Last updated: July 29, 2025

Introduction

EPIPEN 2-PACK, a combined package of two epinephrine auto-injectors, addresses the urgent need for timely anaphylaxis treatment. As a critical emergency medication, its market dynamics are shaped by allergic disease prevalence, regulatory landscape, competitive positioning, and evolving healthcare practices. This report outlines a comprehensive market analysis and establishes sales projections based on current trends and future outlooks.

Market Overview

Global Demand Drivers

The global allergy and anaphylaxis market has experienced steady growth, propelled by increasing prevalence of food allergies, insect venom allergies, and drug hypersensitivities. In the United States, estimates indicate that approximately 1 in 13 children suffer from food allergies, with similar trends observed globally [1]. The rising awareness, improved diagnosis, and expanding access to emergency medications further bolster demand.

Regulatory Framework

The FDA-approved EPIPEN 2-PACK is positioned as a convenient solution for individuals at risk of severe allergic reactions. Regulatory approvals and safety profiles support broad adoption, especially in schools, workplaces, and travel sectors. Importers, manufacturers, and distributors monitor these regulatory pathways closely, often influencing sales strategies.

Market Segmentation

-

End-User Segments: Patients with diagnosed allergies, schools, daycare centers, airlines, travel agencies, and workplaces.

-

Geographical Markets: Predominantly North America (US and Canada), expanding into Europe and Asia-Pacific due to rising allergy prevalence.

Competitive Landscape

Key Players

- Mylan (EpiPen brand): Dominates the market with extensive distribution channels.

- Teva Pharmaceuticals: Offers alternative epinephrine auto-injectors.

- Auvi-Q and Adrenaclick: Present as competitive alternatives with different device features.

Market Differentiators

- Device design and usability.

- Pricing strategies and insurance coverage.

- Public awareness campaigns.

Despite competition, EpiPen’s brand recognition sustains its market share. However, new entrants and generic versions influence prices and utilization.

Market Challenges

- Pricing and Reimbursement: High costs limit accessibility, affecting sales volume.

- Storage and Handling: Strict storage requirements may influence purchase decisions.

- Alternatives and Substitutes: Competition from generics and devices with improved features.

Sales Projections

Baseline Scenario (Conservative Growth)

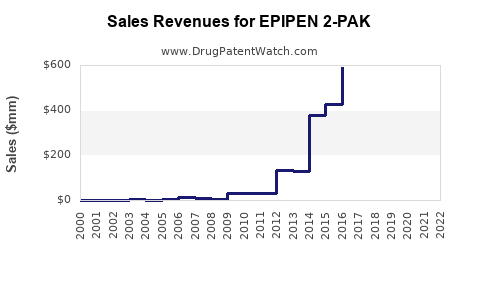

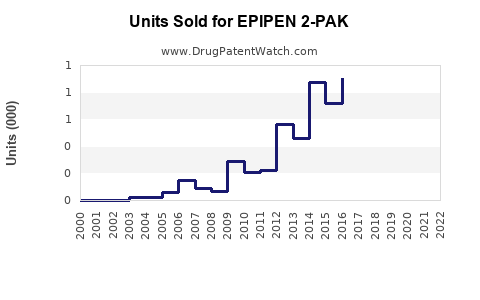

Considering historical sales data, regulatory environments, and market expansion:

- 2022: Approximate sales volume of 3 million units globally, with US market accounting for 70% (~2.1 million units).

- Growth Rate: Estimated at 10-12% annually, driven by increased allergy prevalence and awareness.

- 2023: Projected sales of ~3.4 million units globally.

- 2024-2026: Sustained CAGR of 10%, leading to:

| Year |

Estimated Units Sold |

Notes |

| 2022 |

3.0 million |

Baseline |

| 2023 |

3.4 million |

Increased awareness and access |

| 2024 |

3.75 million |

Further market penetration |

| 2025 |

4.1 million |

Expanding into emerging markets |

| 2026 |

4.5 million |

Global adoption growth |

Revenue Estimate

At an average wholesale price of $120 per device, potential revenue:

- 2022: ~$360 million

- 2023: ~$408 million

- 2024: ~$450 million

- 2025: ~$486 million

- 2026: ~$540 million

The projections assume stable pricing; however, optional premium features, insurance reimbursement levels, and generic competition may influence actual revenues.

Market Expansion Opportunities

- International Expansion: Penetrating European and Asian markets, where allergy awareness escalates.

- Product Line Extensions: Offering auto-injector variants with enhanced features or multi-dose formats.

- Partnerships: Collaborating with healthcare providers, insurance firms, and educational institutions to broaden access.

Risks and Considerations

- Regulatory Delays: Post-market safety recalls or regulatory changes could impact sales.

- Pricing Pressures: Insurance policies and pricing controls may limit revenue growth.

- Emerging Competitors: New devices with superior features or lower costs could erode market share.

Conclusion

The EPIPEN 2-PACK remains a pivotal emergency treatment with robust growth potential, driven by rising allergy incidences and increased awareness. Conservative forecasts suggest steady sales expansion, with a significant upside contingent upon successful market penetration, regulatory environment, and competitive positioning.

Key Takeaways

- Growth Trend: The global need for epinephrine auto-injectors is projected to grow at a CAGR of approximately 10%, supported by rising allergy prevalence.

- Market Penetration: Focused efforts in international markets could significantly amplify sales.

- Pricing Dynamics: Maintaining favorable reimbursement policies is critical for sustained revenue.

- Competitive Landscape: Innovation and price competition will shape market share dynamics.

- Strategic Focus: Expanding distribution channels and broadening access through partnerships can unlock growth potential.

FAQs

1. What factors influence EPIPEN 2-PACK sales growth?

Market growth hinges on rising allergy diagnoses, regulatory approvals, public awareness, pricing strategies, and the introduction of competitive products.

2. How does pricing impact global adoption?

High retail prices and inconsistent insurance coverage restrict access, especially in lower-income regions, limiting sales growth.

3. What regions offer the greatest sales opportunities?

North America, particularly the US, remains the largest market. Europe and Asia-Pacific are emerging markets with considerable growth potential.

4. How does competition affect future sales?

The entrance of generic versions and innovative devices with enhanced features may reduce market share for current brand leaders.

5. What strategic initiatives could boost sales?

Expanding distribution, advocating for insurance reimbursement, educating the public, and entering new geographic markets are effective pathways.

References

- Food Allergy Research & Education (FARE). "Food Allergy Facts and Figures." [2022 Data].

- U.S. Food and Drug Administration. "Epinephrine Auto-Injectors." [FDA Approval Data].

- MarketWatch. "Global Allergy and Anaphylaxis Market Size and Forecast," 2023.

- IQVIA. "Pharmaceutical Market Reports," 2022.

- Nielsen. "Healthcare Consumer Trends," 2022.

Note: All projections are estimates based on current market data and trends and are subject to change with market dynamics.