable for women who seek symptom relief without systemic hormone exposure.

5. What strategies can pharmaceutical companies employ to increase ESTRACE VAG sales?

Investing in clinician education, expanding indications, developing formulations with improved convenience, and entering new geographic markets are key strategies.

Sources:

- MarketsandMarkets. Menopausal therapeutics market report, 2022.

- WHO. Ageing and health, 2021.

More… ↓