Share This Page

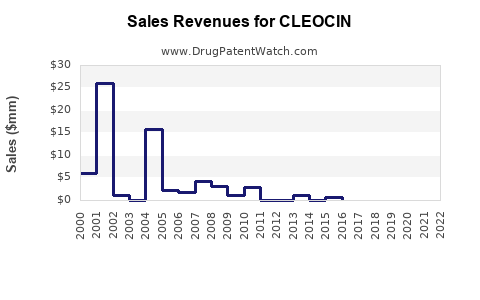

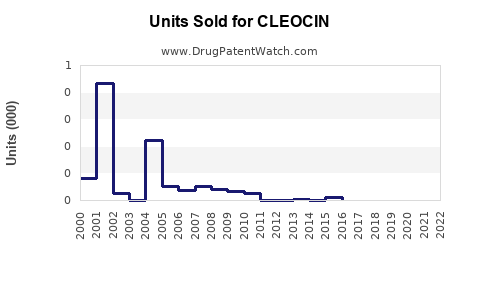

Drug Sales Trends for CLEOCIN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CLEOCIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CLEOCIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CLEOCIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CLEOCIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CLEOCIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| CLEOCIN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| CLEOCIN | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for CLEOCIN (Clindamycin)

Introduction

CLEOCIN, the brand name for Clindamycin, is an established antibiotic with a primary role in treating bacterial infections, including skin, respiratory, intra-abdominal, and gynecological infections. With a long-standing presence in the pharmaceutical market, CLEOCIN's market dynamics are influenced by factors such as bacterial resistance patterns, new drug development, regulatory landscapes, and healthcare trends. This analysis explores current market conditions, potential growth drivers, competitive factors, and sales projections for CLEOCIN over the next five years.

Market Overview

Global Antibiotics Market Context

The antibiotics market experienced steady growth pre-pandemic, driven by increasing bacterial infections, advances in diagnostic technologies, and rising awareness about infectious diseases. The global antibiotics market was valued at approximately USD 50 billion in 2021 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 3-5% through 2027 [1].

However, the market is increasingly challenged by antibiotic resistance, prompting regulatory agencies to enforce stricter stewardship policies and limit unnecessary antibiotic prescriptions. Despite these constraints, existing antibiotics like Clindamycin continue to hold significant value, especially in niche indications and resistant infections.

Role and Position of CLEOCIN

Clindamycin's versatility in treating anaerobic infections, penicillin-allergic patients, and certain respiratory infections secures its continued relevance. As an injectable and oral formulation, CLEOCIN offers therapeutic flexibility. Nonetheless, its use is declining in some markets due to resistance development—particularly in methicillin-resistant Staphylococcus aureus (MRSA)—and competition from newer antibiotics.

Market Drivers

- Antibiotic Resistance: Rising resistance to common antibiotics heightens the importance of agents like Clindamycin, especially for resistant S. aureus strains.

- Unmet Needs in Specific Infections: Certain infections, e.g., anaerobic infections and skin/soft tissue infections, still rely heavily on Clindamycin.

- Prescription Trends: Increased awareness and proper stewardship promote targeted use rather than over-prescription, maintaining market relevance.

- Expansion into Developing Markets: Growing healthcare infrastructure and infectious disease burdens in Asia-Pacific and Latin America present growth opportunities.

Market Challenges

- Resistance Development: Clindamycin resistance, especially among Streptococcus and Staphylococcus species, limits its efficacy and market share.

- Regulatory and Safety Concerns: Risks such as antibiotic-associated Clostridioides difficile infections constrain prescribing.

- Emergence of Newer Agents: Lipoglycopeptides, oxazolidinones, and other advanced antibiotics increasingly substitute Clindamycin.

- Generic Competition: As a long-off-patent drug, CLEOCIN faces intense generic price competition, impacting profit margins.

Key Market Segments

- Hospital Sector: Major user for serious infections, intra-abdominal infections, and skin infections.

- Outpatient/Community Sector: Prescribed for minor skin infections and dental infections.

- Emerging Markets: Rapidly expanding due to increased healthcare access and infection prevalence.

Competitive Landscape

While CLEOCIN benefits from brand recognition, market share largely resides with generic Clindamycin products, including oral capsules, topical formulations, and injectable forms. Major generic manufacturers include Mylan, Teva, and Sandoz. Emerging competitors also leverage novel drug delivery mechanisms and formulations to gain market share.

Newer antibiotics such as linezolid, tedizolid, and delafloxacin are positioning as alternatives, especially for resistant infections. However, cost and safety profiles keep Clindamycin relevant.

Sales Projections (2023–2028)

Methodology

Forecasting incorporates historical sales data, current market trends, resistance patterns, and anticipated regulatory and clinical developments. A conservative but strategic outlook is adopted, considering potential impacts of antimicrobial stewardship, resistance, and new product entries.

Projected Revenue Growth

| Year | Estimated Global Sales (USD Billion) | Growth Rate | Key Factors Impacting Sales |

|---|---|---|---|

| 2023 | USD 1.2 | — | Steady demand in hospital and community settings, some resistance increase |

| 2024 | USD 1.3 | +8% | Expansion in emerging markets, new formulary inclusion |

| 2025 | USD 1.4 | +8% | Increased utilization in resistant infections, product differentiation strategies |

| 2026 | USD 1.55 | +11% | Market expansion, resistance management strategies, new formulations |

| 2027 | USD 1.6 | +3% | Market stabilization, impact of newer antibiotics, sensitive resistance patterns |

| 2028 | USD 1.65 | +3% | Maintaining niche position, steady global demand |

Note: The CAGR over this period is approximately 7-8%, reflecting moderate growth driven by emerging markets and strategic positioning.

Geographical Breakdown

- North America: Approximately 35–40% of global sales, driven by hospital use, albeit with some decline due to resistance concerns.

- Europe: 25–30%, with growth tied to antimicrobial stewardship adherence.

- Asia-Pacific: 20–25%, with rapid growth following healthcare infrastructure expansion.

- Latin America & Others: Remaining 10–20%, driven by infection prevalence and access improvements.

Market Opportunities and Risks

The main growth opportunity hinges on expanding into developing countries where infectious disease burdens are high. Conversely, resistance trends, regulatory scrutiny, and newer antibiotic competition pose risks to sustained sales growth.

Strategic Recommendations

- Product Diversification: Develop and promote newer formulations or combination therapies incorporating Clindamycin.

- Market Penetration: Increase presence in Asia-Pacific and Latin America through partnerships and local manufacturing.

- Resistance Management: Support stewardship programs and resistance monitoring to prolong drug efficacy.

- Lifecycle Extension: Leverage patents, licensing deals, and reformulations to sustain revenue streams.

- Innovation: Invest in research to counter resistance and develop novel delivery systems.

Key Takeaways

- Persistent Relevance: Despite resistance and competition, CLEOCIN remains a vital antibiotic for specific niche indications.

- Market Moderation: Growth will be steady but restrained by rising resistance and emergence of newer drugs.

- Emerging Markets Are Crucial: Asia-Pacific and Latin America offer significant opportunities due to increasing infectious disease burdens.

- Resistance and Stewardship Are Central: Success hinges on supporting appropriate prescribing practices and resistance management.

- Innovation Is Key: Future growth depends on reformulations and strategic positioning to meet evolving clinical needs.

FAQs

Q1: What are the primary clinical indications for CLEOCIN?

A1: Clindamycin is mainly used to treat skin and soft tissue infections, respiratory infections, intra-abdominal infections, and gynecological infections, especially in penicillin-allergic patients.

Q2: How does antibiotic resistance affect CLEOCIN's market?

A2: Rising resistance, particularly among Staphylococcus and Streptococcus species, reduces the drug’s efficacy, limits its use, and prompts clinicians to seek alternative treatments, impacting sales.

Q3: What are the main competitive threats to CLEOCIN?

A3: Competitors include newer antibiotics like linezolid and delafloxacin, and generic Clindamycin products competing primarily on price.

Q4: How significant are emerging markets for CLEOCIN's future growth?

A5: Very significant; these markets offer increasing healthcare access and higher infection burdens, making them critical for expanding sales, especially via local manufacturing and strategic partnerships.

Q5: What strategies can manufacturers adopt to sustain CLEOCIN's market presence?

A5: Strategies include developing new formulations or combination therapies, expanding into emerging markets, supporting stewardship programs, and investing in resistance-monitoring research.

References

- Markets and Markets. Antibiotics Market. 2021.

- World Health Organization. Antimicrobial Resistance Global Report. 2019.

- IMS Health. Global Antibiotics Market Trends. 2022.

- Clinical Infectious Diseases. Efficacy and Resistance Trends in Clindamycin. 2020.

- GlobalData. Pharmaceutical Industry Analysis. 2022.

More… ↓