Share This Page

Drug Sales Trends for DEXTROAMPHET

✉ Email this page to a colleague

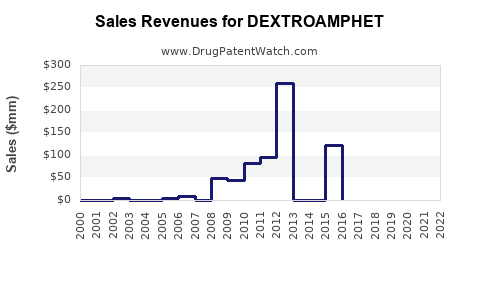

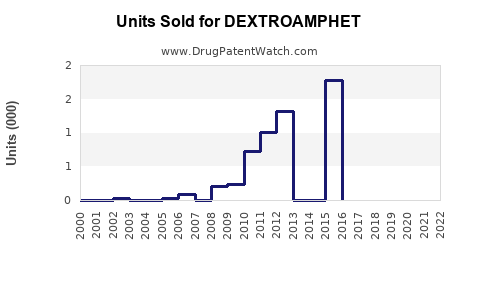

Annual Sales Revenues and Units Sold for DEXTROAMPHET

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DEXTROAMPHET | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DEXTROAMPHET | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DEXTROAMPHET | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| DEXTROAMPHET | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Dextroamphetamine

Introduction

Dextroamphetamines, commonly known by its generic name Dextroamphetamine, is a central nervous system stimulant primarily prescribed for attention deficit hyperactivity disorder (ADHD), narcolepsy, and certain cases of refractory depression. As a Schedule II controlled substance in the United States, its market dynamics are influenced by regulatory constraints, evolving prescribing practices, and competitive landscape shifts. This analysis offers a comprehensive overview of the current market landscape, future sales outlook, and strategic considerations for stakeholders interested in the Dextroamphetamine segment.

Market Overview

Current Market Size

The global ADHD medication market was valued at approximately USD 15 billion in 2022, with stimulants accounting for about 70% of total revenues [1]. Within this, Dextroamphetamine-based formulations—including immediate-release (IR) and extended-release (ER) products—play a significant role, especially in North America. North America dominates the market with an estimated share exceeding 60%, driven by high diagnosis rates, favorable prescribing practices, and extensive insurance coverage.

Prescription Trends

Data indicates that Dextroamphetamine prescriptions have increased annually at approximately 4-7%, reflecting broader recognition of ADHD diagnoses and utilization of pharmacotherapy. The American Psychiatric Association reports that nearly 10% of children aged 4-17 in the U.S. are diagnosed with ADHD, with a significant proportion receiving stimulant medications [2]. Adults with ADHD also constitute a growing segment, expanding market reach.

Competitive Landscape

Dextroamphetamine competes primarily with other stimulants like methylphenidate formulations (e.g., Ritalin, Concerta), mixed amphetamine salts (e.g., Adderall), and non-stimulant drugs such as atomoxetine and guanfacine. Key pharmaceutical players include:

- Shire/Takeda: Market leader with multiple Dextroamphetamine products.

- Eli Lilly: Produces similar stimulant formulations.

- Generic manufacturers: Contribute significantly to market volume, often at lower price points.

Patent expiry for several branded Dextroamphetamine products has facilitated increased generic penetration, intensifying price competition [[3]].

Regulatory and Legal Considerations

Dextroamphetamine’s classification as a Schedule II drug imposes strict prescribing and dispensing regulations. Emerging concerns regarding abuse potential and regulatory scrutiny may influence prescribing patterns and market access, especially amid rising reports of misuse and diversion.

Market Drivers and Challenges

Drivers

- Increasing ADHD diagnosis rates.

- Greater awareness and destigmatization of mental health conditions.

- Expansion of adult ADHD treatment.

- Development of novel formulations (e.g., longer-acting or abuse-deterrent tablets).

Challenges

- Stringent regulatory oversight and potential for abuse.

- Competition from non-stimulant therapies.

- Pricing pressures from generic manufacturers.

- Concerns surrounding long-term safety and side effects.

Sales Projections (2023-2030)

Assumptions

- Steady growth in ADHD diagnosis globally, with North America leading.

- Increased adoption of extended-release formulations to improve adherence.

- Growth in adult ADHD prescriptions surpassing pediatric segments.

- Regulatory stability; no significant restrictions introduced.

Forecasts

- 2023: The market for Dextroamphetamine is projected to reach approximately USD 2.8 billion driven by existing demand, with steady prescription volumes.

- 2025: Sales are expected to grow to about USD 3.4 billion, bolstered by increased adoption in adult populations and regulatory approvals for new formulations.

- 2030: Market growth could reach USD 4.5 billion, assuming continued diagnosis rates, expanded access, and global market penetration, notably in Europe and Asia.

These projections assume a compound annual growth rate (CAGR) of approximately 7%, reflecting the balance between rising demand and market saturation.

Regional Dynamics

North America

Dominates due to high diagnosis and treatment rates, with sales accounting for over 60% of global revenues. Reformulations and patent expiries could influence shifts toward generics and new delivery systems.

Europe

Expanding slowly, with increased diagnoses and broadening acceptance of stimulant therapies. Market growth is estimated at a CAGR of 4-5%.

Asia-Pacific

Emerging markets demonstrate increasing ADHD awareness and healthcare expenditure but face regulatory hurdles. Growth rates are modest but poised for acceleration, with projections reaching USD 800 million by 2030.

Strategic Implications

- Generic Competition: Companies should develop differentiated formulations (e.g., abuse-deterrent, long-acting) to protect market share.

- Regulatory Engagement: Proactive measures to address abuse concerns and comply with evolving laws are critical.

- Global Expansion: Investment in emerging markets offers significant upside, especially in regions with rising ADHD diagnosis.

- Innovation: Focused R&D on novel delivery systems can support premium pricing and adherence improvements.

Conclusion

The Dextroamphetamine market remains robust, driven by rising diagnosis rates and evolving treatment paradigms. While regulatory restrictions and competition from generics introduce challenges, strategic innovation and geographic expansion can foster sustained growth. Stakeholders should prioritize compliance, product differentiation, and market diversification to capitalize on projected sales trajectories.

Key Takeaways

- Market Potential: Anticipated to grow from USD 2.8 billion in 2023 to USD 4.5 billion by 2030 at a CAGR of 7%, driven by increased ADHD diagnoses and adult treatment adoption.

- Competitive Landscape: Dominated by generics; traditional brands must innovate to maintain a competitive edge.

- Regional Opportunities: North America remains the primary market; Asia-Pacific and Europe offer growth opportunities amid evolving healthcare practices.

- Regulatory Focus: Monitoring and adaptation to abuse-related regulations are essential to sustain market access.

- Innovation: Development of abuse-deterrent, long-acting formulations will be critical for future market positioning.

FAQs

1. What factors influence the pricing of Dextroamphetamine?

Pricing is affected by patent status, generic competition, formulation type, regulatory restrictions, and reimbursement landscape. Generic entries typically lead to price erosion, while innovative formulations command premium pricing.

2. How do regulatory restrictions impact sales projections?

Stringent regulations and abuse controls can limit prescriptions, thereby restricting sales growth. Conversely, regulatory approvals for novel formulations can expand market potential.

3. What demographic shifts are influencing market growth?

Rising adult ADHD diagnoses and increased awareness in pediatric populations are expanding the target market, influencing prescription volumes.

4. What role do non-stimulant therapies play in this market?

Non-stimulants like atomoxetine serve as alternatives for certain patients but generally account for a smaller market share compared to stimulants like Dextroamphetamine.

5. How might emerging markets affect future sales?

Growing healthcare infrastructure, increasing awareness, and expanding diagnosis capabilities in Asia and Latin America could significantly contribute to the global market size, especially post-2025.

Sources:

[1] Reports and market analyses from IQVIA and Grand View Research.

[2] American Psychiatric Association, ADHD diagnosis statistics.

[3] Public patent and regulatory filings, industry reports.

More… ↓