Share This Page

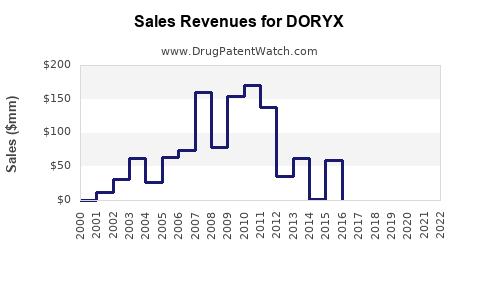

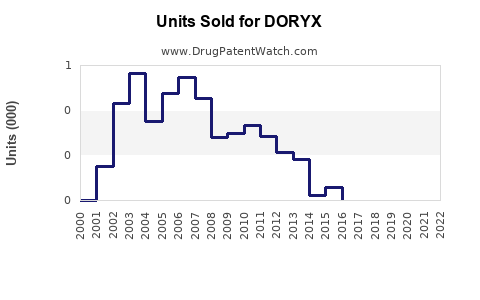

Drug Sales Trends for DORYX

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for DORYX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DORYX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DORYX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DORYX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| DORYX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| DORYX | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for DORYX (Doxycycline Hyclate)

Introduction

DORYX, the brand name for doxycycline hyclate, is a broad-spectrum tetracycline antibiotic used to treat a variety of bacterial infections, including respiratory tract infections, Lyme disease, chlamydia, and skin infections. Since its approval, DORYX has maintained a significant presence within the antibiotic market, driven by its efficacy, oral formulation, and longstanding clinical use. A comprehensive market analysis and sales projection for DORYX must consider therapeutic demand, competitive landscape, regulatory factors, and emerging market trends.

Market Overview

Global Antibiotic Market Landscape

The global antibiotics market was valued at approximately USD 45 billion in 2022 and is forecasted to grow at a CAGR of around 3.2% through 2028 [1]. The growth is fueled by increasing infectious disease prevalence, rising antibiotic resistance, and expanding indications. Within this landscape, doxycycline remains a key player owing to its broad-spectrum activity, cost-effectiveness, and established safety profile.

DORYX Positioning and Differentiation

DORYX's primary advantage lies in its extended-release formulation that offers advantages in dosing convenience and patient compliance. Additionally, it benefits from a long-standing reputation and existing physician familiarity, which sustain its market share despite the influx of generic options.

Regulatory and Patent Expiry

DORYX’s patent protection has expired, allowing multiple generics to enter the market, exerting downward price pressure but expanding accessibility. The original formulation's exclusivity period ended around 2010, prompting increased generic competition.

Market Drivers

- Increased Prevalence of Infectious Diseases: Rising cases of bacterial infections bolster demand for doxycycline-based therapies.

- Antibiotic Resistance: The growing threat of resistant strains promotes the continued use of doxycycline, especially as part of combination regimens.

- Expanding Indications: Emerging uses in acne, periodontitis, and malaria prophylaxis extend the drug's potential market.

- Patient Compliance: Once-daily dosing and oral administration favor higher adherence rates, supporting sustained demand.

Market Constraints

- Generic Competition: Multiple generic versions have decreased drug pricing and margins.

- Regulatory Scrutiny & Stewardship: Increased emphasis on antibiotic stewardship may limit unwarranted use, impacting growth.

- Side Effect Profile: Tetracyclines' association with photosensitivity and gastrointestinal symptoms may restrict use in certain populations.

Market Segmentation & Customer Profile

-

By Application:

- Respiratory infections

- Skin and soft tissue infections

- Sexually transmitted infections

- Malaria prophylaxis

- Acne vulgaris

-

By Distribution Channel:

- Hospital pharmacies

- Retail pharmacies

- E-commerce platforms

-

Regional Markets:

- North America: Largest market due to high infection burden and established healthcare infrastructure.

- Europe: Moderate growth driven by antibiotic stewardship policies.

- Asia-Pacific: Rapidly expanding due to rising infectious disease prevalence and healthcare access.

Competitive Landscape

Key competitors encompass generic doxycycline products and alternative antibiotics. Notable market players include:

- Pfizer (original manufacturer, now generic licensing)

- Teva Pharmaceuticals

- Mylan (now part of Viatris)

- Sandoz

- Sun Pharmaceuticals

Market share is primarily held by generics, with branded formulations like DORYX maintaining premium positioning through differentiated formulations (e.g., extended-release).

The dominance of generics has intensified pricing competition, impacting sales margins but expanding overall volume.

Sales Projections (2023–2028)

Methodology

Forecasting relies on analyzing historical sales data, market penetration rates, demographic trends, and competitive dynamics. Assumptions include:

- Gradual penetration of expanded indications.

- Maintained prescription volumes in primary infection treatments.

- Moderate price erosion due to generics.

- External factors like antibiotic stewardship impacting overall demand.

Projected Sales Volume

- The global doxycycline market is estimated to grow at approximately 2% annually, driven by increased infectious disease cases and expanded indication use.

- DORYX's market share is projected to stabilize around 10-15% within the doxycycline segment, factoring in brand preferences and generics.

Revenue Forecast

| Year | Estimated Global Sales (USD billion) | DORYX Share (USD billion) | Comments |

|---|---|---|---|

| 2023 | $3.2 | $0.32 - $0.48 | Continued generic competition impacts brand sales. |

| 2024 | $3.3 | $0.33 - $0.50 | Slight growth with expanding indications. |

| 2025 | $3.5 | $0.35 - $0.52 | Market stabilization and generics saturation. |

| 2026 | $3.6 | $0.36 - $0.55 | Growing awareness of doxycycline uses. |

| 2027 | $3.7 | $0.37 - $0.57 | Increased prescribing due to resistant infections. |

| 2028 | $3.8 | $0.38 - $0.58 | Outlook balanced; growth driven by emerging indications. |

Note: These projections assume consistent prescription trends and no major regulatory or market disruptions.

Emerging Trends Influencing Future Sales

- Antimicrobial Stewardship: Growing focus on responsible antibiotic use may dampen volume growth unless expanded indications or new formulations are developed.

- Novel Formulations: Extended-release variants (like DORYX) may command premium pricing and foster brand loyalty.

- Biopharmaceutical Advances: Potential for combination therapies and targeted delivery systems could shift usage patterns.

- Geographical Expansion: Developing countries experiencing epidemiological shifts pose long-term growth opportunities.

Conclusion

DORYX's future sales trajectory hinges on its ability to adapt to competitive pressures, regulatory landscapes, and evolving clinical practices. While generics have eroded original pricing margins, DORYX's differentiated extended-release formulation and established clinical reputation provide opportunities for sustainable demand, especially in specific therapeutic niches.

Key Takeaways

- The doxycycline market shows steady but modest growth, driven by infectious disease prevalence and expanded use in dermatology and malaria prophylaxis.

- Patent expiration and widespread generic competition have pressured DORYX's sales but also broadened access.

- Strategic focus on expanding indications, leveraging formulation advantages, and maintaining clinical relevance will be critical for DORYX’s sales growth.

- Regional markets vary significantly; North America remains dominant, but Asia-Pacific offers substantial growth potential.

- Market challenges include antibiotic stewardship policies and resistance trends, requiring proactive adaptation.

FAQs

-

What factors primarily influence DORYX's sales growth?

Growth depends on infection rates, prescribing habits, competition from generics, regulatory policies, and the drug's expanded therapeutic indications. -

How does generic competition affect DORYX’s market share?

It reduces pricing power and margins but increases overall volume due to greater accessibility and affordability. -

What are the key opportunities for DORYX to increase sales?

Expanding indications (e.g., acne, malaria prophylaxis), developing new formulations, and entering emerging markets. -

How might antibiotic stewardship influence DORYX's future demand?

Increased stewardship efforts could limit unnecessary prescribing, constraining growth but encouraging targeted, appropriate use. -

Are there new formulations of doxycycline that could challenge DORYX?

Yes, including extended-release and combination formulations that may offer improved compliance, potentially impacting DORYX’s market share.

References

[1] MarketsandMarkets. "Antibiotics Market by Product & Application," 2022.

More… ↓