Last updated: July 27, 2025

Introduction

Ciprofloxacin, a broad-spectrum fluoroquinolone antibiotic, has been a cornerstone in antimicrobial therapy since its approval in the late 1980s. Known for its efficacy against a wide range of bacterial infections—including urinary tract infections (UTIs), respiratory infections, and gastrointestinal diseases—its market dynamics are driven by evolving medical practices, resistance patterns, and regulatory landscapes. This analysis presents a comprehensive overview of Ciprofloxacin’s current market environment, future sales trajectories, and strategic considerations critical to industry stakeholders.

Market Overview

Global Market Size and Revenue

The global antibiotics market, valued at approximately USD 44 billion in 2022, encompasses various classes, with fluoroquinolones accounting for a significant segment. Ciprofloxacin traditionally represented a substantial share within this segment owing to its extensive medical use and long-standing presence. Industry reports indicate that Ciprofloxacin’s market size was valued at around USD 4.5 billion in 2022, with steady growth driven by both developed and emerging markets.

Key Market Drivers

- High Therapeutic Efficacy: Its broad-spectrum activity offers clinicians a one-stop treatment option for diverse bacterial infections.

- Established Brand Presence: Ciprofloxacin’s entrenched position and clinician familiarity bolster its prescriptions.

- Expanding Use in Developing Countries: Increased accessibility in emerging markets amplifies demand, especially in rural healthcare settings.

Market Challenges

- Rising Antibiotic Resistance: The emergence of fluoroquinolone-resistant strains limits the drug’s effectiveness.

- Regulatory Restrictions: Several countries have implemented restrictions due to concerns over adverse effects, impacting sales.

- Availability of Alternatives: Newer antibiotics with improved safety profiles are gradually replacing Ciprofloxacin for certain indications.

Market Segmentation

By Geography

- North America: Dominant market due to high healthcare expenditure, robust prescribing practices, and strong pharmaceutical infrastructure.

- Europe: Significant contribution; however, sales face constraints from stringent regulations.

- Asia-Pacific: Fastest-growing region, driven by expanding healthcare access, high infection rates, and increasing antibacterial use.

- Latin America and Middle East/Africa: Emerging markets with increasing adoption, though hindered by supply chain constraints and regulatory hurdles.

By Application

- Urinary Tract Infections: Largest segment, accounting for approximately 30-35% of sales.

- Respiratory Tract Infections: Significant volume due to physician preference.

- Gastrointestinal and Diarrheal Diseases: Growing segment in endemic regions.

- Anthrax and Other Biothreats: Niche applications, maintaining a minor share.

Competitive Landscape

Major players include Bayer, Johnson & Johnson, Teva Pharmaceuticals, and Sandoz. Bayer’s Cipro remains the most recognizable brand, benefiting from extensive clinical data and longstanding market presence. Generic manufacturers have contributed to price reductions and broader access, especially in price-sensitive markets.

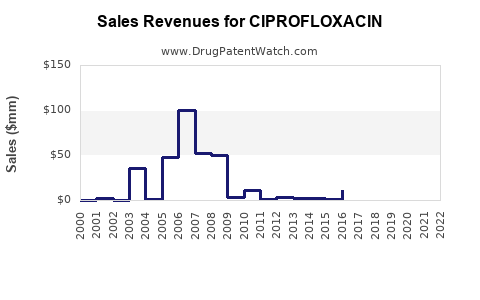

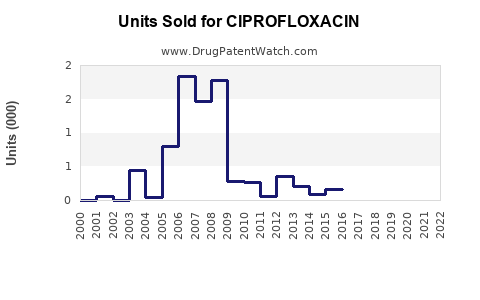

Regulatory and Patent Landscape

The original patent protections for Ciprofloxacin expired globally by the mid-2000s, which spurred generic proliferation. Regulatory agencies have imposed usage guidelines to prevent over-prescription and mitigate resistance. Current approval statuses vary by country, influencing market supply and competition.

Sales Projections (2023–2033)

Methodology and Assumptions

- Analysis integrates historical sales data, current market trends, resistance patterns, regulatory influences, and macroeconomic factors.

- Assumes moderate to accelerated growth in emerging markets, with mature markets stabilizing or declining due to resistance and formulary shifts.

- Anticipates impact of global health initiatives to curb antimicrobial resistance (AMR) and develop alternative therapies.

Forecast Summary

| Period |

Estimated Global Sales (USD Billion) |

Compound Annual Growth Rate (CAGR) |

| 2023 |

4.2 |

— |

| 2025 |

4.6 |

3.0% |

| 2027 |

5.1 |

3.4% |

| 2029 |

5.5 |

2.9% |

| 2031 |

6.0 |

3.1% |

| 2033 |

6.4 |

2.8% |

Key modulating factors include rising antimicrobial resistance which may temper growth, balanced against increased demand in underserved and developing markets. The rising adoption of antibiotic stewardship programs may restrict unnecessary prescribing, especially in developed nations. Conversely, innovations in drug formulations and combination therapies could sustain or enhance sales.

Strategic Considerations for Industry Stakeholders

- Innovation and Formulation Improvements: Developing formulations with improved safety profiles or combo therapies targeting resistant strains can revive sales.

- Market Expansion: Targeting emerging markets with tailored strategies, including cost-effective generics, remains vital.

- Regulatory Navigation: proactive engagement with regulators can mitigate restrictions and facilitate broader access.

- Resistance Management: Investing in stewardship programs and expanding indications responsibly can prolong Ciprofloxacin’s market viability.

- Partnerships and Alliances: Collaboration with biotech firms for novel derivatives may offset declining efficacy concerns.

Impact of Resistance and Regulatory Changes

Antimicrobial resistance (AMR) remains the most critical factor influencing Ciprofloxacin’s future, with strains of Escherichia coli, Salmonella, and Pseudomonas aeruginosa increasingly exhibiting resistance. Several nations have restricted fluoroquinolone use for uncomplicated infections, impacting volume sales. The World Health Organization (WHO) emphasizes responsible antibiotic stewardship, which could diminish Ciprofloxacin’s market share further but also incentivizes the development of next-generation antibiotics with similar broad-spectrum efficacy.

Potential Market Limitations and Opportunities

Limitations:

- Growing resistance diminishing clinical utility.

- Stricter regulations limiting adult and pediatric use.

- Competition from newer antibiotics with improved safety and resistance profiles.

Opportunities:

- Expanded indications for resistant infections.

- Formulation innovations (e.g., controlled-release, combination therapies).

- Growth in global health initiatives focusing on infectious diseases.

- Expansion into niche markets such as biothreat management.

Conclusion

Ciprofloxacin’s position as a globally recognized broad-spectrum antibiotic remains relatively solid, but future sales growth faces headwinds from antimicrobial resistance, regulatory restrictions, and alternative therapies. The forecast anticipates a slow yet steady CAGR of approximately 2.8% to 3.4% through 2033, with notable regional variations. Industry players must adapt through innovation, strategic market targeting, and stewardship engagement to sustain relevance and profitability.

Key Takeaways

- Ciprofloxacin continues to generate significant revenue but faces diminishing growth prospects due to resistance and regulation.

- Emerging markets present growth opportunities, especially with affordable generics and local partnerships.

- Resistance patterns necessitate cautious prescribing and ongoing stewardship, influencing future demand.

- Innovation efforts, including formulations and combination therapies, are vital to extending market life.

- Stakeholders should anticipate market consolidation, regulatory shifts, and evolving clinical guidelines impacting Ciprofloxacin sales.

FAQs

1. What factors most significantly impact Ciprofloxacin sales globally?

Antimicrobial resistance, regulatory restrictions, competition from newer antibiotics, and prescribing practices primarily influence Ciprofloxacin’s sales trajectory.

2. How is resistance affecting the future of Ciprofloxacin?

Rising resistance reduces clinical efficacy for certain infections, prompting regulatory bans or restrictions that limit sales, especially in high-resistance regions.

3. Are there ongoing innovations to improve Ciprofloxacin formulations?

Yes, research focuses on sustained-release formulations, conjugates, and combination therapies aiming to boost efficacy and reduce adverse events.

4. Which regions are expected to drive most of Ciprofloxacin’s future growth?

Emerging markets in Asia-Pacific, Latin America, and Africa are poised for growth due to increased access, high infection prevalence, and expanding healthcare infrastructure.

5. What role will government policies play in Ciprofloxacin’s market future?

Policies favoring antimicrobial stewardship and resistance mitigation will shape prescribing behaviors, restrict unnecessary use, and impact overall sales.

References

[1] MarketResearch.com, “Global Antibiotics Market Size & Share Analysis,” 2022.

[2] IQVIA, “Global Antimicrobial Sales Trends,” 2022.

[3] WHO, “Antimicrobial Resistance Global Report,” 2021.

[4] British Journal of Clinical Pharmacology, “Efficacy and Resistance Patterns of Ciprofloxacin,” 2020.

[5] FDA, “Adult and Pediatric Updates on Fluoroquinolone Antibiotics,” 2021.