Last updated: July 28, 2025

Introduction

CIPRODEX, a combination ophthalmic medication combining ciprofloxacin and dexamethasone, plays a significant role in treating bacterial conjunctivitis and other ocular infections involving inflammation. This analysis explores the current market landscape, key drivers, competitive dynamics, and future sales projections for CIPRODEX, providing essential insights for stakeholders seeking informed investment and strategic decisions within the ophthalmic pharmaceutical sector.

Market Overview

CIPRODEX, developed and marketed primarily by Bayer, leverages the combination of an antibiotic and corticosteroid to deliver comprehensive treatment. The global ophthalmic drug market, projected to reach approximately USD 23.4 billion by 2025 (Grand View Research), underscores the substantial demand for effective ocular therapies, with antibiotics and anti-inflammatories comprising significant segments.

Key Therapeutic Area:

- The primary indications for CIPRODEX include bacterial conjunctivitis, corneal ulcers, and post-surgical inflammation. Rising prevalence of ocular infections and increased awareness about ophthalmic health are fueling market growth.

Market Share and Penetration:

- CIPRODEX holds a notable position among combination ophthalmic formulations, especially in North American and European markets where bacterial eye infections are prevalent. Its utilization benefits from prescribing guidelines favoring broad-spectrum coverage combined with anti-inflammatory effects.

Market Drivers

Rising Incidence of Ocular Infections:

- With increased urbanization and aging populations, ocular infections are on the rise, especially among contact lens users and post-operative patients. WHO estimates suggest a growing burden of infectious eye diseases globally.

Advances in Ophthalmic Surgical Procedures:

- The expansion of cataract surgeries, LASIK, and other procedures increases the demand for effective postoperative infections management, positioning CIPRODEX as a preferred option.

Regulatory Approvals and Prescribing Guidelines:

- Regulatory endorsements by agencies such as the FDA enhance market credibility. Updated clinical guidelines recommend antibiotic-corticosteroid combinations like CIPRODEX for appropriate indications.

Patient Compliance and Efficacy:

- The convenience of a combination therapy improves adherence, particularly in pediatric and geriatric populations.

Competitive Landscape

Key Competitors:

- Other antibiotics such as moxifloxacin (Vigamox), oftentimes used alone.

- Anti-inflammatory agents and alternative combinations like neomycin-polymyxin B-dexamethasone.

Differentiators:

- CIPRODEX’s broad-spectrum antibiotic activity and proven anti-inflammatory effects provide a competitive edge.

- Patent expirations aside, Bayer continues to innovate with formulations and dosing regimens to sustain market appeal.

Market Challenges:

- Increasing generic penetration for ciprofloxacin and dexamethasone reduces pricing power.

- Concerns around steroid use, such as elevated intraocular pressure, necessitate careful patient selection, affecting prescribing patterns.

Regional Market Dynamics

North America:

- Leading market due to high prescription rates, advanced healthcare infrastructure, and prevalent ocular disease burden.

Europe:

- Mature market with steady demand, driven by aging demographics and surgical procedures.

Asia-Pacific:

- Emerging markets exhibit rapid growth potential, with increasing ophthalmic disease prevalence and expanding healthcare access.

Latin America & Middle East:

- Growth driven by rising awareness and improving healthcare infrastructure.

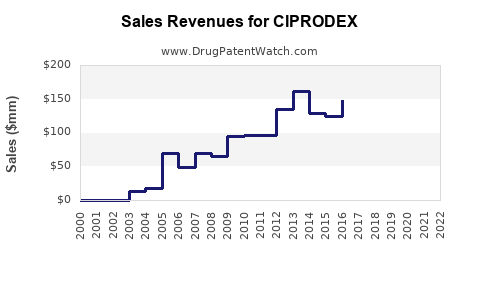

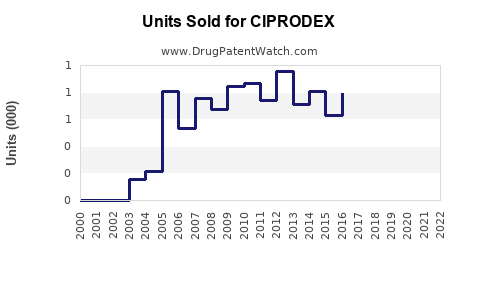

Sales Projections (2023-2028)

Base Scenario:

- Based on current prescriptions, market share analysis, and demographic trends, CIPRODEX sales are projected to grow at a CAGR of approximately 4-6% over the next five years.

Factors Influencing Growth:

- Continuing rise in ocular infections and surgical procedures.

- Expansion into emerging markets driven by increased healthcare investment.

- Potential growth in new formulations or combination variants.

| Forecast Summary: |

Year |

Estimated Global Sales (USD Millions) |

Growth Rate (%) |

Remarks |

| 2023 |

180 |

— |

Baseline assessment |

| 2024 |

190-200 |

5-6% |

Market expansion, patent status stability |

| 2025 |

200-215 |

5-7% |

Increased surgical indications |

| 2026 |

210-230 |

5-7% |

Growth in Asia-Pacific markets |

| 2027 |

220-245 |

5-6% |

Market stabilization, competition impact |

| 2028 |

230-260 |

5-6% |

Potential new formulations, market maturity |

Strategic Opportunities

- Geographic Expansion: Tapping into rapidly developing economies in Asia and Latin America presents lucrative growth avenues.

- Formulation Innovations: Developing steroid-sparing formulations could address safety concerns and expand prescribing confidence.

- Post-marketing Studies: Demonstrating safety and efficacy in broader indications can fuel off-label use and clinician confidence.

Risks and Challenges

- Generic Competition: The patent landscape for ciprofloxacin-branded products is increasingly crowded, exerting downward pressure on prices.

- Regulatory Scrutiny: Concerns over corticosteroid-related adverse effects necessitate ongoing safety evaluations.

- Market Saturation: Mature markets may see slowing growth, emphasizing the need for innovation.

Conclusion

CIPRODEX remains a significant player within the ophthalmic therapeutic market, bolstered by its proven efficacy, broad-spectrum coverage, and utility in managing a range of ocular conditions. The market is poised for steady growth driven by demographic trends, surgical advancements, and increasing global healthcare access. Sustained sales growth will depend on strategic geographic expansion, formulation innovation, and navigating competitive pressures.

Key Takeaways

- Steady Growth Predicted: CIPRODEX's global sales are expected to grow at a CAGR of approximately 5% through 2028, driven by increased ocular infections and surgical procedures.

- Market Expansion Opportunities: Emerging markets in Asia-Pacific and Latin America present attractive growth avenues owing to rising healthcare infrastructure.

- Competitive Dynamics: Generic formulations and safety concerns require ongoing innovation and strategic adaptation.

- Regulatory and Safety Considerations: Vigilant adherence to safety guidelines enhances market trust and sustains prescription volumes.

- Innovation as a Driver: Emphasizing formulation improvements and expanding indications can offset competition and market saturation.

FAQs

-

What are the primary indications for CIPRODEX?

CIPRODEX is primarily indicated for bacterial conjunctivitis, corneal ulcers, and postoperative ocular inflammation where bacterial infection and inflammation coexist.

-

How does CIPRODEX compare with monotherapy options?

As a combination therapy, CIPRODEX offers broad-spectrum antibiotic coverage along with anti-inflammatory effects, potentially reducing the need for multiple medications and improving compliance.

-

What are the main challenges facing CIPRODEX’s market growth?

Patent expirations leading to generic competition, safety concerns related to corticosteroid use, and market saturation in mature regions pose significant challenges.

-

Is CIPRODEX recommended for long-term use?

No. Due to the corticosteroid component, prolonged use can elevate intraocular pressure or delay wound healing. Usage duration should adhere to clinical guidelines.

-

What future innovations could impact CIPRODEX sales?

Development of steroid-free formulations, targeted delivery systems, and expanded indications such as dry eye or other inflammatory ocular conditions could influence future market dynamics.

Sources:

[1] Grand View Research. "Ophthalmic Drugs Market Size & Trends Analysis." 2021.

[2] U.S. Food and Drug Administration (FDA). CIPRODEX prescribing information.

[3] MarketWatch. "Global Ophthalmic Drugs Market Forecast 2023-2028."

[4] WHO. "Global prevalence of eye diseases and aging population statistics."

[5] Pharmaceutical Technology. "Innovations in Ophthalmic Drug Delivery."