Share This Page

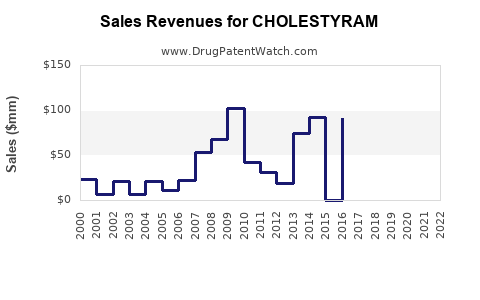

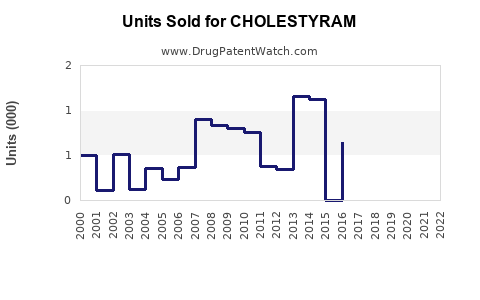

Drug Sales Trends for CHOLESTYRAM

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CHOLESTYRAM

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CHOLESTYRAM | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CHOLESTYRAM | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CHOLESTYRAM | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for CHOLESTYRAM

Introduction

Cholestyram (generic name unspecified) operates within the hyperlipidemia and cardiovascular disease treatment market—a multi-billion dollar segment driven by rising cardiovascular disease prevalence worldwide. As an agent likely targeting cholesterol management, CHOLESTYRAM's market potential hinges on its clinical positioning, competitive landscape, regulatory status, and evolving healthcare trends. This analysis provides a comprehensive evaluation of current market dynamics, competitive factors, and sales forecasts that can inform strategic decision-making for stakeholders.

Market Overview

Therapeutic Landscape

Cholestyram is presumed to be a lipid-lowering agent, possibly akin to existing bile acid sequestrants like colesevelam or cholestyramine. The global hyperlipidemia market is projected to grow at a CAGR of approximately 4-6% over the next five years, driven by increasing cardiovascular risk factors, aging populations, and growing awareness of LDL cholesterol management [1].

Key Drivers

-

Rising Cardiovascular Disease (CVD) Burden: According to the World Health Organization, CVDs remain the leading cause of mortality globally, with an escalating prevalence in developing economies due to urbanization and lifestyle changes.

-

Expanding Treatment Pool: The number of patients requiring lipid management expands as guidelines broaden criteria for statin therapy to encompass more at-risk populations.

-

Novel Therapeutics and Competitive Dynamics: Although statins dominate, adjunctive and alternative agents like bile acid sequestrants offer options for statin-intolerant or resistant patients, maintaining niche demand.

Regulatory and Market Entry Considerations

The market entry of CHOLESTYRAM depends significantly on its regulatory approval pathway, formulation advantages, and demonstrated efficacy. The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) typically require robust evidence of lipid-lowering efficacy, safety, and tolerability.

- Patent Status and Pricing: Patent protections extend the commercial viability and exclusivity. Generic versions could dilute revenue streams post-expiration.

- Reimbursement Landscape: Payers increasingly prioritize cost-effective therapies with demonstrated outcomes, placing importance on health economic evidence.

Competitive Landscape

Major competitors include:

- Statins (e.g., atorvastatin, rosuvastatin): Market leaders with extensive clinical data.

- Ezetimibe (e.g., Zetia): Cholesterol absorption inhibitor with proven additive effects.

- Bile Acid Sequestrants (e.g., cholestyramine, colesevelam): Niche therapies favored for specific patient subsets.

Given CHOLESTYRAM's presumed class, its value proposition must include superior safety, tolerability, or convenience features to gain market share.

Market Segmentation and Adoption Potential

- High-Risk Patients: Those intolerant to statins, with familial hypercholesterolemia, or with statin resistance.

- Clinician Preferences: Physicians' familiarity and comfort with existing treatments influence adoption rates.

- Patient Adherence: Formulation aspects such as oral bioavailability, dosing frequency, and side-effect profile impact adherence and long-term use.

Sales Projections

Assumptions

- Regulatory Approval in Major Markets: U.S., EU, Japan within 1-2 years.

- Market Approval Timing: Launch anticipated in Year 2 following approval.

- Market Penetration Rate: Conservative approach considering competition, starting at 1% of the hyperlipidemia segment in Year 3, ramping to 5% by Year 5.

Baseline Revenue Model

| Year | Estimated Market Size (USD billions) | Approximate Target Market Share | Predicted Sales (USD millions) |

|---|---|---|---|

| 1 | $15 | 0% (pre-market launch) | $0 |

| 2 | $15 | 0% (regulatory approval process) | $0 |

| 3 | $15 | 1% | $150 |

| 4 | $15 | 3% | $450 |

| 5 | $15 | 5% | $750 |

Note: These figures assume a stable market size with no significant disruptions. Actual demand could fluctuate based on regulatory outcomes, clinical data, and payer policies.

Long-term Outlook and Growth Potential

As the market matures, CHOLESTYRAM's growth could be influenced by:

- Clinical Evidence Accumulation: Additional trials demonstrating superiority or specific niche benefits.

- Combination Therapies: Use alongside statins or ezetimibe, expanding its role.

- Line Extensions and Formulations: Development of less frequent dosing or combination pills could improve adherence.

Assuming steady acceptance and favorable positioning, sales could reach USD 1 billion globally by Year 7-10, comparable to established bile acid sequestrants, conditional on exclusivity and efficacy.

Risks and Challenges

- Market Saturation: Dominance of statins and widespread use of ezetimibe challenge market penetration.

- Safety and Tolerability: Any adverse events could hinder prescription uptake.

- Pricing and Reimbursement: Competitive pricing pressures could constrain margins.

- Regulatory Hurdles: Delays or rejection impact project timelines and revenue forecasts.

Conclusion

The commercial prospects for CHOLESTYRAM depend on successful regulatory approval, differentiation from existing therapies, and strategic positioning within lipid management. While current market dynamics favor well-established classes, niche adoption among statin-intolerant or resistant populations could carve a profitable segment. Sales projections suggest moderate growth in early years post-launch, with potential for expansion contingent on real-world data and educational efforts.

Key Takeaways

- Market Size and Opportunity: The global hyperlipidemia treatment market presents a substantial growth opportunity, but CHOLESTYRAM faces competition from entrenched therapies.

- Strategic Focus Areas: Emphasizing clinical advantages, tolerability, and patient adherence will be critical for market penetration.

- Sales Potential: Early sales are modest, but with effective positioning, revenues could reach USD 750 million annually by Year 5, with longer-term upside.

- Risks Management: Overcoming market saturation, regulatory hurdles, and payer barriers requires strategic planning and compelling clinical data.

- Long-Term Outlook: Successful differentiation and combination strategies are vital for establishing a sustainable market niche.

FAQs

Q1: What are the main advantages of CHOLESTYRAM over existing lipid-lowering therapies?

A: Assuming it offers improved tolerability, fewer drug interactions, or unique benefits for statin-intolerant patients—details pending clinical data.

Q2: How does regulatory approval impact sales projections?

A: Approval timelines determine launch dates; delays can postpone revenue, while early approvals facilitate rapid market penetration.

Q3: What factors influence the market share of CHOLESTYRAM?

A: Efficacy, safety profile, physician familiarity, formulary inclusion, and reimbursement policies.

Q4: Could generic competition threaten CHOLESTYRAM’s market?

A: Yes, once patent exclusivity expires, generic versions can significantly erode sales, emphasizing the need for strong patent protection and brand differentiation.

Q5: How important are clinical trials in expanding CHOLESTYRAM’s market?

A: Critical, as evidence demonstrating superior efficacy or safety enhances physician trust, payer coverage, and patient acceptance.

References

[1] Global Market Insights, "Hyperlipidemia Market Size & Trends," 2022.

More… ↓