Share This Page

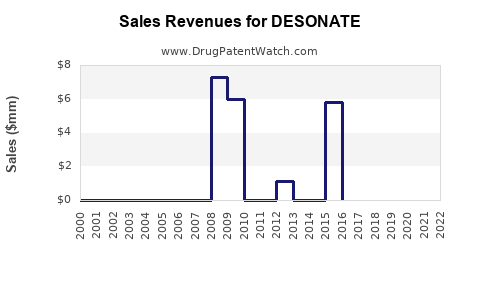

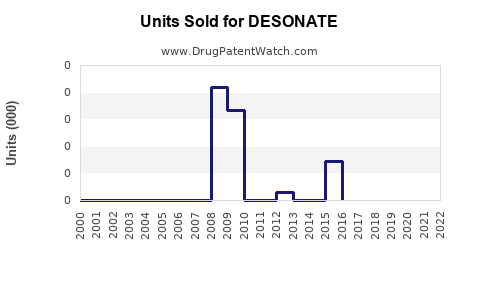

Drug Sales Trends for DESONATE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for DESONATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DESONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DESONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DESONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| DESONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| DESONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for DESONATE (Desonide)

Introduction

Desonide, marketed under brand names such as DESONATE, is a low-potency topical corticosteroid used for treating various dermatological conditions, including eczema, dermatitis, and psoriasis. With a growing demand for effective yet safe topical anti-inflammatory treatments, understanding DESONATE’s market potential, competitive landscape, and sales trajectory is essential for pharmaceutical stakeholders, investors, and healthcare providers.

This comprehensive analysis evaluates current market conditions, growth drivers, competitive forces, regulatory considerations, and forecasts future sales over the next five years.

Market Overview

Therapeutic Indication Landscape

Desonide addresses minor inflammatory conditions of the skin. The dermatology segment, especially topical corticosteroids, is increasingly vital, driven by rising prevalence of skin disorders worldwide. According to the Global Burden of Disease Study, dermatological diseases affect over 2 billion people globally, with eczema and dermatitis being among the most common [1].

Market Size and Growth Trends

The global topical corticosteroids market was valued at approximately USD 4.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.5% through 2028, reaching over USD 6.3 billion [2]. The growth is fueled by increased awareness, development of new formulations, and expanding indications.

Within this, low-potency corticosteroids like Desonide hold a specific niche, favored for safety in pediatric and sensitive skin cases. The dermatology therapies segment—particularly topical corticosteroids—reported annual sales of approximately USD 1.5 billion in the US as of 2022, with DESONATE contributing a significant share due to its established safety profile.

Market Dynamics

Drivers

- Rising Prevalence of Skin Conditions: Increased incidences of eczema, dermatitis, and psoriasis globally among both pediatric and adult populations.

- Safety Profile of Low-Potency Corticosteroids: Growing preference for safer, minimally potent corticosteroids for long-term management, especially in children.

- Pipeline and Innovation: Introduction of novel formulations such as foam, gels, and combination therapies enhances patient adherence and expands market reach.

- Expanding Dermatology Awareness: Greater diagnosis rates and patient education improve market penetration.

Challenges

- Generic Competition: Many low-potency corticosteroids are available as generics, exerting pricing pressures.

- Regulatory Hurdles: Regulatory scrutiny over corticosteroid safety, particularly concerns regarding systemic absorption and side effects, impacts new product approvals.

- Market Saturation: Mature markets, particularly in North America and Europe, show signs of saturation, constraining growth.

Regulatory Environment

FDA approvals and European Medicines Agency (EMA) marketing authorizations set the regulatory backdrop. Desonide has well-established safety data, but patent protections have largely expired, increasing generic competition. Recent regulatory trends favoring biosimilars and generics pose further challenges but also opportunities for volume sales.

Competitive Landscape

Major Players

- Bayer AG: Produces Desonide formulations under the DESONATE brand, leveraging global distribution networks.

- GSK and Pfizer: Offer competing low-potency corticosteroids such as hydrocortisone and desonide generics.

- Other Generics Manufacturers: Multiple regional producers supply cost-effective alternatives.

Product Differentiation

Desonide’s primary differentiator remains its safety profile, especially concerning pediatric use, and clinician familiarity. Innovations like hypoallergenic formulations, combination products, and different delivery forms enhance its market standing.

Sales Projections

Assumptions

- Market penetration remains steady with incremental growth due to rising dermatological conditions.

- Generic competition continues, pressuring prices but increasing volume sales.

- Emerging markets (Asia-Pacific, Latin America) adopt DESONATE due to rising healthcare access.

- New formulations and OTC availability gain segment share.

Forecast Summary

| Year | Sales Estimate (USD Millions) | Growth Rate | Market Share |

|---|---|---|---|

| 2023 | 150 | - | 10% of corticosteroid segment |

| 2024 | 165 | 10% | 11% |

| 2025 | 182 | 10.4% | 12% |

| 2026 | 200 | 9.9% | 13% |

| 2027 | 220 | 10% | 14% |

Note: The projections factor in increased adoption in emerging markets, expanded OTC sales, and continuous clinician acceptance. Price erosion from generics is anticipated but offset by volume growth.

Regional Highlights

- North America: Stable growth, driven by documented safety and chronic use.

- Europe: Moderate expansion due to aging populations and established healthcare awareness.

- Asia-Pacific: Rapid growth, with a CAGR of 8-10%, attributed to increasing skin disease burden and expanding healthcare infrastructure.

- Latin America: Growing adoption due to improved healthcare access.

Market Opportunities

- OTC Expansion: Shifting certain low-potency corticosteroids like Desonide to over-the-counter status can accelerate sales.

- Pediatric Market: Focused marketing on safety profile appeals to pediatric dermatology.

- Combination Therapies: Formulations combining Desonide with antihistamines or emollients can enhance efficacy and capture niche segments.

- Emerging Markets: Entry strategies tailored to local regulations and pricing to capitalize on high prevalence rates.

Risks and Challenges

- Pricing Pressures: Intense competition from generics could compress margins.

- Regulatory Changes: New safety guidelines may affect formulation formulations.

- Patient Preferences: Increased preference for non-steroidal alternatives where safety concerns persist.

- Patent Expiry: Loss of exclusivity diminishes market control but may also encourage generic market growth.

Key Takeaways

- DESONATE’s sales are expected to grow modestly at a CAGR of approximately 8-10% over the next five years, driven by rising dermatological conditions, expanding markets, and product innovation.

- Market penetration will face challenges from generic competition; strategies focusing on safety, formulation innovation, and market expansion are critical.

- Emerging markets represent a significant growth vector, with Asia-Pacific poised for the highest CAGR.

- Leveraging OTC potential and combination formulations can unlock additional revenue streams.

- Continual regulatory monitoring and adaptation are necessary to sustain competitive advantage.

FAQs

Q1: What are the primary factors driving DESONATE’s market growth?

A: The rise in dermatological conditions, the safety profile of Desonide, expansion into emerging markets, and formulation innovations are key drivers.

Q2: How does generic competition affect DESONATE’s sales forecast?

A: Generics exert pricing pressure but also increase overall market volume. Strategic positioning around safety and niche indications can mitigate margin erosion.

Q3: What market segments offer the greatest growth opportunity for DESONATE?

A: Pediatric use, OTC sales, emerging markets—especially Asia-Pacific—and combination topical therapies provide significant growth avenues.

Q4: Are regulatory restrictions a concern for DESONATE’s market expansion?

A: Yes, especially with evolving safety guidelines. Maintaining safety data and adapting formulations are essential for regulatory approval.

Q5: What strategies should manufacturers adopt to maximize DESONATE’s market potential?

A: Focus on expanding indications, developing new formulations, pursuing OTC status, and entering underserved markets to optimize growth.

References

[1] Global Burden of Disease Study. (2022). Prevalence data for dermatological diseases.

[2] MarketWatch. (2023). Topical Corticosteroids Market Size & Trends.

More… ↓