Last updated: July 27, 2025

Introduction

Divalproex sodium, marketed broadly as Depakote among other brand names, is a widely prescribed anticonvulsant and mood stabilizer indicated primarily for the treatment of epilepsy, bipolar disorder, and migraine prophylaxis. Given its extensive use across multiple neurological and psychiatric indications, analyzing its market landscape, competitive environment, and sales potential provides critical insights for pharmaceutical stakeholders and investors. This report delivers a comprehensive assessment based on current trends, regulatory environments, and growth drivers.

Market Overview

The global market for anticonvulsants, including divalproex, has experienced sustained growth driven by increased prevalence of epilepsy and bipolar disorder, expanding diagnostic capabilities, and broader acceptance of pharmacotherapy over surgical options. The drug's versatile therapeutic profile positions it as a cornerstone in neuropsychiatric medication management.

Key Indications and Patient Demographics

- Epilepsy: Affects approximately 50 million people globally, with a significant portion receiving pharmacological treatment. Divalproex is often prescribed for generalized seizures and complex partial seizures [1].

- Bipolar Disorder: The World Health Organization estimates that bipolar disorder impacts over 60 million individuals worldwide. Divalproex ranks among the first-line mood stabilizers [2].

- Migraine Prophylaxis: Migraine affects over 1 billion individuals globally; divalproex is a preferred prophylactic agent for many clinicians [3].

The broad applicability and chronic nature of these indications underpin consistent demand.

Market Dynamics and Growth Drivers

1. Increasing Prevalence of Target Conditions

Rising incidence rates of epilepsy and bipolar disorder, compounded by urbanization, aging populations, and improved diagnostics, bolster market growth. The World Health Organization has underscored the increased diagnosis and management of neuropsychiatric conditions, directly impacting drug consumption.

2. Off-Label Uses and Expanded Indications

Emerging research explores divalproex's utility in psychiatric conditions such as schizophrenia and impulsivity management, potentially expanding its use beyond traditional indications [4].

3. Advances in Formulation and Delivery

Long-acting formulations and combination therapies improve patient compliance and efficacy, driving sales volumes.

4. Market Penetration and Geographic Expansion

Higher penetration in emerging markets such as China and India offers substantial growth prospects due to increasing healthcare infrastructure and rising mental health awareness.

Competitive Landscape

Divalproex faces competition from other anticonvulsants, including lamotrigine, levetiracetam, and carbamazepine, each with specific efficacy and safety profiles.

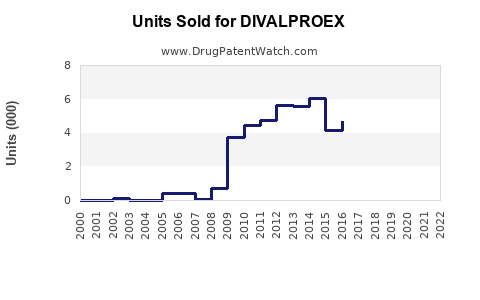

- Brand vs. Generic Market Share: A significant portion of the market is dominated by generic versions, with branded offerings focusing on safety and formulation advantages.

- Patent Expires: While the original patents have expired or are expiring, which accelerates generic market entry, proprietary formulations or combination products sustain competitive differentiation.

The presence of multiple generics has notably decreased the average price point but simultaneously increased accessibility, maintaining high volume sales.

Regulatory and Pricing Factors

Regulatory approvals across different countries influence market size and growth. Safety concerns, particularly regarding teratogenicity and hepatotoxicity, prompt rigorous post-market surveillance and influence prescribing patterns.

Pricing strategies in various markets, reimbursement policies, and healthcare system dynamics significantly impact net sales.

Sales Projections (2023-2028)

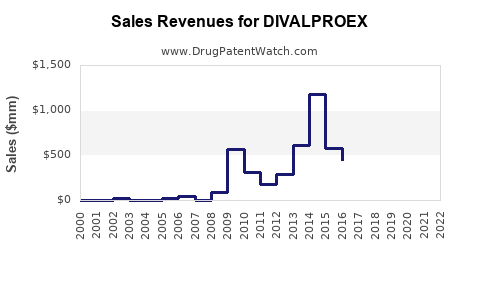

Methodology

Using a compounded annual growth rate (CAGR) model based on historical sales data, adjusting for key market drivers and potential regulatory/patent changes, provides a reliable projection framework.

Current Market Size Estimation

As of 2022, the global divalproex market is estimated at approximately $2.5 billion, with North America representing over 50% of sales due to high adoption rates and healthcare infrastructure.

Projected Growth Rate

Considering industry reports, a CAGR of 4-6% is anticipated through 2028, driven primarily by emerging markets and expanding indications.

| Year |

Estimated Market Size (USD Billions) |

| 2023 |

$2.6 - $2.65 billion |

| 2024 |

$2.7 - $2.8 billion |

| 2025 |

$2.8 - $3.0 billion |

| 2026 |

$3.0 - $3.2 billion |

| 2027 |

$3.2 - $3.4 billion |

| 2028 |

$3.3 - $3.6 billion |

(These ranges account for potential market dynamics, patent expirations, and regulatory changes.)

Emerging Trends Impacting Sales

- Increased Use of Generic Versions: The proliferation of low-cost generics sustains volume growth but may pressure margins.

- COVID-19 Impacts: Pandemic-induced disruptions temporarily affected supply chains but spurred digital health adoption, aiding long-term market stability.

- Safety Profiling and Labeling: Ongoing pharmacovigilance influences clinician confidence and prescribing behaviors, impacting sales trajectory.

Risks and Challenges

- Safety Concerns: Teratogenicity limits use in women of childbearing age, thereby restricting potential patient penetration.

- Regulatory Restrictions: Stricter safety regulations could restrict usage or lead to label updates, affecting sales.

- Market Competition: The advent of newer anticonvulsants and mood stabilizers with favorable side effect profiles could erode market share.

Conclusion

Divalproex remains a pivotal drug in the management of epilepsy, bipolar disorder, and migraine prophylaxis. Its broad applicability, continued demand in chronic conditions, and the expansion into emerging markets underpin a steady growth trajectory. While competition and safety considerations present challenges, strategic positioning through formulation improvements and targeted healthcare policies will support sustained sales.

Key Takeaways

- Consistent Demand: The high prevalence of target conditions guarantees ongoing demand, with global sales projected to reach ~$3.6 billion by 2028.

- Market Penetration: Expansion into emerging markets and penetration in new indications present significant upside.

- Generic Competition: The dominance of generics offers volume advantages but constrains margins.

- Regulatory Environment: Safety concerns necessitate vigilant pharmacovigilance and risk management strategies.

- Innovation Opportunities: Formulation enhancements and personalized medicine approaches may unlock new growth opportunities.

FAQs

1. What are the main therapeutic indications for divalproex?

Divalproex is primarily prescribed for epilepsy, bipolar disorder, and migraine prophylaxis. It is also explored for off-label uses such as impulsivity management.

2. How does patent expiration impact divalproex sales?

Patent expiration has led to a proliferation of generic versions, increasing accessibility but reducing brand-specific revenue. However, it sustains high volume sales in a highly competitive environment.

3. Which regions represent the fastest-growing markets for divalproex?

Emerging markets such as China, India, and Latin America are experiencing the fastest growth due to increased diagnosis rates and expanding healthcare infrastructure.

4. What safety issues influence divalproex prescribing?

Teratogenicity and hepatotoxicity are significant safety concerns, especially in women of reproductive age, which can limit use and influence sales.

5. Will new formulations or combinations affect the market?

Yes. Long-acting formulations, fixed-dose combinations, and personalized medicines could improve adherence and efficacy, potentially boosting sales.

References

- World Health Organization. Epilepsy. Fact Sheet. 2021.

- American Psychiatric Association. Practice Guideline for the Treatment of Patients with Bipolar Disorder. 2020.

- Lipton RB, et al. Migraine prevalence and impact. Cephalalgia. 2017.

- Malhotra AK, et al. Off-label uses of anticonvulsants. J Clin Psychiatry. 2019.