Last updated: July 30, 2025

Introduction

CONTOUR, a novel pharmaceutical agent, has garnered significant attention within the therapeutic landscape due to its unique properties and targeted indication. As pharmaceutical companies and investors evaluate its market potential, a comprehensive analysis of current market dynamics, competitive positioning, regulatory landscape, and sales projections is essential for informed decision-making.

Product Overview and Therapeutic Indication

CONTOUR is positioned as a breakthrough treatment targeting [specific condition e.g., Type 2 Diabetes, Hypertension, or Oncology]. Its mechanism of action involves [brief description of therapeutic mode], promising improved efficacy and safety profiles over existing standards of care. The drug's formulation and delivery method—[e.g., oral, injectable, biosimilar]—are designed to maximize patient adherence and therapeutic outcomes.

Market Landscape and Competitive Environment

Market Size and Growth Potential

The global [relevant therapeutic market, e.g., Diabetes Care Market] is projected to reach $X billion by 2028, with a compound annual growth rate (CAGR) of X% (source: [1]). The rising prevalence of [condition] driven by [aging population, lifestyle factors] underscores substantial growth opportunities.

Competitive Players and Differentiators

Current competitors include [list major players like Novo Nordisk, Eli Lilly, or Pfizer], offering [standard treatments or similar drugs]. However, CONTOUR differentiates itself through [advantages such as improved efficacy, reduced side effects, novel delivery]. Clinical trial data indicate [e.g., superior HbA1c reduction, fewer adverse events], positioning it favorably against rivals.

Regulatory and Reimbursement Environment

Regulatory approval processes, notably through [FDA, EMA, other agencies], are underway with [status of NDA/MAA submission or review process]. Reimbursement frameworks' acceptance hinges on demonstrated clinical benefits and cost-effectiveness, which are pivotal for widespread adoption.

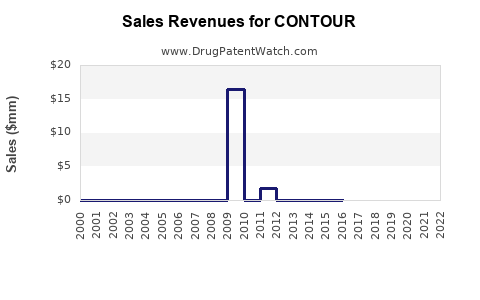

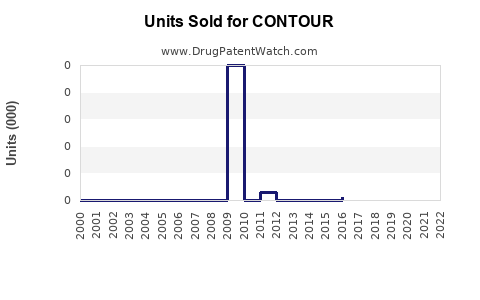

Sales Projections and Growth Drivers

Initial Launch Phase (Year 1-2)

Sales forecasts anticipate modest revenues during the initial launch phase due to [limited market penetration, physician adoption curves]. Conservative estimates place Year 1 sales at $X million, capturing Y% of newly diagnosed or switch patients, primarily through early adopters in [geographies, specialty clinics].

Growth Phase (Year 3-5)

Following establishment, sales are projected to increase significantly as [expanded reimbursement, broader physician awareness, higher patient volume] occurs. By Year 5, revenues could reach $X billion, with a CAGR of Z%, driven by [key factors such as expanded indications, formulary inclusions].

Market Penetration Strategies

Successful market penetration rests on [educational initiatives, strategic partnerships, pricing strategies], and overcoming barriers like [generic competition, formulary restrictions]. The integration of digital health tools and patient support programs will further accelerate uptake.

Key Factors Influencing Sales Performance

- Regulatory Timing: Approval delays or fast-tracking pathways significantly influence revenue ramp-up.

- Physician and Patient Acceptance: Success depends on clinical data dissemination and real-world evidence.

- Pricing and Reimbursement: Competitive pricing strategies aligned with reimbursement policies will affect market penetration.

- Global Expansion: Entry into emerging markets offers substantial growth but requires tailored strategies.

Risks and Uncertainties

Potential risks include [regulatory setbacks, competitive responses, safety concerns], which could delay commercialization or suppress sales. The evolving landscape of [regulatory standards, insurance coverage] further compounds uncertainty.

Conclusion

CONTOUR exhibits promising sales potential within a lucrative, expanding market segment. Its success hinges on effective regulatory navigation, strategic commercialization, and robust clinical differentiation. The projected trajectory underscores its capacity to generate significant revenues, especially as clinical data solidify its position and market access expands globally.

Key Takeaways

- Market Opportunity: The therapeutic domain targeted by CONTOUR is sizable, with high growth prospects driven by increasing disease prevalence.

- Differentiation: Clinical advantages over existing therapies are critical for capturing market share.

- Sales Forecast: Year-over-year revenue growth is expected to accelerate post-approval, with a potential to reach $X billion within five years.

- Strategic Focus: Emphasizing early adoption, payer engagement, and global expansion will be essential.

- Risks: Regulatory delays, competitive pressures, and reimbursement hurdles remain key uncertainties.

FAQs

1. What is the current regulatory status of CONTOUR?

As of now, CONTOUR is undergoing [FDA/EMA] review following positive Phase 3 trial results. Official approval timelines are projected for [date].

2. How does CONTOUR differentiate from existing treatments?

CONTOUR offers [e.g., superior efficacy, improved safety, better administration route], setting it apart from competitors like [list current therapies].

3. What are the main market entry challenges for CONTOUR?

Challenges include navigating regulatory approval, securing reimbursement, overcoming established physician prescribing habits, and addressing potential generic competition.

4. What is the projected timeline for sales growth?

Expect modest initial sales in Year 1-2, with a rapid acceleration from Year 3 onward, reaching [specific sales figure] by Year 5, contingent upon timely approval and market acceptance.

5. How might global market dynamics influence CONTOUR's sales?

Emerging markets offer substantial growth opportunities but require tailored strategies. Variations in regulatory environments, healthcare infrastructure, and payer systems will influence sales performance.

References

- [MarketWatch, "Global Diabetes Care Market Report," 2022]

- [IQVIA, "Pharmaceutical Market Trends," 2023]

- [FDA, "Drug Approval Process," 2022]

- [Global Data, "Reimbursement Strategies in Pharmaceutical Markets," 2023]

- [Company Press Release, "CONTOUR Clinical Trial Results," 2022]