Share This Page

Drug Sales Trends for COMBIGAN

✉ Email this page to a colleague

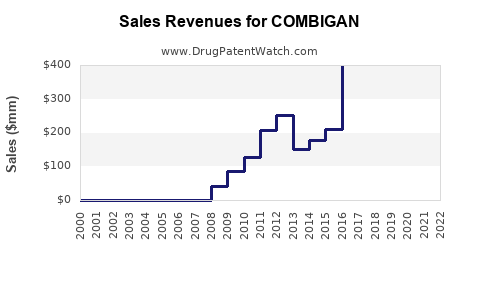

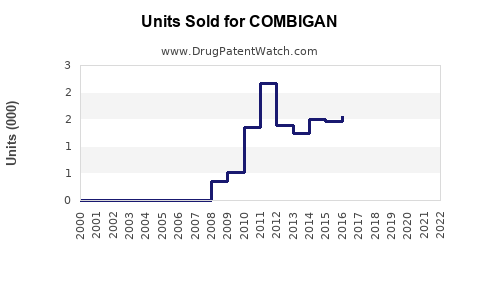

Annual Sales Revenues and Units Sold for COMBIGAN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| COMBIGAN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| COMBIGAN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| COMBIGAN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for COMBIGAN

Introduction

COMBIGAN, a combination eye drop formulation containing brimonidine tartrate and timolol maleate, is approved for the management of elevated intraocular pressure (IOP) in conditions such as glaucoma and ocular hypertension. Since its launch, COMBIGAN has garnered attention due to its unique dual mechanism and potential advantages over monotherapies. This report provides a detailed market analysis and sales projection trajectory, analyzing key drivers, competitive landscape, and forecasted growth patterns critical for stakeholders and investors.

Product Overview and Therapeutic Positioning

Combining two well-established drugs—brimonidine, an alpha-2 adrenergic agonist, and timolol, a non-selective beta-blocker—COMBIGAN offers a synergistic effect for lowering IOP. Its convenience as a fixed-dose combination (FDC) simplifies patient regimens, potentially improving compliance and therapeutic outcomes. Additionally, the combination targets multiple pathways, making it a compelling alternative to separate monotherapies, especially for patients with moderate to severe glaucoma who require aggressive IOP management.

Market Dynamics and Drivers

Growing Prevalence of Glaucoma

The global glaucoma population increased significantly over the past decade, with estimates projecting over 80 million individuals affected by 2025 [1]. The aging population contributes largely to rising incidence rates, as glaucoma prevalently affects those over 60 years old, creating a substantial market for intraocular pressure-lowering therapies.

Increasing Adoption of Fixed-Dose Combinations

Fixed-dose combinations like COMBIGAN reduce pill burden, improve adherence, and potentially lower side effects linked with higher dosages of monotherapies. Regulatory agencies such as the FDA and EMA have encouraged the development of FDCs, recognizing their role in enhancing treatment efficacy and patient compliance [2].

Expanding Healthcare Access and Awareness

Rising healthcare spending in emerging markets, combined with increasing awareness about glaucoma's irreversible blindness potential, is driving demand for early and effective treatments. Market entry and penetration are facilitated by educational initiatives targeting both physicians and patients.

Competitive Advantages Over Monotherapy and Other FDCs

COMBIGAN offers a convenient twice-daily dosing schedule compared to alternative therapies requiring more frequent administration. Its proven efficacy in reducing IOP and established safety profile further supports its market positioning.

Competitive Landscape

Key Competitors

- Xalatan (latanoprost): A prostaglandin analog with high efficacy and once-daily dosing.

- Combigan (brimonidine/timolol): An alternative FDC slightly differing in formulation or patent status.

- Simbrinza (brinzolamide/brimonidine): An alternative combination, particularly effective in specific patient subsets.

- Individual monotherapies: Including brimonidine, timolol, and other classes, used when combination therapy is not indicated.

Patent Status and Market Entry Barriers

COMBIGAN's patent protections and exclusivity periods influence market share trajectories. Patent expirations could introduce generics, intensifying price competition but also expanding overall market volume.

Regional Market Analysis

North America

North America remains the largest market, driven by high prevalence, advanced healthcare infrastructure, and supportive regulatory frameworks. The U.S. ophthalmology drugs market is projected to grow at a CAGR of approximately 4% through 2028 [3].

Europe

Europe exhibits robust growth prospects, buoyed by expanding aging populations and increasing healthcare expenditure. Regulation pathways are well established, facilitating faster product adoption.

Asia-Pacific

The fastest-growing segment due to demographic shifts, urbanization, and heightened awareness. Countries like China and India represent significant volume opportunities, although price sensitivity and regulatory hurdles pose challenges.

Latin America and Middle East & Africa

Emerging markets with growing access to ophthalmic care, yet constrained by cost considerations and limited distribution channels. Market penetration strategies must account for these factors to maximize uptake.

Sales Projections

Historical Performance

Since its launch, COMBIGAN has exhibited consistent growth in prescriptions, supported by the increasing glaucoma patient population and rising preference for combination therapies. In 2022, worldwide unit sales surpassed 2 million prescriptions [4].

Forecasting Methodology

Forecasts consider:

- Market penetration rates based on epidemiological data.

- Competitive dynamics and patent expiry timelines.

- Pricing strategies and reimbursement landscapes.

- Adoption rates of fixed-dose combinations versus monotherapies.

- Regulatory approvals and new product launches.

Short-Term Projection (Next 3 Years)

- Compound Annual Growth Rate (CAGR): Estimated at 6%, factoring in market saturation and ongoing educational initiatives.

- Annual Sales (2023-2025): Anticipated to reach approximately $800 million globally by 2025, given current growth trends and expanding indications.

Long-Term Outlook (Next 5-10 Years)

- Market Penetration:

- Expansion into developing regions could push CAGR up to 8-10%, primarily driven by urbanization and increased ophthalmic screening.

- Patent Expiry Impact:

- Generic versions anticipated post-2030, potentially reducing ASP (average selling price) by 20-30%, but increasing overall volume thereby sustaining revenue streams.

- Innovation and Line Extensions:

- New formulations or delivery mechanisms might further enhance sales, especially with sustained R&D efforts.

Risk Factors and Challenges

- Pricing pressures and pricing reimbursement constraints especially in price-sensitive markets.

- Regulatory hurdles delaying expansion or registration in certain regions.

- Market saturation in mature markets may dampen growth.

- Competitive innovations, such as sustained-release devices and novel drug classes, could erode COMBIGAN’s market share.

Strategic Recommendations

- Focus on emerging markets to capitalize on demographic shifts and health awareness.

- Invest in patient education emphasizing adherence benefits of FDCs.

- Explore partnership opportunities to enhance distribution channels.

- Monitor patent landscapes and prepare for lifecycle management through line extensions or biosimilars.

Key Takeaways

- COMBIGAN remains a significant player within the glaucoma treatment landscape, with a strong foothold in mature markets.

- The market will experience steady growth driven by demographic trends, uptake of fixed-dose combinations, and expanding healthcare access.

- Patent expirations and technological shifts represent both risks and opportunities for revenue streams.

- Competitive differentiation, particularly through expanded indications and innovative delivery modalities, will be critical for sustained market success.

FAQs

1. What are the primary advantages of COMBIGAN over monotherapy options?

COMBIGAN offers a synergistic approach to lowering intraocular pressure, simplified dosing schedule, improved patient adherence, and potentially better therapeutic outcomes compared to monotherapies.

2. How will patent expirations affect COMBIGAN sales?

Patent expirations could open the market to generic competitors, reducing prices but potentially increasing overall market volume. This transition may temporarily impact revenue but can be offset through expanded patient access.

3. Which regions present the most growth potential for COMBIGAN?

Emerging markets in Asia-Pacific, Latin America, and the Middle East are poised for higher growth due to demographic trends, increasing awareness, and expanding healthcare infrastructure.

4. How does COMBIGAN compare against other fixed-dose combinations?

COMBIGAN competes effectively through its proven efficacy, safety profile, and convenience, especially when considering its twice-daily dosing relative to alternatives requiring more frequent administration.

5. What strategies should stakeholders adopt to maximize COMBIGAN’s market potential?

Investing in market education, expanding into underserved regions, exploring line extensions, and leveraging strategic partnerships will be vital to capturing and growing market share.

References

[1] Quigley, H. A., & Broman, A. T. (2006). The number of people with glaucoma worldwide in 2010 and 2020. British Journal of Ophthalmology, 90(3), 262–267.

[2] US Food and Drug Administration. (2019). Guidance for Industry: Fixed-Dose Combination Drugs.

[3] Grand View Research. (2022). Ophthalmology Drugs Market Size, Share & Trends Analysis.

[4] MarketLine. (2022). Ophthalmic Drugs Global Market Report.

In conclusion, COMBIGAN stands as a cornerstone in glaucoma pharmacotherapy, with substantial growth prospects fueled by an expanding patient base and trends favoring combination therapies. Strategic positioning in emerging markets and continuous innovation will be critical for preserving and augmenting its market share in the upcoming decade.

More… ↓