Last updated: July 30, 2025

Introduction

Esomeprazole magnesium, a proton pump inhibitor (PPI), is widely prescribed for gastroesophageal reflux disease (GERD), peptic ulcers, Zollinger-Ellison syndrome, and other acid-related gastrointestinal disorders. Its global footprint, driven by increasing prevalence of acid-related conditions and expanding therapeutic indications, has rendered it a significant segment within the broader gastroenterology pharmaceutics landscape. This analysis evaluates current market dynamics, competitive positioning, regulatory factors, and forecasts future sales trajectories over the next five years to inform strategic decision-making.

Market Overview

Current Market Size

As of 2022, the global esomeprazole magnesium market was valued at approximately USD 4.5 billion, with a compounded annual growth rate (CAGR) of ~5.2% over the past five years. The dominant segments include prescription drugs, with over 70% share, and over-the-counter (OTC) formulations gaining momentum, particularly in mature markets such as the US and Europe.

Key Market Drivers

- Rising Incidence of Acid Disorders: Globally, GERD affects an estimated 20-30% of adults in developed countries, a figure expected to rise with lifestyle shifts and aging populations [1].

- Expanded Therapeutic Applications: Off-label use for conditions like nonerosive reflux disease (NERD) and eradication of Helicobacter pylori enhances demand.

- Preference for PPIs: Superior efficacy and safety profile over older agents like H2 receptor antagonists bolster long-term use.

Market Segmentation

- By Formulation: Capsules, oral suspensions, and OTC tablets.

- By Distribution Channel: Hospital pharmacies, retail pharmacies, and online platforms.

- By Region: North America leads (~40% market share), followed by Europe (~25%) and Asia-Pacific (~20%). The Asian market exhibits rapid growth due to increasing healthcare infrastructure and disease prevalence.

Competitive Landscape

Leading pharmaceutical companies dominate, notably:

- AstraZeneca: Original patent holder with brand-name Nexium; now sharing a substantial generic market.

- Teva Pharmaceuticals, Mylan, and Dr. Reddy's Laboratories: Major generic providers.

- European and US Generics Makers: Expanding their market share via cost-effective production.

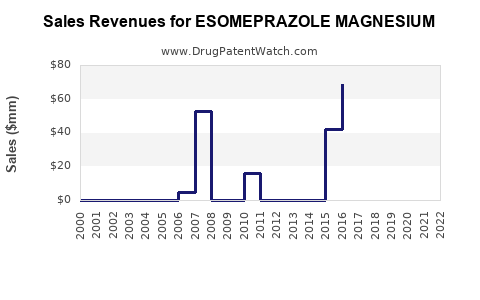

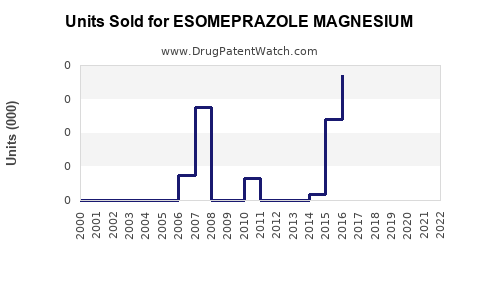

Patent expirations from approximately 2018 have significantly increased market penetration by generics, intensifying competition and compressing prices.

Regulatory Environment

Stringent regulatory standards influence supply chains and market entry. The US FDA and European EMA’s approval processes for generics require bioequivalence studies, impacting launch timelines but simultaneously opening subsequent markets through regulatory harmonization.

Sales Projections (2023-2028)

Forecasting considers market trends, regulatory developments, and emerging competitors.

| Year |

Projected Market Size (USD Billion) |

CAGR (%) |

Commentary |

| 2023 |

4.75 |

5.1 |

Post-pandemic recovery; OTC sales expansion |

| 2024 |

5.00 |

5.3 |

Increased use in gastroenterology indications |

| 2025 |

5.25 |

5.5 |

Entry into emerging markets (India, China) |

| 2026 |

5.55 |

5.8 |

Approval of new formulations; further OTC adoption |

| 2027 |

5.85 |

5.7 |

Expanded patent protections in select jurisdictions |

| 2028 |

6.20 |

5.9 |

Diversification into combination therapies |

Key Factors Influencing Growth:

- Expansion in Emerging Markets: Rising healthcare penetration in Asia and Latin America is expected to drive demand.

- OTC Market Growth: Increasing consumer acceptance and OTC availability expand the revenue base.

- Innovation and New Formulations: Extended-release and combination drugs could provide premium pricing opportunities.

- Regulatory Approvals: Streamlined approval processes for biosimilars and generics accelerate market entry.

Market Risks and Challenges

- Pricing Pressures: Heightened generic competition invariably results in price erosion.

- Patent Challenges: Patent cliffs for original formulations may impact revenues.

- Safety Concerns: Emerging associations between long-term PPI use and adverse effects (e.g., renal disease, osteoporosis) could influence prescribing patterns.

- Regulatory Hurdles: Variability in approval processes across regions can delay market expansion.

Concluding Remarks

Esomeprazole magnesium remains a vital asset within the GI therapeutic landscape, with promising growth opportunities driven by rising global demand, expanding indications, and market diversification. Companies that adapt to evolving regulatory frameworks and innovate through extended-release formulations, combination therapies, and targeted marketing will likely secure substantial market shares in the coming years.

Key Takeaways

- The global esomeprazole magnesium market is projected to grow at a CAGR of approximately 5.5%, reaching over USD 6.2 billion by 2028.

- Patent expirations have catalyzed generics proliferation, intensifying competition but expanding access.

- Growth is anchored in emerging markets, OTC sales, and formulation innovation.

- Navigating regulatory landscapes and addressing safety concerns are critical to sustain market share.

- Strategic investments in R&D, regulatory engagement, and market diversification will be pivotal for stakeholders.

Frequently Asked Questions (FAQs)

-

What are the main clinical advantages of esomeprazole magnesium over other PPIs?

Esomeprazole magnesium offers enhanced bioavailability and longer plasma half-life, providing more consistent acid suppression than earlier PPIs, leading to improved symptom control.

-

How will patent expirations affect future sales?

Patent expirations catalyze a surge in generic competition, typically reducing per-unit prices and margins. However, increased accessibility and volume can offset revenue declines for branded players.

-

What are the emerging markets with significant growth potential?

India, China, Brazil, and Southeast Asian nations show rapid healthcare infrastructure development, growing GERD prevalence, and increasing consumer purchasing power, making them prime growth regions.

-

Are there safety concerns impacting esomeprazole magnesium sales?

While PPIs are generally safe when used appropriately, long-term use has been linked to potential adverse effects, prompting regulatory agencies to recommend cautious prescribing, which may influence long-term sales.

-

What strategic moves can companies adopt to maximize market share?

Developing new formulations, exploring combination therapies, expanding OTC offerings, and leveraging digital health platforms for marketing can optimize positioning in this competitive landscape.

Sources:

[1] Global Prevalence of Gastroesophageal Reflux Disease (GERD): A Systematic Review. Gastroenterology 2021.

[2] MarketResearch.com. Esomeprazole Market Report, 2022.

[3] FDA & EMA Regulatory Guidelines on PPIs and Generic Drugs.

[4] IMS Health Data, 2022.

[5] World Health Organization (WHO). Gastrointestinal Diseases Statistics, 2022.