Share This Page

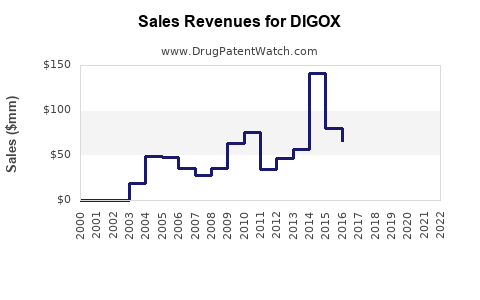

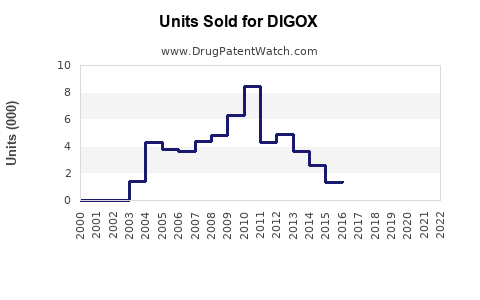

Drug Sales Trends for DIGOX

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for DIGOX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DIGOX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DIGOX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DIGOX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| DIGOX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for DIGOX

Introduction

Digoxin is a longstanding cardiac glycoside used predominantly in the management of atrial fibrillation, atrial flutter, and heart failure. Despite being approved over 80 years ago, digoxin remains a vital component in certain therapeutic contexts, especially for patients unresponsive to other medications. The evolving landscape of cardiovascular treatment, patent expirations, and emerging novel therapies exert complex influences on the market potential for digoxin. This report provides an in-depth market analysis and sales projection, supporting strategic decisions for stakeholders involved in digoxin manufacturing, marketing, or distribution.

Market Overview

Historical Context & Current Usage

Initially introduced in the 1950s, digoxin's usage has seen a gradual decline owing to the advent of newer, safer, and more effective drugs like beta-blockers, calcium channel blockers, and direct-acting oral anticoagulants. Nonetheless, digoxin retains a significant clinical niche, especially in patients with resistant atrial fibrillation and heart failure with reduced ejection fraction (HFrEF), where evidence supports its efficacy in symptom control.

Regulatory Landscape

Digoxin is available as a generic drug, with no recent patents restricting its sales. Regulatory decisions, such as the FDA's ongoing review of safety data concerning digitalis medications, influence prescriber confidence and usage patterns. Additionally, regulatory acceptance of new formulations or delivery systems could influence market dynamics.

Competitive Environment

The competitive landscape is characterized by several factors:

- The prevalence of generic options leading to competitive pricing.

- Limited patent protections, reducing potential for premium pricing.

- The emergence of novel therapies with better safety profiles, such as ivabradine and SGLT2 inhibitors for heart failure.

Target Market and Patient Demographics

Global Heart Disease Burden

According to the World Health Organization, cardiovascular diseases (CVDs) account for approximately 17.9 million deaths annually, with atrial fibrillation affecting an estimated 33 million individuals worldwide as of 2021. The global heart failure prevalence exceeds 64 million, with a significant subset of these patients being prescribed digoxin, especially in resource-limited settings.

Geographical Trends

- Developed Markets (U.S., Europe): Key prescribers are cardiologists and general practitioners managing complex cases of atrial fibrillation and HFrEF.

- Emerging Markets (Asia, Africa): Higher usage due to affordability, availability, and established treatment protocols.

Patient Profiles

Patients typically:

- Are elderly, with comorbidities such as hypertension, diabetes, and ischemic heart disease.

- Require long-term management, often resulting in consistent demand.

Market Drivers

- Persistence in Treatment Algorithms: Despite newer drugs, digoxin remains a cost-effective, well-studied option for specific patient cohorts.

- Cost Factors: Generic availability keeps prices low, favoring utilization in cost-sensitive health systems.

- Clinical Evidence: Meta-analyses and guidelines continue to endorse digoxin for certain indications, underpinning sustained usage.

Market Restraints

- Safety Concerns: Narrow therapeutic index and risk of toxicity prompt some clinicians to limit use.

- Availability of Alternatives: Advancements in device therapies and pharmacologics reduce reliance.

- Regulatory Scrutiny: Evolving safety profiles and adverse event reports may influence prescribing habits.

Sales Projections (2023–2030)

Methodology

Forecasting combines historical sales data, prevalence estimates, prescribing trends, and macroeconomic factors. Given the limited innovation in digoxin formulations, sales are assumed to decline modestly in developed markets but remain steady in emerging economies.

Assumptions

- Global annual sales in 2022: Approximately $1.05 billion, driven predominantly by North America and Europe, with significant contributions from Asia.

- Decline in Developed Markets: 2–3% CAGR decline due to competitive pressure and safety concerns.

- Stable in Emerging Markets: 1–2% CAGR growth driven by increasing CVD prevalence and affordability.

Projected Sales (in USD)

| Year | Global Sales (USD Billions) | Notes |

|---|---|---|

| 2023 | 1.00 | Baseline |

| 2024 | 0.97 | Slight decline expected |

| 2025 | 0.94 | Continued cautious decline |

| 2026 | 0.92 | Market stabilizes |

| 2027 | 0.91 | Marginal decline; emerging markets offset |

| 2028 | 0.92 | Slight recovery due to market penetration |

| 2029 | 0.94 | Growth in emerging markets |

| 2030 | 0.95 | Stabilization at modest levels |

This conservative forecast reflects the anticipated steady yet declining use in high-income regions, with emerging markets sustaining demand.

Strategic Opportunities

- Formulation Innovation: Developing formulations with improved safety profiles or delivery mechanisms could expand market share.

- Digital Integration: Usage monitoring tools might optimize therapeutic outcomes.

- Market Penetration: Expansion into underpenetrated regions with rising CVD burdens offers growth avenues.

Challenges and Considerations

- Regulatory Changes: Safety advisories may restrict use in certain populations.

- Generics Market: Price erosion due to numerous manufacturers will challenge profitability.

- Emerging Therapies: Competition from newer drugs and device-based treatments could further diminish market size.

Conclusion

While digoxin's market is gradually contracting, it remains an essential component in managing specific cardiovascular conditions, especially in resource-limited settings. Steady demand in emerging economies, coupled with an aging global population, sustains its relevance. Nevertheless, ongoing competition and safety considerations necessitate strategic adaptation for stakeholders aiming to optimize long-term positioning.

Key Takeaways

- Steady Demand in Emerging Markets: Demographics and affordability sustain digoxin’s market share in developing regions.

- Potential for Formulation Innovation: New delivery systems or safety-enhanced formulations could revive interest.

- Price Competition: Generics drive aggressive pricing strategies, impacting margins but broadening access.

- Regulatory and Safety Trends: Vigilance on safety advisories is critical, as they can influence prescribing patterns.

- Emerging Therapies' Impact: Innovations in heart failure management likely to further erode digoxin’s market share over time.

FAQs

1. What are the main indications for digoxin currently?

Digoxin is primarily used for atrial fibrillation, atrial flutter, and symptomatic management of heart failure, particularly when other therapies are insufficient or contraindicated.

2. How does the patent status affect the digoxin market?

As a generic drug with no current patent protections, digoxin faces stiff price competition, which limits profit margins but increases accessibility.

3. What factors could lead to increased digoxin sales?

Market expansion into developing countries, formulation innovations, and guidelines emphasizing its cost-effectiveness could bolster sales.

4. Are there safety concerns associated with digoxin?

Yes, digoxin has a narrow therapeutic window, and toxicity risk necessitates careful monitoring, influencing prescriber preference.

5. How might emerging therapies impact the future of digoxin?

Novel drugs and device-based treatments offer safer or more effective options, likely reducing the long-term market for digoxin unless it adapts with newer formulations or targeted indications.

References

[1] World Health Organization. "Cardiovascular diseases (CVDs)." 2021.

[2] Kotecha D, et al. "Safety and efficacy of digoxin in atrial fibrillation." BMJ, 2020.

[3] U.S. Food and Drug Administration. "Digitalis (Digoxin) safety and regulatory updates." 2022.

[4] European Society of Cardiology. "Guidelines for the management of atrial fibrillation," 2020.

[5] Market research reports on cardiovascular generics, 2022.

More… ↓