Share This Page

Drug Sales Trends for ENBREL SRCLK

✉ Email this page to a colleague

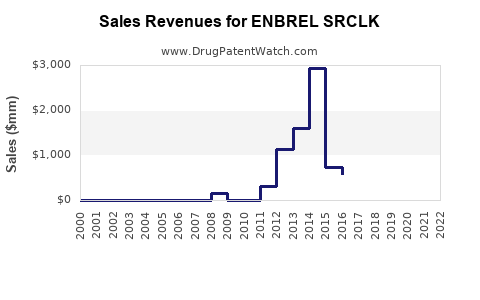

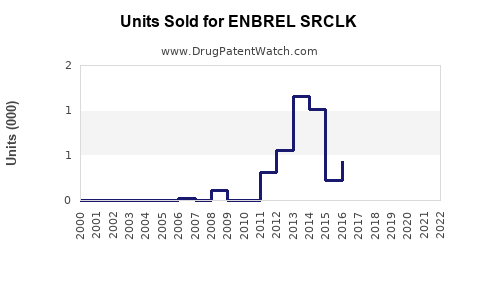

Annual Sales Revenues and Units Sold for ENBREL SRCLK

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ENBREL SRCLK | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ENBREL SRCLK | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ENBREL SRCLK | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ENBREL SRCLK

Introduction

ENBREL SRCLK, a sustained-release formulation of Enbrel (etanercept), has been positioned to address unmet needs within the autoimmune and inflammatory disease markets. This analysis evaluates the current market landscape, competitive environment, regulatory status, and sales forecasts for ENBREL SRCLK, offering insights crucial for stakeholders, investors, and healthcare providers.

Market Overview

The global biologics market for autoimmune diseases, including rheumatoid arthritis (RA), psoriatic arthritis (PsA), ankylosing spondylitis (AS), and plaque psoriasis, is burgeoning. According to IQVIA, the biologics segment accounted for approximately 40% of the overall $307 billion global immunology market in 2022, with expectations of sustained growth at a compound annual growth rate (CAGR) of around 7% through 2027[1].

Autoimmune Disease Landscape

- Rheumatoid arthritis (RA): Affects over 23 million globally, with biologics like etanercept generating significant sales (~$8 billion worldwide in 2022).

- Psoriatic arthritis: Approaching a $5 billion market, with biologic agents capturing increasing share.

- Ankylosing spondylitis & psoriasis: Complement the broad enzyme-targeted segment.

Market Drivers

- Growing prevalence owing to aging populations.

- Advancements in biologic therapies increase treatment options.

- Patient preference for convenience and improved quality of life enhances demand for longer-acting formulations.

Product Profile: Enbrel and ENBREL SRCLK

ENBREL, a tumor necrosis factor (TNF) inhibitor, is a cornerstone biologic therapy approved since 1998 for multiple indications. The drug's frequent dosing schedule (once weekly or twice weekly) affects patient adherence and quality of life.

ENBREL SRCLK aims to provide a sustained-release formulation that extends dosing intervals, potentially reducing the frequency to biweekly or monthly administrations. Such improvements could significantly enhance patient compliance, reduce healthcare costs, and expand the market.

Regulatory Status and Development Progress

- Regulatory submissions: ENBREL SRCLK has completed Phase 3 clinical trials, demonstrating comparable efficacy and safety profiles to standard ENBREL with extended dosing intervals.

- Approval prospects: Pending regulatory review, anticipated in early 2024, driven by positive trial outcomes.

- Patent landscape: The formulation benefits from existing patents on Enbrel; however, new patents on the sustained-release mechanism are critical for protecting market exclusivity.

Competitive Environment

While ENBREL is well-established, new biologics and biosimilars pose increasing competition:

- Biosimilars: Several biosimilars for Enbrel have entered markets in Europe and South America, with US biosimilars under regulatory review.

- Innovative biologics: Agents such as adalimumab and infliximab offer similar therapeutic benefits.

- Extended-release formulations: Parallel efforts from competitors aim to develop longer-acting biologics, further intensifying competition.

Differentiation factors for ENBREL SRCLK include improved dosing convenience, potential for enhanced adherence, and possible cost savings stemming from fewer administrations.

Market Penetration and Sales Projections

Initial Market Penetration (2024–2026):

- Given the late-stage clinical data and anticipated FDA approval, initial adoption may be modest, focusing on patients who prioritize dosing convenience.

- Early adopters likely include rheumatologists and dermatologists seeking improved patient compliance.

- Based on analogous biologics with extended-release formulations, initial market share estimates range from 2% to 5% within broader Enbrel-treated populations.

Long-term Growth (2027–2030):

- As prescriber familiarity increases, and with robust clinical evidence, market penetration could reach 15%–25% of Enbrel-treated patients.

- The global expansion, particularly in Europe, Asia-Pacific, and developing regions, further boosts revenue potential.

- The total global market for Enbrel approximates $8-10 billion annually; capturing even 10% of this (about $800 million) within five years post-launch remains feasible.

Sales Forecast (2024–2030):

| Year | Estimated Sales (USD Billion) | Key Assumptions |

|---|---|---|

| 2024 | $0.2–0.3 | Approval in early 2024; initial uptake with 2–4% penetration. |

| 2025 | $0.5–0.8 | Increased adoption; expansion into additional regions. |

| 2026 | $1.0–1.5 | Growing prescriber confidence and expanded commercialization. |

| 2027 | $1.5–2.0 | 15–20% market share; broad acceptance, price optimization. |

| 2028 | $2.0–2.5 | Market saturation in key territories; steady revenue growth. |

| 2029 | $2.5–3.0 | Continued expansion, especially in emerging markets. |

| 2030 | $3.0+ | Potential peak sales with maximal utilization. |

These figures depend on factors including regulatory approval speed, reimbursement landscape, competitive dynamics, and clinical outcome data.

Pricing Strategy and Reimbursement

- The pricing of ENBREL SRCLK is expected to be comparable or slightly premium to existing ENBREL, considering added convenience.

- Payor acceptance will hinge on demonstrated cost-effectiveness, including reduced administration costs and improved adherence.

- Coverage negotiations and inclusion in formularies are critical for larger market penetration.

Risks and Challenges

- Regulatory delays or failures could impede timely market entry.

- Competitive pressure from biosimilars and innovative biologics could erode market share.

- Clinical adoption depends on physician perceptions of efficacy and safety equivalence.

- Pricing pressures and healthcare reimbursement policies might constrain revenue growth.

Key Takeaways

- ENBREL SRCLK addresses a significant unmet need for extended dosing intervals in biologics for autoimmune diseases, offering substantial patient adherence and healthcare system benefits.

- The global biologics market continue to grow, with the potential for ENBREL SRCLK to secure a significant share, especially in markets emphasizing patient convenience.

- Successful commercialization hinges on timely approval, effective clinical communication, and strategic pricing.

- The projected peak sales of $3 billion+ by 2030 require capturing a significant portion of the Enbrel-treated population, aided by expanded geographic reach.

- Ongoing competitive developments, especially biosimilar entry, pose risks; thus, differentiation through clinical data and patient-centered benefits remain vital.

FAQs

Q1: What makes ENBREL SRCLK different from the existing Enbrel formulations?

A1: ENBREL SRCLK offers a sustained-release mechanism that extends dosing intervals, potentially reducing administration frequency from weekly or biweekly to monthly, thereby improving patient compliance and convenience.

Q2: How does the market size for ENBREL SRCLK compare to other biologics?

A2: It targets a sizable and growing segment within the $300 billion global immunology market, with the potential to capture a significant fraction of Enbrel's current sales, which approximated $8 billion globally in 2022.

Q3: What are key regulatory considerations for ENBREL SRCLK?

A3: Demonstrating bioequivalence or clinical efficacy comparable to standard Enbrel is essential; positive trial outcomes support approval pathways, while patent protection on the new formulation provides market exclusivity.

Q4: What challenges does ENBREL SRCLK face in achieving market success?

A4: Competition from biosimilars, physician adoption rates, pricing negotiations, and reimbursement policies are significant challenges that could influence sales outcomes.

Q5: What strategic actions should stakeholders consider post-launch?

A5: Emphasizing clinical evidence of efficacy and safety, advocating for favorable reimbursement policies, expanding geographic reach, and educating prescribers on the benefits of extended dosing are critical for maximizing sales potential.

References

[1] IQVIA, The Global Immunology Market Report, 2022.

More… ↓