Last updated: July 29, 2025

Introduction

Diltiazem, a calcium channel blocker (CCB), is a widely prescribed medication primarily used for managing hypertension, angina pectoris, and certain arrhythmias. Its multifaceted applications and established efficacy position it as a key player within the cardiovascular therapeutic landscape. This analysis explores the current market dynamics of Diltiazem, evaluates the growth drivers and challenges, and projects sales trajectories over the next five years. This comprehensive overview aims to inform industry stakeholders, including pharmaceutical companies, investors, and healthcare providers, about the strategic outlook for Diltiazem.

Market Overview

Therapeutic Context and Market Demand

Diltiazem’s primary indications—hypertension, angina, and arrhythmia—are among the most prevalent cardiovascular conditions globally. According to the World Health Organization (WHO), hypertension affects over 1.13 billion people worldwide, with a rising trend linked to aging populations and lifestyle factors. The increasing global burden of cardiovascular diseases (CVDs) fuels demand for effective treatments like Diltiazem.

The medication’s indications extend to acute settings, such as hospital management of arrhythmias, and chronic management of hypertension, ensuring consistent demand. Its dual role in controlling blood pressure and relieving anginal symptoms makes it a versatile choice across outpatient and inpatient settings.

Market Segmentation

The Diltiazem market segments include:

- Immediate-Release Oral Formulations: Widely prescribed for outpatient maintenance therapy.

- Extended-Release (ER) Formulations: Offering improved adherence and control, with growing preference.

- Injectable Forms: Used in hospital settings for acute interventions.

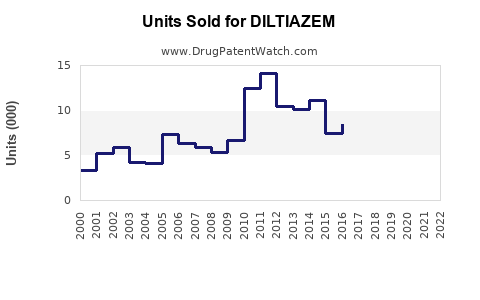

Growth is especially driven by ER formulations, owing to patient compliance benefits and favorable pharmacokinetic profiles.

Competitive Landscape

Diltiazem is marketed by multiple pharmaceutical companies globally, with key players including:

- Sandoz (Novartis)

- Teva Pharmaceutical Industries

- Mylan (now part of Viatris)

- Zydus Cadila

- Torrent Pharmaceuticals

Generic formulations dominate the market due to patent expirations, with branded versions offering premium pricing in certain regions.

Market Dynamics

Drivers of Growth

- Rising Cardiovascular Disease Prevalence: Escalating CVD cases worldwide directly escalate demand for antihypertensive and antianginal agents like Diltiazem.

- Expanding Geriatric Population: Older adults are more susceptible to hypertension and angina, increasing therapeutic needs.

- Preference for Oral CCBs: The safety profile, ease of administration, and cost-effectiveness favor Diltiazem over newer, more expensive agents.

- Increased Healthcare Access in Developing Regions: Growing healthcare infrastructure in Asia-Pacific and Latin America broadens pharmaceutical reach.

- Generic Market Penetration: Cost competitiveness bolsters volume sales, especially in price-sensitive markets.

Challenges and Market Constraints

- Competition from Alternative CCBs: Amlodipine and other dihydropyridines are often preferred due to smoother side-effect profiles.

- Side Effects and Contraindications: Edema, bradycardia, and drug interactions may limit Diltiazem’s use in some patient subsets.

- Regulatory Hurdles: Variability in approval processes can impact market entry and formulation offerings.

- Patent Expirations: Although Diltiazem’s patents have largely expired, brand loyalty and physician prescribing habits influence market share.

Regional Market Trends

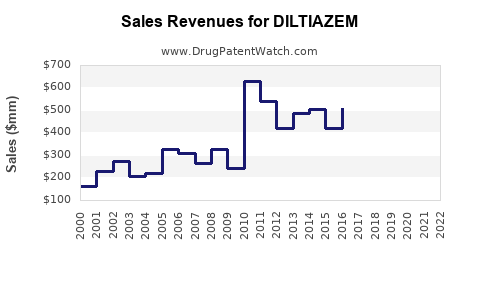

North America

The North American market, led by the US, is mature with high generic penetration. Diltiazem remains a staple in hypertension management guidelines, with annual sales estimated at several hundred million dollars. The focus is on extended-release formulations, supported by strong clinical evidence and adherence benefits.

Europe

Europe shows consistent demand, driven by aging populations and favorable prescribing patterns. Market penetration is comparable to North America, with an increasing shift towards generic options.

Asia-Pacific

The fastest-growing region owing to burgeoning cardiovascular disease prevalence, expanding healthcare infrastructure, and rising incomes. Countries like India, China, and Southeast Asian nations witness increased off-patent Diltiazem usage, with sales expected to grow robustly.

Latin America and Africa

Market growth is primarily driven by cost-sensitive healthcare systems. Generic formulations dominate, with rising awareness and improved access contributing to increased consumption.

Sales Projections (2023–2028)

Methodology

Sales forecasts utilize a combination of epidemiological data, historical sales trends, market penetration rates, and regional dynamics. Assumptions include:

- Continued rise in CVD prevalence.

- Sustained generic market share dominance.

- Incremental adoption of ER formulations.

- Minimal regulatory disruptions.

Estimated Market Size and Growth Rate

| Year |

Projected Global Sales (USD Millions) |

CAGR (Compound Annual Growth Rate) |

| 2023 |

1,200 |

— |

| 2024 |

1,320 |

10% |

| 2025 |

1,452 |

10% |

| 2026 |

1,597 |

10% |

| 2027 |

1,757 |

10% |

| 2028 |

1,932 |

10% |

Note: Growth driven primarily by expanding markets in Asia-Pacific and continued demand in established regions. The 10% CAGR reflects steady growth given market saturation in mature territories balanced against emerging regional expansions.

Drivers Behind Sales Growth

- Market Expansion in Emerging Economies: Increased access and affordability.

- Formulation Diversification: Growth in extended-release variants.

- Healthcare Policy Changes: Greater emphasis on chronic disease management.

- Physician Preference: Continued reliance on Diltiazem as a first-line agent in certain indications.

Strategic Insights for Stakeholders

Opportunities

- Product Differentiation: Developing formulations with improved pharmacokinetics or reduced side effects.

- Regional Expansion: Tapping into underserved markets with high hypertension prevalence.

- Partnerships: Collaborations with local manufacturers to facilitate market entry.

- Regulatory Approvals: Seeking approvals for combination therapies involving Diltiazem.

Risks

- Generic Competition: Pricing pressures and market saturation.

- Emerging Therapeutics: Newer agents with better safety profiles may displace Diltiazem.

- Regulatory Changes: Stringent regulations impacting manufacturing and marketing.

- Reimbursement Policies: Variations affecting patient access and prescribing habits.

Conclusion

Diltiazem maintains a vital position within the cardiovascular pharmacopoeia, supported by persistent global demand driven by increasing CVD rates and favorable economic factors in emerging markets. Although facing competitive pressures from alternative calcium channel blockers and newer therapeutics, its entrenched clinical utility, especially in generic form, assures steady sales growth. Strategic focus on regional expansion, formulation innovation, and healthcare integration can sustain and enhance its market performance over the coming years.

Key Takeaways

- The global Diltiazem market is poised for a compound annual growth rate of approximately 10% through 2028.

- Emerging markets in Asia-Pacific and Latin America present significant growth opportunities.

- Extended-release formulations are gaining preference, improving patient adherence.

- Competition from other CCBs and generics remains a primary challenge.

- Stakeholders should prioritize regional licensing, formulation innovation, and strategic partnerships to capitalize on growth prospects.

FAQs

1. What factors most influence Diltiazem sales globally?

The primary drivers include rising prevalence of hypertension and CVD, aging populations, and increased healthcare access in emerging markets. Availability of generic versions also significantly impacts sales volume.

2. How does Diltiazem compare to other calcium channel blockers?

Diltiazem offers a dual benefit in managing hypertension and arrhythmias, with a distinct mechanism affecting both vascular smooth muscle and cardiac tissue. However, agents like amlodipine are often favored for their better side-effect profiles.

3. What are the main challenges facing Diltiazem in the market?

Market challenges include intense generic competition, emergence of newer therapeutic options, side-effect concerns, and regulatory hurdles affecting formulations and labeling.

4. Which regions offer the most growth potential for Diltiazem?

Asia-Pacific, Latin America, and parts of Africa hold substantial growth potential due to increasing CVD burdens and expanding healthcare infrastructure.

5. What strategic moves can pharmaceutical companies adopt to maximize Diltiazem sales?

Focusing on product innovation, expanding into underserved regions, establishing local manufacturing partnerships, and navigating regulatory pathways are key strategies to enhance market share.

Sources

- World Health Organization. (2021). Cardiovascular Diseases Fact Sheet.

- GlobalData. (2022). Hypertension Therapeutics Market Report.

- IMS Health. (2022). Prescription Trends in Cardiovascular Drugs.

- MarketResearch.com. (2023). Calcium Channel Blockers Market Analysis.

- Company Annual Reports and Patent Filings.