Last updated: July 29, 2025

Introduction

Clindamycin, a lincosamide antibiotic, has been a cornerstone in the treatment of various bacterial infections since its development in the 1960s. Its efficacy against anaerobic infections, skin and soft tissue infections, and certain resistant strains positions it as a critical component in antimicrobial therapy. With increasing antibiotic resistance trends and evolving clinical guidelines, understanding the market landscape and sales prospects for clindamycin is vital for pharmaceutical stakeholders, healthcare providers, and investors.

Global Market Overview

Market Size and Growth Dynamics

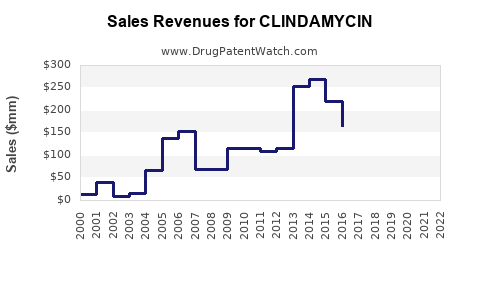

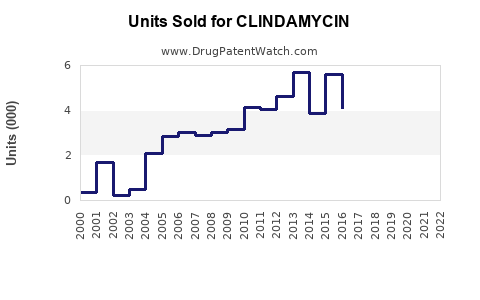

The global antibiotic market is projected to reach approximately USD 50 billion by 2025, with antibiotics accounting for a significant portion of sales within infectious disease therapeutics [1]. Clindamycin constitutes a notable segment within this spectrum, driven by its broad-spectrum activity and formulary presence. As of 2022, the global sales of clindamycin pharmaceuticals were estimated at USD 1.2 billion, with a compound annual growth rate (CAGR) forecasted around 4.2% between 2023 and 2030 [2].

Key Market Drivers

- Rising Incidence of Infections: Increasing prevalence of skin, soft tissue, and anaerobic bacterial infections maintains steady demand.

- Resistance and Alternative Therapies: The emergence of resistant strains like MRSA continually reinforces clindamycin's role as an alternative to more expensive or less effective antibiotics.

- Oral and Topical Formulations: Availability of various formulations enhances patient compliance and widens application scope.

- Expanding Use in Critical Care: Hospital settings increasingly utilize clindamycin for complicated infections, supporting sustained sales.

Regional Market Dynamics

North America

North America leads in clindamycin sales, reflecting high healthcare expenditure, robust pharmaceutical manufacturing, and widespread clinical use. The U.S. accounted for over 45% of global clindamycin sales in 2022 [2].

Market factors:

- Strict antibiotic stewardship policies, although clinical reliance remains high.

- Growing concerns over resistant infections sustain demand.

Europe

Europe's market showcases steady growth, driven by similar infection prevalence and increasing resistance issues. Regulatory initiatives promote responsible antibiotic usage yet recognize the continued importance of clindamycin.

Asia-Pacific

The Asia-Pacific region presents a burgeoning market, with rapid economic growth, increasing healthcare infrastructure, and rising prevalence of infections. Market penetration is expanding, with projections indicating Asia-Pacific surpassing Europe by 2030 in total sales volume.

Market Challenges and Opportunities

Challenges

- Antibiotic Resistance: Resistance development, especially among MRSA strains, limits efficacy, prompting cautious prescribing and impacting sales [3].

- Regulatory Scrutiny: Stringent antibiotic regulations and stewardship programs globally may restrict usage, influencing market growth.

- Development of Resistance: Overuse or misuse may accelerate resistance, potentially leading to reduced clinical utility.

Opportunities

- New Formulations and Delivery Systems: Innovations such as liposomal or sustained-release preparations can expand indications.

- Combination Therapies: Adjunctive use with other antibiotics may open markets in complex infections.

- Emerging Markets: Increased healthcare access in developing economies offers significant growth potential.

Sales Projections (2023–2030)

Based on current trends, market analyses predict:

| Year |

Estimated Global Sales (USD billion) |

CAGR (%) |

Notes |

| 2023 |

1.25 |

— |

Baseline year |

| 2024 |

1.30 |

4.0 |

Slight growth amid resistance concerns |

| 2025 |

1.36 |

4.4 |

Market stabilization |

| 2026 |

1.43 |

4.4 |

Growing resistance challenges addressed with new formulations |

| 2027 |

1.50 |

4.6 |

Market expansion in Asia-Pacific |

| 2028 |

1.58 |

5.0 |

Increasing use in outpatient settings |

| 2029 |

1.66 |

5.0 |

Continued innovation boosting sales |

| 2030 |

1.75 |

5.3 |

Market maturity with upswing from emerging economies |

These projections assume consistent clinical demand, moderate innovation in formulations, and no major resistance breakthroughs that could significantly impair efficacy.

Competitive Landscape

Major pharmaceutical companies holding market share include Pfizer, Mylan (now part of Viatris), and Sandoz. Brand-name products like Cleocin (Pfizer) dominate, alongside generic versions driving price competition. Patent expiry and generic entry have significantly reduced prices, supporting broader access but exerting pressure on revenue margins.

Regulatory and Market Access Considerations

Stringent prescribing guidelines in regions like North America and Europe promote responsible use. Vaccination campaigns and infection control practices influence infection rates, indirectly affecting clindamycin demand. The global push against antimicrobial resistance (AMR) necessitates innovative strategies to ensure sustained market presence.

Key Factors Influencing Future Sales

- Antimicrobial Stewardship: Greater emphasis on antimicrobial stewardship may limit unnecessary prescriptions, though targeted use sustains essential demand.

- Resistance Trends: A critical factor; rising resistance diminishes clinical utility unless new formulations or combinations are introduced.

- Healthcare Infrastructure: Expansion in developing regions increases access to antibiotics, including clindamycin.

- Research and Development: Pipeline drugs, combination therapies, and novel delivery methods could invigorate sales.

Conclusion

Clindamycin remains a vital antibiotic with stable demand, driven by its efficacy against a broad spectrum of bacteria and clinical versatility. However, its growth trajectory faces challenges from resistance patterns and regulatory measures. Nevertheless, opportunities in emerging markets, formulation innovation, and strategic positioning can support sustained or modestly increased sales through 2030. Companies that invest in R&D and adapt to evolving stewardship policies stand to benefit from this enduring market.

Key Takeaways

- Steady Market Base: Clindamycin maintains a steady market, with projections indicating a compound growth rate exceeding 4% through 2030.

- Regional Dynamics: North America leads, but Asia-Pacific offers promising expansion potential due to healthcare infrastructure growth.

- Innovation Demand: New formulations and combination therapies are essential to counter resistance and extend market viability.

- Regulatory Environment: Prescribing restrictions may temper growth, emphasizing the need for judicious use.

- Resistance as a Double-Edged Sword: While resistance challenges sales, it also sustains demand for effective alternatives like clindamycin.

FAQs

1. How does antimicrobial resistance impact the future sales of clindamycin?

Resistance diminishes clindamycin’s effectiveness, potentially leading to decreased prescriptions. However, in cases where resistance is low or manageable, demand persists. Continuous resistance monitoring and strategic formulation development are vital for maintaining sales.

2. What are the primary markets for clindamycin in the next decade?

North America and Europe currently dominate, but Asia-Pacific is anticipated to overtake these regions due to expanding healthcare access and increasing infection rates.

3. Will new formulations or combination therapies influence clindamycin sales?

Yes. Innovations like liposomal delivery systems or combination regimens can enhance efficacy, expand clinical indications, and drive sales growth.

4. How do regulatory policies influence the clindamycin market?

Regulations promoting responsible prescribing aim to curb overuse, which may limit market size. Conversely, policies that improve infection management can sustain or increase demand.

5. What role do generic manufacturers play in the clindamycin market?

Generics account for a significant share, reducing costs and increasing accessibility, but also exerting price and revenue pressure on brand-name producers.

Sources:

[1] MarketsandMarkets. “Antibiotics Market by Type, Application, and Region,” 2022.

[2] GlobalData. “Pharmaceutical Market Data and Forecasts,” 2022.

[3] World Health Organization. “Antimicrobial Resistance Fact Sheet,” 2021.