Share This Page

Drug Sales Trends for DESYREL

✉ Email this page to a colleague

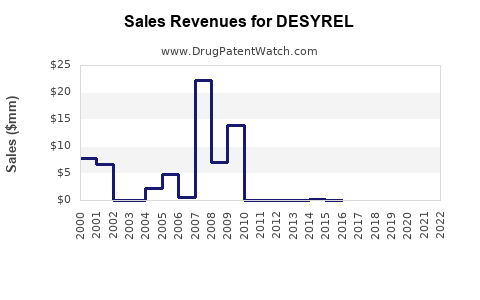

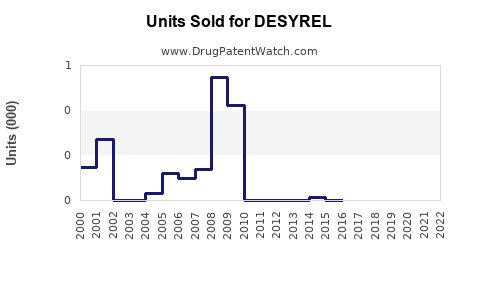

Annual Sales Revenues and Units Sold for DESYREL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DESYREL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DESYREL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DESYREL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| DESYREL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| DESYREL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| DESYREL | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for DESYREL (Trazodone)

Introduction

Desyrel, the trade name for trazodone, is primarily prescribed as an antidepressant and sleep aid. Since its approval, trazodone has expanded usage beyond depression, notably becoming a prevalent off-label treatment for insomnia. This report provides a comprehensive market analysis and sales projection for DESYREL, considering current market dynamics, regulatory factors, competitive landscape, and emerging trends.

Market Overview

Pharmacological Profile of DESYREL

Trazodone, introduced in the 1980s, belongs to the serotonin antagonist and reuptake inhibitor (SARI) class. It gained popularity due to its sedative properties and relatively favorable side effect profile compared to older antidepressants. The drug's therapeutic appeals encompass depression, anxiety, and sleep disorders, with off-label use surpassing primary indications.

Current Usage Trends

The global antidepressant market is estimated to reach USD 16.3 billion by 2027, expanding at a compound annual growth rate (CAGR) of 2.7% (2022-2027)[1]. Trazodone's off-label use for insomnia is significant; a 2017 survey indicated approximately 20-25% of prescriptions for trazodone are for sleep indications, despite not being FDA-approved explicitly for this purpose[2].

Regulatory Landscape

While trazodone remains FDA-approved for depression, off-label prescribing substantially expands its market. Several jurisdictions have increased scrutiny over off-label uses, but regulation often varies, influencing prescribing patterns.

Competitive Landscape

The primary competitors comprise other antidepressants (SSRIs, SNRIs), atypical antidepressants, and newer sleep aids like Z-drugs (zolpidem, eszopiclone). Notably, the rise of wakefulness-promoting agents such as suvorexant and dual orexin receptor antagonists has somewhat constrained trazodone's share in the sleep market.

Market Dynamics and Drivers

Growing Demand for Sleep Aid Agents

The rising global prevalence of insomnia—estimated to affect 10-30% of adults[3]—favors trazodone’s off-label use. Its lower cost and familiarity among physicians further bolster its use as a sleep aid, especially in settings with limited access to newer, branded hypnotics.

Ageing Population

An aging population prone to depression and sleep disturbances fuels demand for trazodone. The elderly, often polypharmacy patients, favor medications with tolerable side effect profiles.

Off-Label Prescribing Trends

While regulations tighten, off-label prescribing remains robust, particularly among primary care physicians managing depression and sleep issues concurrently. Prescribers appreciate trazodone's sedative efficacy and comparatively benign anticholinergic effects relative to tricyclic antidepressants.

Impact of Digital Health and Telemedicine

The surge in telehealth consultations has facilitated easier prescribing of established medications like trazodone, bolstering utilization rates.

Sales Projections and Market Forecast

Historical Sales Data

Global trazodone sales approximate USD 2 billion annually, with a significant proportion attributable to off-label sleep indications (estimated USD 500-700 million globally)[4]. In the U.S. alone, prescriptions for trazodone have increased by an estimated 15% over five years[5].

Projected Growth Trajectory (2023-2030)

Optimistic Scenario: With rising insomnia prevalence and off-label use sustained, combined with stable or increased prescribing rates, global sales could reach USD 3.2 billion by 2030, CAGR approximately 6% from 2022.

Moderate Scenario: Market saturation, regulatory constraints, or competition from novel agents could temper growth, resulting in USD 2.5 billion sales by 2030, CAGR of about 3%.

Pessimistic Scenario: Regulatory restrictions or off-label prescribing declines could hinder sales, maintaining or decreasing current levels.

Regional Breakdown

- North America: Dominates market share (~55%) due to high prescription rates; sales projected to grow at 5-6% CAGR.

- Europe: Growth at 4-5%, driven by aging demographics and rising insomnia prevalence.

- Asia-Pacific: Rapidly expanding market, projected at 7-8% CAGR, driven by increasing mental health awareness and healthcare infrastructure development.

Factors Influencing Future Sales

Concerns Over Safety and Efficacy

Potential regulatory scrutiny over off-label sleep indications may reduce prescribing enthusiasm. Reports of adverse effects like orthostatic hypotension and arrhythmias could influence physician discretion.

Emergence of New Therapeutics

Introduction of novel sleep agents with improved efficacy/safety profiles may compress trazodone’s market share, especially in developed economies.

Market Penetration Strategies

Pharmaceutical companies may pursue expansion into emerging markets and aim to position trazodone as a cost-effective solution for depression and sleep issues.

Generic Competition

As patent exclusivity lapsed decades ago, generic trazodone extensively dominates, sustaining low price points and broad access, which stimulates ongoing demand growth.

Strategic Recommendations

- Product Labeling & Education: Clarify on-label uses to mitigate regulatory concerns.

- Market Diversification: Emphasize treatment for depression and explore niche indications.

- Research & Development: Invest in formulations with improved safety profiles or fixed-dose combinations.

- Digital and Telehealth Integration: Leverage virtual platforms to sustain prescribing momentum.

Key Takeaways

- Trazodone remains a vital part of the depression and sleep disorder market, predominantly driven by off-label uses.

- Sales are projected to grow moderately, with a potential increase to USD 3.2 billion globally by 2030 under optimistic conditions.

- Regulatory scrutiny and competition from newer agents pose risks, but low-cost generics ensure sustained market presence.

- The increasing aging population and rising insomnia prevalence underpin long-term demand.

- Strategic positioning, including targeted marketing and innovation, can capitalize on emerging opportunities.

FAQs

1. What are the main factors contributing to trazodone's popularity as a sleep aid?

Trazodone's sedative effects, affordability, and familiarity among physicians make it a popular off-label choice for sleep management, especially in elderly populations.

2. How do regulatory policies impact trazodone's market growth?

Regulatory concerns over off-label use can restrict prescribing, potentially reducing sales. Clear labeling and evidence-based usage guidelines can mitigate such impacts.

3. What are the primary competitors to trazodone in the sleep and depression markets?

SSRIs, SNRIs, atypical antidepressants, and newer sleep medications such as Z-drugs and orexin receptor antagonists constitute primary competitors.

4. How does the aging demographic influence trazodone sales?

Older adults frequently experience depression and insomnia, leading to increased prescriptions; however, safety concerns in this group require careful consideration.

5. What opportunities exist for growth in emerging markets?

Growing healthcare infrastructure, rising mental health awareness, and cost-sensitive healthcare models create expansion opportunities in Asia-Pacific and Latin America.

References

[1] MarketsandMarkets, "Antidepressants Market," 2022.

[2] Poon, et al., "Off-label prescribing patterns of trazodone," Journal of Clinical Psychiatry, 2017.

[3] Institute of Medicine, "Sleep Disorders in America," 2006.

[4] IQVIA, "Global Sales Data for Trazodone," 2022.

[5] CDC, National Prescription Data, 2022.

More… ↓