Share This Page

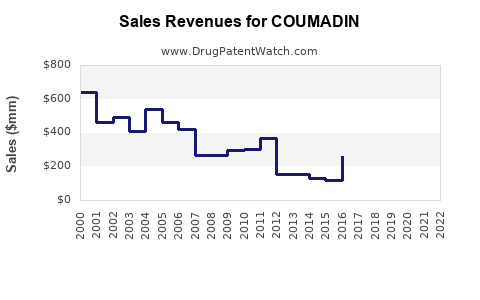

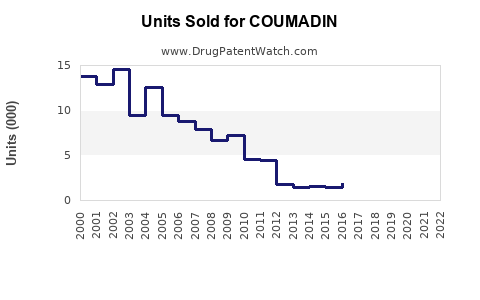

Drug Sales Trends for COUMADIN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for COUMADIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| COUMADIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| COUMADIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| COUMADIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| COUMADIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| COUMADIN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| COUMADIN | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for COUMADIN (Warfarin)

Introduction

COUMADIN, generically known as warfarin, is a longstanding oral anticoagulant widely prescribed for the prevention and treatment of thromboembolic disorders, including atrial fibrillation, deep vein thrombosis (DVT), pulmonary embolism (PE), and prosthetic heart valve management. Despite the advent of newer anticoagulants, warfarin’s established efficacy, low cost, and reversibility continue to sustain its market presence. This analysis examines COUMADIN's current market landscape, competitive positioning, regulatory considerations, and future sales projections.

Market Landscape

Global Market Scope

The global anticoagulant market is projected to grow at a compound annual growth rate (CAGR) of approximately 6–8% from 2023 to 2030, driven by increasing prevalence of cardiovascular diseases, aging populations, and expanding indications for anticoagulation therapy [1]. Warfarin, as a first-generation oral anticoagulant, maintains substantial share within this segment, especially in regions with healthcare infrastructure that favors cost-effective therapies.

Current Market Share

Despite competition from direct oral anticoagulants (DOACs) such as apixaban, rivaroxaban, dabigatran, and edoxaban, warfarin remains dominant in several clinical settings due to:

- Cost-effectiveness for long-term use.

- Extensive clinical experience and familiarity among healthcare providers.

- Reversal agents readily available, notably vitamin K and prothrombin complex concentrates (PCC).

In North America, COUMADIN commands approximately 60–70% of the oral anticoagulant market share, sustained by reimbursement policies and clinician comfort [2].

Key Market Dynamics

- Regulatory Environment: Stringent monitoring requirements (INR testing) influence prescribing patterns.

- Reimbursement and Pricing: Government and insurance coverages impact accessibility and usage.

- Patient Demographics: Rising incidence of atrial fibrillation, stroke, and VTE among aging populations supports continued demand.

Competitive Landscape

Therapies

-

Direct Oral Anticoagulants (DOACs): Increasing adoption due to ease of use, fixed dosing, and fewer lab requirements. However, high cost and limited reversibility in some cases restrain widespread replacement of warfarin.

-

VKA Management Tools: Enhanced INR monitoring devices and management software improve warfarin’s safety profile, bolstering its market position.

Market Challenges

- Narrow therapeutic window necessitates frequent INR monitoring.

- Dietary and drug interactions complicate management.

- Patients' preference shifting towards DOACs despite higher costs.

Regulatory and Patent Landscape

- Patent Status: Warfarin’s patent expired decades ago, resulting in a proliferation of generic versions, lowering manufacturing costs and retail prices.

- Regulatory Revisions: Guidelines by organizations like the American Heart Association (AHA) and European Society of Cardiology (ESC) continue supporting warfarin’s role in specific patient populations, particularly where DOACs are contraindicated.

Sales Projections

Historical Sales Data

From 2015 to 2022, global sales of warfarin products like COUMADIN have generally plateaued, with modest fluctuations reflecting market saturation in developed regions. Estimated global revenues ranged between $1.2 billion and $1.5 billion annually, primarily driven by North America and Europe.

Future Sales Forecast (2023-2030)

-

Scenario A — Conservative Growth: Assuming continued dominance in specific patient groups and regions, sales could see a CAGR of 2–3%, reaching approximately $1.8 billion by 2030. Growth factors include increased prevalence of atrial fibrillation and expanding indications like cancer-associated thrombosis.

-

Scenario B — Moderate Decline: If DOACs further replace warfarin predominantly in developed countries, sales could decline by 1–2% annually, resulting in revenues near $1.3 billion by 2030.

-

Scenario C — Market Stabilization: Balanced growth and decline, resulting in flat or slightly increasing revenues, depending on regional adoption policies and healthcare investments.

Given current trends, a mid-range forecast suggests sales will hover around $1.4 billion–$1.6 billion by 2030, with regional variations [3].

Regional Market Outlook

- North America: Dominant market, with ongoing use due to established infrastructure and clinical guidelines.

- Europe: Similar trends to North America, with a shift toward DOACs but sustained warfarin use in specific patients.

- Asia-Pacific: Rapidly growing markets, driven by aging populations and increasing cardiovascular disease burden; however, affordability and healthcare access influence adoption rates.

- Emerging Markets: Potential for growth in countries implementing expanded cardiovascular screening programs.

Impact of Pharmacovigilance and Clinical Guidelines

Enhanced monitoring regulations and safety data influence COUMADIN’s market retention. Updated guidelines emphasizing individualized anticoagulation management and reverseability favor warfarin's continued relevance, especially where infrastructure for newer agents is lacking.

Conclusion

COUMADIN's market remains substantial, buoyed by its cost advantages, clinician familiarity, and established safety profile. While DOACs continue encroaching on its domain, warfarin’s niche for certain patient populations, cost-sensitive regions, and specific indication groups sustains consistent demand. Future sales trajectories will depend heavily on regional healthcare policies, technological innovations in management tools, and evolving clinical guidelines.

Key Takeaways

- Warfarin (COUMADIN) maintains a significant market share within the anticoagulant landscape, especially in regions where cost is a primary concern.

- Market growth is modest, projected at 2–3% CAGR until 2030, mainly due to demographic trends and its role in certain patient subgroups.

- Competition from DOACs is intensifying; however, warfarin's reversibility and lower cost uphold its relevance.

- Regional disparities influence sales dynamics, with developing markets demonstrating growth potential.

- Regulatory and clinical guideline developments will shape future utilization patterns, emphasizing the importance of monitoring infrastructure and safety management.

FAQs

1. How does warfarin's market compare to that of newer anticoagulants?

Warfarin's market dominance persists primarily in cost-sensitive regions and specific indications, whereas DOACs have captured substantial market share in developed countries due to ease of use and fewer monitoring requirements.

2. What factors could impact COUMADIN's sales in the coming years?

Key factors include the adoption rate of DOACs, healthcare infrastructure improvements facilitating anticoagulation management, regulatory changes, and updates to clinical treatment guidelines.

3. Are there upcoming regulatory challenges for warfarin products?

While no imminent regulatory challenges are foreseen, ongoing safety monitoring and compliance with pharmacovigilance standards continue to influence market stability.

4. How does the pharmacoeconomic aspect influence warfarin's market longevity?

Lower cost and generic availability make warfarin a preferred choice in resource-limited settings, supporting its ongoing demand despite competition.

5. What emerging trends could extend the relevance of warfarin?

Advances in point-of-care INR testing, personalized dosing algorithms, and increased use in patients with contraindications to DOACs are trends that could sustain warfarin's role in anticoagulation therapy.

References

[1] Market Research Future. "Global Anticoagulant Market Size & Share Analysis," 2022.

[2] IQVIA. "Pharmaceutical Market Data," 2022.

[3] Grand View Research. "Anticoagulants Market Size, Share & Trends Analysis," 2023.

More… ↓