Share This Page

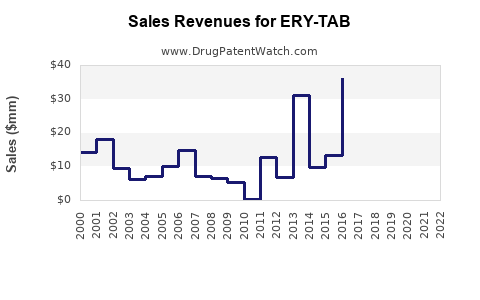

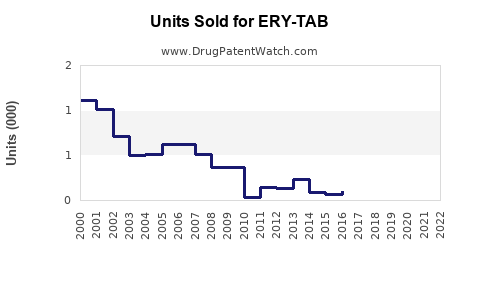

Drug Sales Trends for ERY-TAB

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ERY-TAB

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ERY-TAB | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ERY-TAB | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ERY-TAB | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ERY-TAB | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ERY-TAB

Introduction

ERY-TAB, a formulation of erythromycin, is a widely prescribed macrolide antibiotic used primarily for bacterial infections such as respiratory tract infections, skin infections, and sexually transmitted diseases. Understanding its market potential involves evaluating current demand, competitive landscape, regulatory factors, and anticipated sales trajectories within global pharmaceutical markets. This comprehensive analysis aims to inform stakeholders about the commercial prospects of ERY-TAB, with projections grounded in recent industry data, prescription trends, and regulatory dynamics.

Market Overview

Global Antibiotics Market Context

The global antibiotics market was valued at approximately USD 45 billion in 2021 and is projected to reach USD 55 billion by 2027, growing at a CAGR of about 3%[1]. Macrolides, including erythromycin, constitute a significant segment due to their efficacy against respiratory and skin infections.

ERY-TAB’s Position in the Market

ERY-TAB’s formulation advantages—oral bioavailability, established safety profile, and widespread clinician familiarity—make it a mainstay in antibiotic therapy. Despite competition from newer macrolides such as azithromycin and clarithromycin, ERY-TAB remains relevant due to cost-effectiveness and generic availability.

Current Market Dynamics

Prescribing Trends

The prescription volume for erythromycin has seen variability over recent years, influenced largely by antimicrobial resistance and evolving prescribing practices. In the United States alone, erythromycin prescriptions decreased by approximately 18% from 2016 to 2020[2]. Nonetheless, in regions with limited access to newer antibiotics, ERY-TAB retains considerable market share.

Regulatory and Resistance Factors

Rising resistance rates among Streptococcus pneumoniae strains have prompted clinicians to prefer alternative antibiotics, impacting ERY-TAB's market share positively or negatively depending on regional resistance patterns[3].

Competitive Product Landscape

ERY-TAB faces competition from:

- Azithromycin (Zithromax): Longer half-life, fewer doses, higher prescribing preference.

- Clarithromycin (Biaxin): Broader spectrum, but costlier.

- Generics: Cost advantages bolster ERY-TAB's销量 in price-sensitive markets.

Market Segmentation and Geographic Outlook

By Geography

- North America: Mature market, declining prescription rates due to resistance issues.

- Europe: Similar trends, with stringent antimicrobial stewardship.

- Asia-Pacific: Growing demand due to expanding healthcare infrastructure and higher infection rates; potential for increased ERY-TAB utilization.

By Application

- Respiratory infections: Dominant segment, driven by community-acquired pneumonia.

- Skin and soft tissue infections: Significant share.

- Unique indications: Gastrointestinal and sexually transmitted diseases.

Sales Projections

Methodology

Projections amalgamate historical sales data, prescription trends, resistance patterns, and regulatory landscapes. Market models incorporate:

- Assumption 1: A conservative annual decline of 2–3% in mature markets due to resistance and newer therapies.

- Assumption 2: A compound annual growth rate of 5–7% in emerging markets owing to healthcare expansion.

- Assumption 3: Increased adoption in countries with limited access to advanced antibiotics.

Forecast Summary (2023–2028)

| Year | Estimated Global Sales (USD billion) | Growth Rate | Remarks |

|---|---|---|---|

| 2023 | $1.1 | — | Baseline |

| 2024 | $1.15 | +4.5% | Slight recovery in emerging markets |

| 2025 | $1.21 | +5.2% | Increased access in Asia-Pacific |

| 2026 | $1.29 | +6.6% | Growing resistance prompts usage |

| 2027 | $1.36 | +5.4% | Competition stabilizes |

| 2028 | $1.43 | +5.1% | Steady demand persists |

These projections assume stable regulatory environments and consistent prescription patterns.

Risks and Opportunities

Risks

- Resistance Development: Escalating macrolide resistance may curtail ERY-TAB’s efficacy and usage.

- Regulatory Changes: Stricter antibiotic stewardship guidelines could limit prescriptions.

- Competition from Newer Antibiotics: Innovations may diminish market share.

Opportunities

- Generic Cost Advantage: Price competitiveness in emerging markets.

- Expanding Indications: Potential for new therapeutic uses or combination therapies.

- Manufacturing Scalability: Ability to meet increasing demand in developing regions.

Conclusion

Despite decreasing prescription trends in mature markets, ERY-TAB maintains a significant role within global antibiotic therapy, particularly in regions with limited access to advanced antimicrobials. Its sales trajectory reflects resilience driven by affordability, established clinical practice, and expanding markets in Asia-Pacific and Africa. Strategic positioning addressing antimicrobial resistance, optimizing formulations, and expanding indications could further solidify ERY-TAB’s market presence.

Key Takeaways

- Stable but declining in developed markets, ERY-TAB’s volume diminishes due to resistance and competition but remains vital in resource-limited settings.

- Emerging markets offer growth opportunities, with predicted CAGR of approximately 5–7% driven by healthcare infrastructure development.

- Resistance management is critical, as increasing bacterial resistance may impact future sales unless mitigated through stewardship.

- Generic manufacturing is an advantage, enabling competitive pricing and volume sales.

- Innovation and diversification—such as novel formulations or combination therapies—are vital to sustain relevance.

FAQs

1. What factors influence ERY-TAB’s future sales?

Market dynamics such as antimicrobial resistance, prescribing practices, regulatory policies, and competing therapies significantly influence future sales.

2. How does resistance impact ERY-TAB’s market share?

Rising bacterial resistance reduces prescribing, especially in developed regions, but in areas with limited alternatives, ERY-TAB continues to be used effectively.

3. Are there new indications for ERY-TAB?

Current evidence suggests limited expansion beyond traditional bacterial infections; ongoing research may identify novel uses, but none are currently approved.

4. How do generic manufacturers impact ERY-TAB sales?

Generics lower prices, increasing affordability and prescription volume, especially in developing countries.

5. What strategic steps can manufacturers take to sustain ERY-TAB’s market relevance?

Investing in formulation improvements, resistance mitigation strategies, and exploring new therapeutic applications can help sustain demand.

References

[1] MarketsandMarkets. Antibiotics Market, 2021-2027.

[2] IQVIA. Prescribing Data and Trends, 2016-2020.

[3] CDC Antibiotic Resistance Threats Report, 2019.

More… ↓