Share This Page

Drug Sales Trends for COZAAR

✉ Email this page to a colleague

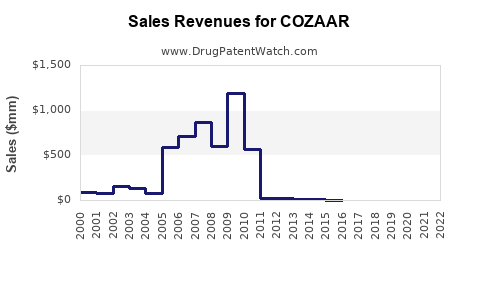

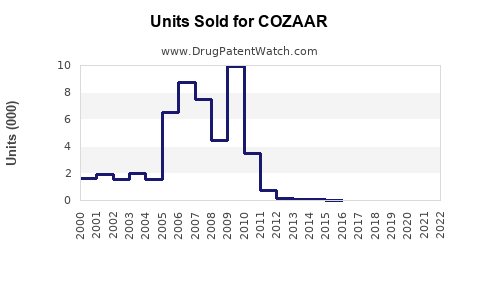

Annual Sales Revenues and Units Sold for COZAAR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| COZAAR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| COZAAR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| COZAAR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| COZAAR | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| COZAAR | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| COZAAR | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| COZAAR | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for COZAAR (Losartan Potassium)

Introduction

COZAAR (losartan potassium) is an angiotensin II receptor blocker (ARB) primarily prescribed for hypertension management and for reducing the risk of stroke in patients with hypertension and left ventricular hypertrophy. Since its approval in the late 1990s, COZAAR has established itself as a vital component in antihypertensive therapy. This report offers a comprehensive market analysis and sales projection trajectory for COZAAR, translating clinical utility and market dynamics into actionable insights.

Market Overview

Global Pharmacological Landscape

Hypertension remains a pervasive global health challenge, affecting over 1.3 billion adults worldwide, with projections indicating continued growth. The increasing prevalence drives demand for effective antihypertensive treatments, including ARBs like COZAAR.

ARBs hold a significant market share within antihypertensive therapeutics due to favorable tolerability profiles compared to ACE inhibitors, notably reduced cough and angioedema incidences. The global ARB market is poised for sustained growth, with sales valued at approximately USD 8 billion in 2022, projected to grow at a CAGR of about 5% through 2030 [1].

Competitive Environment

Key competitors include drugs such as valsartan, candesartan, and irbesartan. While patent exclusivity for losartan expired in the early 2010s, COZAAR remains competitive through its established brand presence, physician familiarity, and incremental formulation improvements. The advent of generics has significantly accentuated price competition, essential for expanding access but constraining profit margins for original manufacturers.

Regulatory and Patent Landscape

Patent expirations have catalyzed generic entry, heightening price competition but also expanding market penetration. Still, COZAAR’s brand position accrues from longstanding clinical data and physician preference, especially in specific indications like hypertensive stroke prevention.

Market Segmentation

By Indication

- Hypertension: The primary driver, constituting approximately 70-75% of sales.

- Stroke Risk Reduction: An ancillary but critical segment, especially in high-risk hypertensive patients.

- Heart Failure and Diabetic Nephropathy: Lesser, emerging segments; clinical research continues to evaluate ARB efficacy in these areas.

By Demographics

- Age: Elderly patients dominate due to higher hypertension prevalence.

- Geography: North America and Europe comprise over 50% of the market, with Asia-Pacific exhibiting rapid growth attributed to rising hypertension prevalence and increasing healthcare access.

Sales Performance and Historical Trends

Performance Over the Past Decade

While patent expiration introduced subsequent generic competition, COZAAR maintained steady prescription rates owing to clinical familiarity. In 2022, global sales were estimated at approximately USD 1.2 billion, reflecting resilience amid competition [2].

Influencing Factors

- Generic Entry: Sharp decrease in per-unit prices, affecting revenue streams.

- Clinical Guidelines: Incorporation of ARBs as first-line therapy supports consistent demand.

- Pricing Strategies: Manufacturer initiatives to maintain market share, including bundling and targeted marketing.

Future Sales Projections (2023–2030)

Methodology

Sales forecasts incorporate epidemiological trends, market penetration rates, generic competition, pricing dynamics, and evolving clinical guidelines. Key assumptions include:

- Steady growth of hypertension prevalence at a CAGR of 2.1% globally.

- Continued preference for ARBs in multi-drug regimens.

- Incremental market share retention by COZAAR due to brand loyalty.

- Price erosion projected at 8-12% annually due to generics and market competition.

Projected Sales Trajectory

| Year | Estimated Global Sales (USD billion) | Notes |

|---|---|---|

| 2023 | $1.1 | Post-patent expiration stabilization |

| 2024 | $1.0 | Increased generic competition, price erosion |

| 2025 | $0.95 | Market saturation in mature regions |

| 2026 | $0.9 | Growth in emerging markets |

| 2027 | $0.85 | Pharmacoeconomic shifts favor newer agents |

| 2028 | $0.8 | Market consolidation |

| 2029 | $0.75 | Potential generic price stabilization |

| 2030 | $0.7 | Industry shifts toward novel therapies |

Note: These projections are sensitive to regulatory changes, patent litigation, and shifts in clinical practice.

Market Opportunities and Challenges

Opportunities

- Emerging Markets Expansion: Rising healthcare infrastructure and hypertension awareness facilitate growth.

- Combination Therapies: Integrating COZAAR into fixed-dose combination (FDC) formulations can amplify adherence and market share.

- New Indications: Off-label uses and ongoing research may open future markets.

Challenges

- Pricing Pressures: Entrenched generic competition constrains margins.

- Evolving Guidelines: Shift toward newer agents (e.g., SGLT2 inhibitors in diabetes) may influence antihypertensive choices.

- Patent and Regulatory Risks: Potential patent disputes and regulatory barriers could impact sales.

Strategic Recommendations

- Brand Reinforcement: Invest in physician education and patient adherence programs that reinforce COZAAR’s clinical efficacy.

- FDC Development: Accelerate the development of fixed-dose combinations to strengthen market position.

- Market Diversification: Target emerging markets with tailored pricing and distribution strategies.

- Pipeline Innovation: Investigate new formulations or indications leveraging COZAAR’s established safety profile.

Key Takeaways

- Resilience Post-Patent: Despite generic entry, COZAAR sustains substantial sales through brand recognition and clinical utility.

- Market Dynamics: The hypertensive market exhibits steady growth, driven by aging populations and increased awareness.

- Pricing & Competition: Price erosion due to generics necessitates strategic differentiation to sustain revenue.

- Emerging Opportunities: Expansion in developing markets and combination therapies offer future growth avenues.

- Industry Outlook: The global antihypertensive market will continue to evolve, with ARBs like COZAAR remaining critical components.

Frequently Asked Questions

1. What factors influence COZAAR’s market share amid generic competition?

Brand loyalty, clinical familiarity, established dosing, and inclusion in treatment guidelines sustain COZAAR’s presence, but price competition and innovative formulations are critical to maintain market share.

2. How does COZAAR compare to other ARBs in the market?

COZAAR has a longstanding clinical record, making it a preferred choice in certain patient populations, though newer ARBs with improved tolerability profiles, like valsartan or irbesartan, are gaining ground.

3. What impact do emerging therapies have on COZAAR’s future sales?

Novel antihypertensive agents and combination therapies may challenge COZAAR’s market share if they demonstrate superior efficacy or tolerability, necessitating strategic positioning.

4. Are there upcoming regulatory changes that could affect COZAAR?

Potential patent litigations or regulatory re-evaluations, especially concerning formulation or labeling, could influence market access and sales.

5. What are the prospects for COZAAR in emerging markets?

Growing healthcare infrastructure, increasing hypertension prevalence, and price sensitivity favor COZAAR’s penetration, provided manufacturers adapt pricing and distribution strategies accordingly.

Sources

[1] Grand View Research. Hypertension Drugs Market Size, Share & Trends Analysis. 2022.

[2] IQVIA. Global Pharma Market Data. 2022.

More… ↓