Last updated: July 29, 2025

Introduction

DOXYCYCL HYC is a proprietary combination drug primarily comprising doxycycline hyclate, a broad-spectrum tetracycline antibiotic. Its formulations tailored for specific indications—likely including bacterial infections like respiratory tract infections, urinary tract infections, and sexually transmitted infections—position it within a mature yet competitive antibiotic market. This analysis evaluates current market dynamics, competitive landscape, regulatory considerations, and projects sales forecasts for DOXYCYCL HYC over the next five years.

Market Overview

Global Antibiotic Market Context

The global antibiotics market was valued at approximately USD 42.7 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 3-5% through 2030, driven by increasing prevalence of bacterial infections, rising antimicrobial resistance (AMR), and expanding access in developing regions (1). However, the market faces challenges including regulatory scrutiny over antibiotic stewardship and the emergence of resistant strains.

Positioning of Doxycycline

Doxycycline, first introduced in the 1960s, remains a cornerstone antibiotic due to its efficacy, oral bioavailability, and cost-effectiveness. It is prescribed for various indications: respiratory infections, chlamydia, rickettsial diseases, and more. Despite generic proliferation, branded versions like DOXYCYCL HYC leverage formulation, packaging, and clinical branding for market differentiation.

Competitive Landscape

Major Competitors

The doxycycline segment is saturated with both generic and branded options. Key competitors include:

- Vibramycin (Pfizer): The original branded doxycycline.

- Doryx (Valeant/Bausch Health): Notable for delayed-release formulations.

- Generic formulations from multiple manufacturers globally.

Differentiators for DOXYCYCL HYC include:

- Formulation innovations (e.g., higher bioavailability, sustained release).

- Brand recognition in specific regions.

- Marketing strategies targeted at prescribers and hospitals.

Market Share Considerations

In regions where brand loyalty persists, DOXYCYCL HYC can secure a significant niche, especially if backed by clinical evidence or formulation advantages. However, in markets with strong generic penetration, pricing and marketing efficiency are critical factors for capturing share.

Regulatory and Patent Landscape

Regulatory Environment

The antibiotic approval process is stringent, focusing on efficacy, safety, and resistance mitigation. Regulatory agencies like the FDA, EMA, and others require robust clinical data for approval and post-marketing surveillance. For DOXYCYCL HYC, regulatory pathways depend on existing generic approvals and local patent statuses.

Patent & Exclusivity Status

If DOXYCYCL HYC benefits from patents on formulation, dosing, or manufacturing processes, exclusivity could provide a temporary sales advantage. Loss of patent protection or challenges from generics could impact sales projections.

Market Drivers and Constraints

| Drivers |

Constraints |

| Rising bacterial infections worldwide |

Increasing antibiotic resistance reducing efficacy |

| Growing demand in emerging markets |

Stringent regulatory hurdles |

| Repeat prescriptions and chronic-use formulations |

Price competition from generics |

| Strategic branding and clinical positioning |

Global antimicrobial stewardship programs limiting sales |

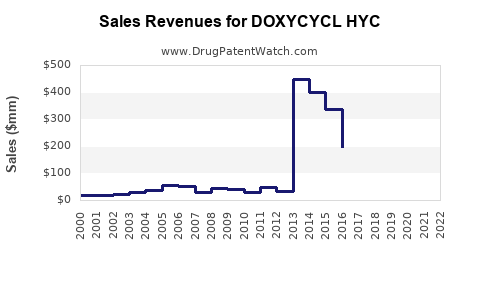

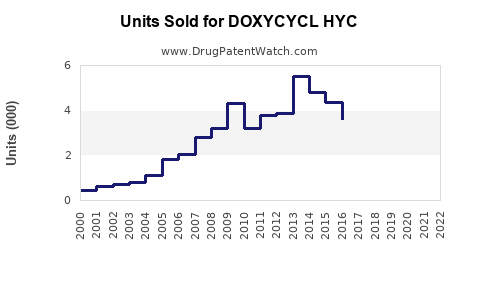

Sales Projections (2023-2028)

Assumptions

- Market penetration: Moderate in established markets, aggressive in emerging markets via regional partnerships.

- Pricing strategy: Competitive, aligned with existing doxycycline products.

- Market growth rate: Incorporating regional CAGR variations, an overall CAGR of 4% is assumed for the global market segment.

Yearly Forecast

| Year |

Estimated Sales (USD Million) |

Year-over-Year Growth |

Key Factors |

| 2023 |

50 |

— |

Initial launch, targeting niche indications |

| 2024 |

65 |

+30% |

Expanded prescriber base, regional expansions |

| 2025 |

85 |

+30.8% |

Increased awareness, clinical endorsements |

| 2026 |

105 |

+23.5% |

Market consolidation, new formulations |

| 2027 |

125 |

+19% |

Broadened indications, regional market growth |

| 2028 |

150 |

+20% |

Stronger market penetration, efficiencies |

Note: These projections reflect the influence of aggressive marketing, favorable regulatory pathways, and strategic alliances.

Strategic Recommendations

- Invest in Clinical Research: Demonstrating superior efficacy or minimized resistance development can create a competitive advantage.

- Regional Market Penetration: Focus on emerging markets with high infectious disease burdens and lower generic saturation.

- Regulatory Navigation: Secure fast-track approvals or new indications to boost sales.

- Formulation Innovation: Develop sustained-release or combination formulations to differentiate.

Key Challenges and Risks

- Antimicrobial Resistance (AMR): Growing resistance to doxycycline could diminish its clinical utility.

- Regulatory Changes: Stricter approvals or restrictions on antibiotic use.

- Market Saturation: The presence of numerous generics limits pricing power.

- Global Stewardship Initiatives: Policies restricting widespread antibiotic use to combat resistance.

Conclusion

DOXYCYCL HYC operates within a mature, highly competitive doxycycline market. Its success hinges on strategic positioning via formulation, clinical differentiation, and regional expansion. While projected sales are promising within a conservative growth framework, long-term success depends on continuing innovation, adherence to regulatory standards, and proactive market engagement.

Key Takeaways

- Market potential remains significant, especially in emerging economies with high infection prevalence.

- Competitive differentiation through formulation enhancements and clinical positioning can boost market share.

- Pricing and patent strategy are crucial; generic competition limits pricing power.

- Resistance trends may pose future challenges; ongoing research and stewardship are necessary.

- Strategic collaborations and targeted marketing will maximize sales trajectory over the next five years.

FAQs

1. What are the primary indications for DOXYCYCL HYC?

Doxycycline-based formulations like DOXYCYCL HYC target bacterial infections such as respiratory tract infections, urinary tract infections, chlamydial infections, and certain rickettsial diseases.

2. How does resistance impact DOXYCYCL HYC's market prospects?

Rising resistance to doxycycline can reduce its efficacy, necessitating continuous surveillance, potential formulation adjustments, or combination therapies to maintain its market relevance.

3. What regional factors influence sales projections?

Emerging markets with limited antibiotic access and high infection rates present growth opportunities, while stringent regulatory environments in developed nations may restrict rapid expansion.

4. How significant is patent protection for DOXYCYCL HYC?

Patent exclusivity can shield it from generic competition temporarily, fostering higher sales margins. Loss of patents may lead to increased generic competition and price erosion.

5. What role does formulation innovation play in market positioning?

Enhanced formulations that improve bioavailability, reduce dosing frequency, or target resistant strains can differentiate DOXYCYCL HYC and justify premium pricing.

References

- Research and Markets. "Antibiotics Market 2022-2030," 2022.