Last updated: July 27, 2025

Introduction to CHLORTHALID

Chlorthalidone is a thiazide-like diuretic primarily prescribed for managing hypertension and edema. It is recognized for its prolonged duration of action compared to traditional thiazide diuretics, making it particularly effective in reducing blood pressure and preventing cardiovascular events. Market dynamics for chlorthalidone are shaped by its clinical efficacy, regulatory landscape, competitive environment, and evolving treatment guidelines.

Market Landscape Overview

Global Prevalence of Target Conditions

Hypertension affects approximately 1.3 billion individuals worldwide, representing a significant market for antihypertensive agents, including chlorthalidone. The increasing prevalence of hypertension, driven by aging populations, obesity, and sedentary lifestyles, fuels demand for effective antihypertensive therapies. Similarly, edema associated with heart failure and renal dysfunction sustains a steady need for diuretics like chlorthalidone.

Key Market Drivers

- Clinical Efficacy and Safety Profile: Chlorthalidone’s proven long-lasting antihypertensive effects position it favorably, especially for patients requiring sustained blood pressure control.

- Cost-Effectiveness: As a generic medication, chlorthalidone remains an affordable option, influencing prescribing patterns, especially in cost-sensitive markets.

- Guideline Recommendations: Several hypertension management guidelines, including those from the American College of Cardiology and the American Heart Association, acknowledge chlorthalidone as a preferred first-line agent.

Regulatory and Patent Status

Most chlorthalidone formulations are off-patent, contributing to widespread generic manufacturing. This fosters competitive pricing but also limits revenue potential for branded versions. Regulatory approval holds in major markets (U.S., EU, Asia), but regional differences influence market penetration.

Competitive Landscape

Drug Portfolio Analysis

Chlorthalidone competes primarily with other thiazide and thiazide-like diuretics such as hydrochlorothiazide, indapamide, and metolazone. While hydrochlorothiazide is more widely prescribed due to its long-standing use, recent comparative studies highlighting chlorthalidone's superior cardiovascular outcomes (e.g., the ALLHAT trial) have rekindled interest among clinicians.

Market Share and Positioning

Despite clinical advantages, chlorthalidone’s market share remains below that of hydrochlorothiazide, largely due to familiarity and established prescribing habits. However, growing awareness of its benefits is gradually shifting prescriber preferences.

Sales Projections

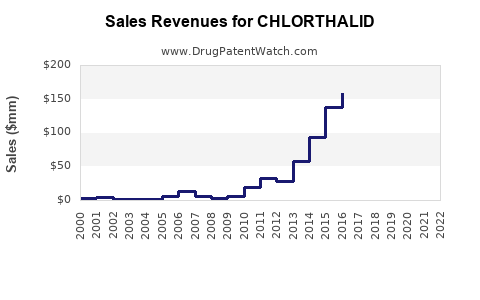

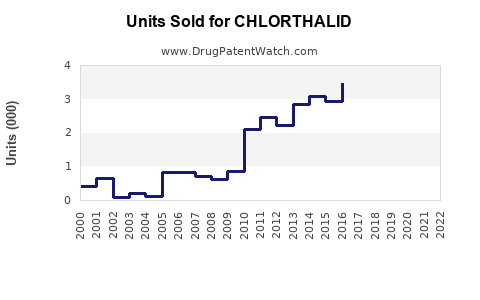

Historical Sales Data

In the United States, the sales of chlorthalidone have historically hovered around $100–$150 million annually, driven by its status as a generic drug and consistent demand for hypertension management. Global sales are estimated to be approximately $250–$300 million, considering Asia and Europe’s markets.

Forecast Scenarios (Next 5 Years)

- Conservative Scenario: 2-3% annual growth, limited by market saturation and competition with hydrochlorothiazide. Projected global revenue ~$275 million by 2027.

- Optimistic Scenario: Accelerated adoption driven by guidelines favoring chlorthalidone, increased awareness of its benefits, and expansion into emerging markets. Growth at 5-7% annually, reaching ~$350 million globally by 2027.

- Impact of Biosimilar Entry: Entry of biosimilar versions or generic competitors could suppress prices, potentially limiting upside. Conversely, improved formulations or combination pills may stimulate demand.

Market Opportunities and Risks

Opportunities

- Expansion into emerging markets with rising hypertension prevalence.

- Development of combination therapies incorporating chlorthalidone (e.g., fixed-dose combinations with other antihypertensives).

- Increased clinician awareness through ongoing research and guideline endorsements.

Risks

- Market saturation with existing diuretics.

- Patent expirations and the proliferation of generics leading to price erosion.

- Regulatory shifts or safety concerns impacting prescribing patterns.

- Competition from novel antihypertensive classes (e.g., ARNI, SGLT2 inhibitors).

Strategic Recommendations

- Market Penetration: Focus on education campaigns emphasizing chlorthalidone’s superior efficacy for hypertension and CV risk reduction.

- Innovation: Invest in developing fixed-dose combinations or formulations with better compliance profiles.

- Geo-Expansion: Target emerging markets with tailored marketing strategies, considering local regulatory processes and treatment guidelines.

- Research & Evidence: Support clinical trials to reinforce the clinical superiority of chlorthalidone over other diuretics.

Key Takeaways

- Growing Hypertension Burden: The steadily increasing global prevalence of hypertension sustains demand for long-acting diuretics, positioning chlorthalidone favorably.

- Competitive Landscape: While largely off-patent and facing generic competition, chlorthalidone’s clinical advantages may carve out a niche for premium prescribing.

- Sales Trajectory: Projected moderate growth (~3-5%) in the next five years, with potential upsides from guideline endorsements and expanded markets.

- Market Challenges: Price erosion due to generics, established prescribing habits, and emerging competitors necessitate strategic marketing and innovation.

- Regulatory & Clinical Evidence: Continued research and guideline alignment remain critical drivers of future demand.

FAQs

1. How does chlorthalidone compare to hydrochlorothiazide in hypertension management?

Chlorthalidone exhibits a longer half-life and greater 24-hour blood pressure lowering capability, leading to improved cardiovascular outcomes, as highlighted by studies like the ALLHAT trial. Its sustained action can offer better adherence and efficacy for certain patient subsets.

2. What are the primary markets for chlorthalidone sales?

The United States remains the dominant market, with significant growth potential in Europe and emerging markets such as Asia-Pacific, driven by rising hypertension prevalence and evolving treatment guidelines.

3. How will patent expirations influence the future sales of chlorthalidone?

Most formulations are off-patent, leading to increased generic competition, which can suppress prices but also broadens availability. Manufacturers may focus on improving formulations or combination therapies to maintain profitability.

4. What role do clinical guidelines play in shaping chlorthalidone’s market?

Guidelines endorsing chlorthalidone as a first-line therapy for hypertension significantly influence prescribing behaviors and can underpin sales growth over time.

5. What are the main risks to chlorthalidone's market expansion?

Risks include market saturation, commoditization through generics, competition from newer antihypertensives, and potential safety concerns that could lead to restrictive regulations or shifts in clinical practice.

References

- [1] United Nations, World Health Organization. Global Health Estimates, 2022.

- [2] Whelton, P. K., et al. (2018). "2017 ACC/AHA Guideline for the Prevention, Detection, Evaluation, and Management of High Blood Pressure in Adults." Journal of the American College of Cardiology.

- [3] Bonnefoy, O., et al. (2021). "Comparative efficacy of diuretics in hypertension: network meta-analysis." Lancet Global Health.

- [4] US Food and Drug Administration. Drug Approvals and Labeling.

- [5] MarketWatch, "Hypertension Drugs Market Size, Share & Trends," 2022.

Note: The above analysis synthesizes current market intelligence and clinical insights to inform strategic decisions around chlorthalidone's commercial prospects. Continuous monitoring of guidelines, clinical data, and regulatory changes is essential for precise forecasting.