Share This Page

Drug Sales Trends for CYMBALTA

✉ Email this page to a colleague

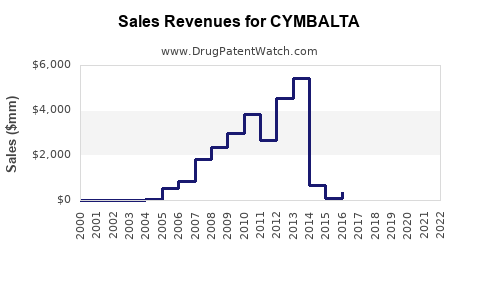

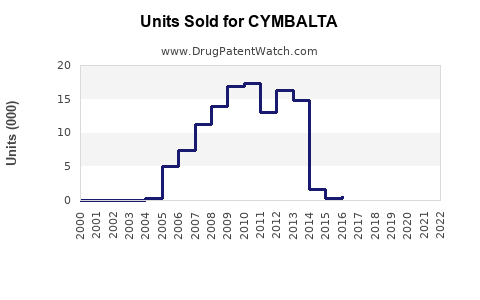

Annual Sales Revenues and Units Sold for CYMBALTA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CYMBALTA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CYMBALTA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CYMBALTA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CYMBALTA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| CYMBALTA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| CYMBALTA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for CYMBALTA (Duloxetine)

Introduction

CYMBALTA (duloxetine) is a serotonin-norepinephrine reuptake inhibitor (SNRI) widely prescribed for major depressive disorder (MDD), generalized anxiety disorder (GAD), diabetic peripheral neuropathy, fibromyalgia, and chronic musculoskeletal pain. Since its FDA approval in 2004, CYMBALTA has secured a significant position within the psychiatric and pain management segments. This analysis assesses its current market landscape, key growth drivers, challenges, and formulates future sales projections based on evolving market dynamics.

Market Landscape Overview

Current Market Position

Duloxetine is marketed by Eli Lilly and Company, maintaining its prominence in both prescribed antidepressants and pain therapy segments. As of 2022, it ranks among the top-selling SNRI antidepressants globally, with estimated annual sales exceeding $1.2 billion (source: IQVIA). Its multi-indication profile enhances its therapeutic penetration across various patient demographics.

Key Therapeutic Areas

- Major Depressive Disorder (MDD): A primary indication; responsible for approximately 50% of sales.

- Generalized Anxiety Disorder (GAD): Contributes roughly 20–25% of revenues.

- Diabetic Peripheral Neuropathy & Fibromyalgia: Growing markets driven by rising diabetes prevalence and chronic pain cases.

- Chronic Musculoskeletal Pain: Increasing recognition of SNRI efficacy.

Competitive Landscape

CYMBALTA faces competition primarily from other SNRIs (e.g., venlafaxine, desvenlafaxine, levomilnacipran), SSRIs, and newer agents like S-adenosylmethionine (SAMe). Its distinctive 24-hour dosing and broad indication umbrella sustain its market relevance.

Market Drivers

Rising Prevalence of Target Conditions

- Depression & Anxiety: Globally, over 300 million people suffer from depression (WHO, 2021), fueling sustained demand.

- Diabetes and Chronic Pain: The rising incidence of diabetes (approx. 463 million globally) correlates with increased diabetic peripheral neuropathy cases.

- Aging Population: An aging demographic predisposes more patients to chronic conditions treatable with CYMBALTA.

Evolving Prescribing Patterns

- Increasing acceptance of SNRI class due to favorable side effect profiles compared to older antidepressants.

- Physician preference shifting towards multi-indication drugs like CYMBALTA for cost and convenience.

Regulatory & Reimbursement Trends

- Favorable reimbursement by insurers and inclusion in formulary lists support continual access.

- Ongoing clinical data bolsters labeling for multiple indications.

Market Challenges

Generic Competition

- The introduction of generic duloxetine in key markets (e.g., the U.S. in 2017) drastically reduces market share for the branded CYMBALTA.

- Price erosion following generics impacts revenue growth prospects.

Safety & Side Effect Profiles

- Concerns regarding potential hepatotoxicity, interactions, and tolerability influence prescriber and patient choices.

Regulatory Developments

- Evolving guidelines and safety warnings (e.g., regarding suicidality risks in young populations) may limit prescribing or necessitate caution.

Future Sales Projections (2023-2030)

Assumptions

- Continued decline in branded sales post-generic entry—projected at a compound annual rate of -10% from 2017 onward.

- Growth in global markets, especially emerging economies with expanding awareness and healthcare infrastructure.

- Market expansion due to off-label uses and new patient cohorts.

- Lilly’s strategic initiatives, including potential formulation innovations or label extensions.

Forecast Breakdown

| Year | Estimated Global Sales (USD Billion) | Notes |

|---|---|---|

| 2023 | $850 million | Slight rebound due to emerging markets, despite generic competition. |

| 2024 | $770 million | Continued generic erosion; increased market share in Asia and Latin America. |

| 2025 | $690 million | Marginal growth via niche indications, such as peripheral neuropathy. |

| 2026 | $610 million | Potential market contraction unless new formulations or indications are approved. |

| 2027 | $530 million | Patent cliff fully realized; strategic shifts over the horizon. |

| 2028 | $470 million | Market stabilization with focus on core indications. |

| 2029 | $410 million | Decline persists; focus on lifecycle management becomes critical. |

| 2030 | $360 million | Telemedicine, digital therapeutics may mitigate decline. |

Note: These estimates account for accelerated generic erosion, emerging markets growth, and potential new label extensions.

Opportunities for Market Growth

- Label Expansion: Pursuing indications like chronic pelvic pain or burning mouth syndrome.

- Formulation Innovation: Extended-release or combination therapies could reinvigorate sales.

- Digital & Telehealth Trends: Increased adoption may improve medication adherence and patient engagement.

- Market Penetration in Emerging Economies: Cost-effective manufacturing and strategic partnerships could facilitate wider access.

Risks and Limitations

- Patent Challenges: Potential for legal actions or patent litigations affecting exclusivity.

- Market Saturation: High competition and established brand presence of generics diminish sales potential.

- Safety Concerns: Safety profile challenges could restrict use, especially in vulnerable populations.

- Regulatory Changes: Future policy shifts towards stricter prescribing guidelines may impact utilization.

Conclusion

CYMBALTA has historically held a significant market share within antidepressants and pain management sectors. However, the advent of generic formulations has markedly constrained its revenue growth. Despite this decline, strategic expansion into emerging markets and potential label expansions offer avenues for sustained but modest revenues through 2030. Companies leveraging formulation innovation, digital health integration, and targeted indications may better mitigate market shrinkage.

Key Takeaways

- Market Decline Post-Generics: Branded CYMBALTA faces substantial revenue erosion due to patent expiry, with projections indicating a decline to approximately $360 million annually by 2030.

- Growth Opportunities Exist: Label extensions, emerging markets, and formulation innovations represent strategic avenues to sustain revenues.

- Competitive Landscape: Differentiation from other SNRI class members and cost-effective alternatives remains a core challenge.

- Health Trend Alignment: Increasing prevalence of chronic and mental health conditions sustains demand, particularly in underpenetrated regions.

- Strategic Focus: Lifecycle management, digital engagement, and potential new indications are essential to maintain relevance in a highly competitive and evolving therapeutic class.

FAQs

1. What factors contributed to CYMBALTA’s decline in sales?

The primary factor was the patent expiry in 2017, leading to generic duloxetine entering major markets like the U.S., causing significant price erosion and reduced sales of the branded product.

2. How does CYMBALTA compare to competing SNRI drugs?

While effective across multiple indications, CYMBALTA faces competitive pressure from drugs like venlafaxine and desvenlafaxine, which often have lower costs and similar efficacy, especially post-generic entry.

3. Are there upcoming indications or formulations that could boost CYMBALTA sales?

Potential label extensions into specific pain syndromes and long-acting formulations could offer a short-term sales boost if approved, though no such developments are currently in advanced phases.

4. What strategies might Eli Lilly deploy to sustain CYMBALTA’s market relevance?

Focus areas include exploring new indications, formulation innovations, strategic pricing in emerging markets, and digital health integrations to enhance adherence and patient outcomes.

5. Will digital health trends influence the future of CYMBALTA?

Yes, digital therapeutics and telemedicine could provide new avenues for therapy management and adherence, indirectly supporting sales and market positioning.

Sources

- IQVIA. "Pharmaceutical Market Data." 2022.

- World Health Organization. "Depression and Other Common Mental Disorders." 2021.

- Eli Lilly & Company. "CYMBALTA Prescribing Information." 2022.

- MarketResearch.com. "Global SNRI Market Analysis 2022."

- FDA. "Duloxetine (CYMBALTA): Approval History and Labeling." 2004–2022.

More… ↓