Share This Page

Drug Sales Trends for DIFLUCAN

✉ Email this page to a colleague

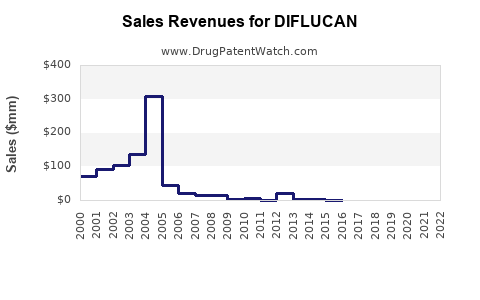

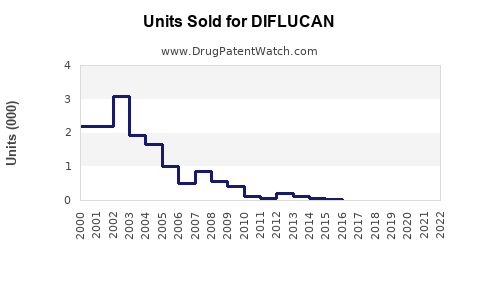

Annual Sales Revenues and Units Sold for DIFLUCAN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DIFLUCAN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DIFLUCAN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DIFLUCAN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for DIFLUCAN

Introduction

DIFLUCAN (generic name: fluconazole) is a widely used antifungal medication indicated for the treatment and prevention of fungal infections, including candidiasis, cryptococcal meningitis, and systemic fungal infections. As a cornerstone in antifungal therapy, DIFLUCAN’s market dynamics are influenced by global healthcare trends, antimicrobial resistance, and shifts in infectious disease management protocols. This analysis provides an in-depth overview of DIFLUCAN’s current market landscape, key drivers, competitive positioning, and future sales forecasts.

Market Overview

The global antifungal therapeutics market was valued at approximately USD 13 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4% from 2023 to 2030 [1]. Fluconazole, a first-generation azole antifungal, accounts for a significant segment within this market due to its efficacy, oral bioavailability, and cost-effectiveness. Its primary revenue streams are derived from hospital and outpatient settings, targeting immunocompromised populations—including HIV/AIDS patients, cancer patients undergoing chemotherapy, and transplant recipients.

Key Indications and Utilization Trends

- Candidiasis: The most common indication, especially oropharyngeal, esophageal, and invasive candidiasis.

- Cryptococcal meningitis: Particularly prevalent among HIV-positive populations, primarily in low- to middle-income countries.

- Prophylaxis: Used in immunosuppressed patients to prevent fungal infections.

- Other fungal infections: Including histoplasmosis and certain dermatophyte infections.

The rising prevalence of immunosuppressive conditions worldwide propels demand, supported by expanding healthcare infrastructure and increased awareness.

Competitive Landscape

DIFLUCAN faces competition from both branded and generic azole antifungals, such as voriconazole, itraconazole, and newer agents like isavuconazole. However, its established efficacy profile, favorable safety, and extensive clinical familiarity sustain its dominant market position. Patent expirations of original formulations, notably in North America and Europe, have facilitated a surge in generic fluconazole sales.

Major pharmaceutical companies, including Pfizer (original developer), now face competition from generic manufacturers. The widespread availability of low-cost generics has significantly expanded access, especially in resource-limited settings.

Market Drivers

- Increasing Disease Burden: The global rise in HIV/AIDS, oncology treatments, and organ transplantation escalates fungal infection incidences.

- Healthcare Infrastructure Development: Improved diagnostics and hospital capacities facilitate earlier infection detection and treatment.

- Cost-Effectiveness: Fluconazole’s low cost compared to newer antifungals makes it a preferred choice, especially in emerging markets.

- Regulatory Approvals: Ongoing approvals for expanded indications and formulations, e.g., intravenous and topical forms, broaden market reach.

Market Challenges

- Antifungal Resistance: Emergence of resistant Candida species, such as Candida glabrata and Candida auris, poses challenges to fluconazole efficacy.

- Side Effect Profile: Although generally well-tolerated, adverse hepatic effects and drug-drug interactions can limit use in certain populations.

- Competition from Newer Agents: Advances in antifungal formulations with broader spectrum and improved safety can encroach on fluconazole’s market share.

- Regulatory and Patent Challenges: Variations in patent laws across countries affect market dynamics, especially in the generics sector.

Sales Projections (2023–2030)

Factors Influencing Forecasts

- Market Penetration in Emerging Markets: Increasing access and local production drive volume growth.

- Global Disease Incidence: Continued rise in immunocompromised patient populations sustains high demand.

- Regulatory Landscape: Approvals for key indications and formulations foster new sales avenues.

- Competitive Innovations: The entry of novel antifungal agents may temper growth but also cyclically renew interest in existing drugs like DIFLUCAN.

Projected Sales Growth

By 2030, global sales of fluconazole are projected to reach approximately USD 3.8 billion, representing a CAGR of about 4%, aligned with the overall antifungal market growth [1]. The bulk of this revenue will originate from generic formulations, primarily in North America, Europe, and Asia-Pacific.

Regional Insights

- North America: Mature market, with stable demand driven by hospital infections and prophylaxis needs. Sales are expected to stabilize but remain significant due to high healthcare spending.

- Europe: Similar to North America, with additional emphasis on resistance management and clinical guidelines favoring fluconazole.

- Asia-Pacific: Rapid growth, driven by expanding healthcare infrastructure, increasing fungal disease burden, and generic market penetration, potentially constituting over 40% of global sales by 2030.

- Latin America and Africa: Emerging markets with considerable growth potential owing to demographic shifts, infectious disease prevalence, and cost-sensitive healthcare systems.

Strategic Opportunities

- Formulation Expansion: Development of novel delivery systems (e.g., long-acting injectables) could expand usage.

- Combination Therapies: Partnering with other antifungals or immunomodulators can enhance efficacy and signal new indications.

- Market Penetration: Focused marketing and partnerships in emerging markets can accelerate sales growth.

- Resistance Monitoring: Investing in surveillance and resistance mitigation strategies can sustain market relevance.

Conclusion

DIFLUCAN remains a vital component of the antifungal treatment landscape, with a robust market driven by rising infectious disease burdens and cost considerations. While generics have expanded access, emerging resistance and competitive innovations present challenges. Anticipated steady growth over the next decade hinges on strategic adaptation, formulation development, and expanding reach in emerging markets.

Key Takeaways

- Market stability driven by its proven efficacy, affordability, and widespread clinical adoption.

- Growth prospects are significant, especially in Asia-Pacific and emerging markets, with projected global sales reaching USD 3.8 billion by 2030.

- Challenges include rising antifungal resistance and competition from newer agents, necessitating ongoing innovation.

- Regional dynamics underscore the importance of tailored market strategies, with markets like Africa and Latin America offering notable expansion opportunities.

- Future success will depend on proactive resistance management, formulation innovations, and deeper penetration into resource-limited settings.

FAQs

1. How does antifungal resistance impact DIFLUCAN’s market outlook?

Resistance, particularly among non-albicans Candida species, diminishes fluconazole’s efficacy, leading to increased demand for alternative agents. Nonetheless, for susceptible infections, fluconazole maintains a strong position owing to its cost-effectiveness and long-standing clinical use.

2. What are the primary markets driving future sales of DIFLUCAN?

Emerging markets in Asia-Pacific, Latin America, and Africa are poised for significant growth, propelled by expanding healthcare infrastructure and higher disease prevalence.

3. Will new antifungal agents threaten DIFLUCAN’s market share?

Potentially. Broad-spectrum and newer azoles like voriconazole and isavuconazole offer advantages in resistant infections and specific indications. However, DIFLUCAN’s affordability and established safety profile sustain its relevance.

4. What role do patent expirations play in the DIFLUCAN market?

Patent expirations facilitate generic manufacturing, dramatically lowering costs and expanding access, which sustains sales volume but may pressure prices and margins on branded versions.

5. How can manufacturers capitalize on DIFLUCAN’s market potential?

By investing in formulation innovations, resistance monitoring, strategic partnerships in emerging markets, and expanding indications, companies can enhance revenue streams and maintain competitive advantage.

Sources:

[1] Grand View Research. “Antifungal Drugs Market Size & Trends Analysis Report,” 2022.

More… ↓