Last updated: July 27, 2025

rket Analysis and Sales Projections for Cetirizine

Introduction

Cetirizine, an antihistamine widely used for allergy relief, stands as one of the most prescribed medications globally. This second-generation antihistamine offers a favorable safety profile, minimal sedative effects, and broad applicability across seasonal allergic rhinitis, perennial allergic rhinitis, and chronic idiopathic urticaria. As the pharmaceutical industry evolves, understanding cetirizine's market landscape and forecasted sales trajectory is critical for stakeholders ranging from manufacturers to investors.

Market Overview

Global Market Size

The global antihistamine market was valued at approximately USD 4.2 billion in 2022, with cetirizine accounting for a significant share, estimated at roughly 35-40% of this pie, owing to its popularity and widespread approval (Market Research Future). The robust demand stems from a rising prevalence of allergies, urbanization-related environmental factors, and increased awareness of allergic conditions.

Key Market Drivers

- Rising Prevalence of Allergic Disorders: According to the World Allergy Organization, allergy prevalence has increased by 50% over the past decade across multiple regions, fueling demand for effective antihistamines like cetirizine.

- Awareness and Prescription Rates: Increased awareness campaigns and evolving clinical guidelines favor the use of second-generation antihistamines, including cetirizine, for first-line allergy management.

- Over-the-Counter (OTC) Availability: The widespread OTC status in many countries enhances consumer access, boosting sales volumes.

Regional Insights

- North America: The largest market, propelled by high allergy prevalence, advanced healthcare infrastructure, and OTC sales channels. US sales alone accounted for over USD 1.2 billion in 2022.

- Europe: Steady growth owing to expanding OTC availability and regulatory approval in multiple countries.

- Asia-Pacific: Fastest-growing segment driven by urbanization, increasing awareness, and expanding healthcare access. China and India are emerging as major markets, collectively constituting over 30% of regional sales.

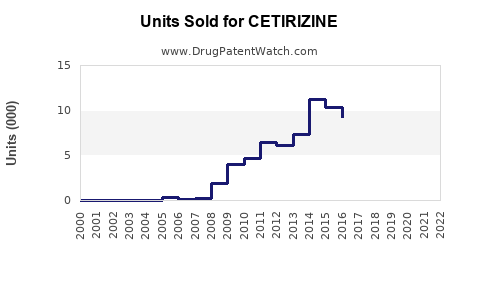

Competitive Landscape

Leading pharmaceutical firms like UCB Pharma, Johnson & Johnson, and Sanofi produce established cetirizine brands (e.g., Zyrtec). Generic manufacturers also dominate the market, intensifying price competition. Patent expirations in key markets have facilitated a surge in generic versions, further expanding the market.

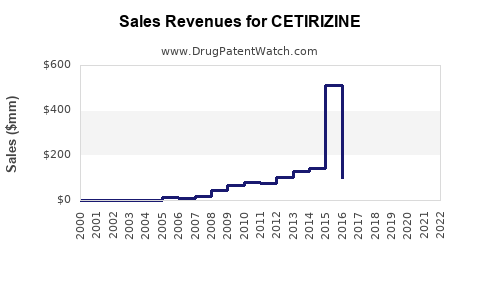

Sales Projections (2023–2028)

Growth Outlook

The global cetirizine market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 4-6% over the next five years, driven by demographic shifts, allergy prevalence, and OTC sales expansion.

Forecasted Revenue

- 2023: USD 1.62 billion

- 2024: USD 1.70 billion

- 2025: USD 1.79 billion

- 2026: USD 1.88 billion

- 2027: USD 1.98 billion

- 2028: USD 2.09 billion

These projections reflect ongoing genericization, continued consumer demand, and expanding regional markets. Growth is expected to be particularly strong in Asia-Pacific, where increasing healthcare infrastructure enhances access.

Market Dynamics Influencing Sales

Regulatory Environment

Regulatory bodies, including the FDA and EMA, have maintained cetirizine's status as OTC or prescription medication based on region, influencing accessibility and sales volume. Stringent regulations can impact approval timelines for new formulations, but existing approvals facilitate sustained sales.

Pricing and Reimbursements

Generic proliferation has driven prices down, expanding affordability. Insurance coverage and reimbursement policies in developed markets sustain high sales volumes, though price sensitivity remains a factor in emerging regions.

Innovation & New Formulations

While cetirizine is a mature compound, evolving formulations—such as fast-dissolving tablets, pediatric suspensions, and combination therapies—offer avenues for boosting sales. Clinical research also underpins options to expand indications.

Risk Factors and Challenges

- Market Saturation: The widespread availability and generic competition limit premium pricing, constraining profit margins.

- Competition from Newer Agents: Novel antihistamines with enhanced efficacy or fewer side effects may impact cetirizine’s market share.

- Regulatory Changes: Potential shifts in OTC classification or new safety regulations can affect sales dynamics.

- Environmental and Allergenic Trends: Variations in allergy prevalence due to climate change and urbanization could influence demand.

Strategic Opportunities

- Regional Expansion: Accelerating penetration in emerging markets, particularly India and Southeast Asia, offers growth potential.

- Product Differentiation: Developing formulations tailored for specific demographics or combining cetirizine with other agents could enhance market share.

- Brand Consolidation: Leveraging strong brand identities in developed regions can sustain premium positioning.

Key Takeaways

- Market size and growth prospects are favorable, with an expected CAGR of 4-6% from 2023-2028.

- Generic competition and price sensitivity are primary factors constraining margins but expanding volumes in emerging markets offset this.

- Regulatory frameworks, OTC availability, and evolving formulations influence sales trajectories significantly.

- Regional disparities favor North America and Europe in mature markets, while Asia-Pacific remains the fastest-growing segment.

- Innovation, regional expansion, and strategic branding will be critical for manufacturers aiming to optimize cetirizine sales.

FAQs

1. What are the primary indications for cetirizine?

Cetirizine is primarily used to treat allergic rhinitis, perennial allergic rhinitis, and chronic idiopathic urticaria, offering quick relief with minimal sedation.

2. How does cetirizine compare to other second-generation antihistamines?

Cetirizine offers comparable efficacy but may have a slightly higher sedative risk compared to loratadine or levocetirizine. Its rapid onset and proven safety track record sustain its popularity.

3. What factors could impact cetirizine's market growth?

Regulatory changes, entry of new antihistamines, patent expirations, environmental allergy trends, and regional economic growth are core influencing factors.

4. How significant is the over-the-counter availability of cetirizine?

OTC access enhances consumer convenience, expands usage, and correlates positively with sales volume, especially in North America and Europe.

5. What strategic moves should manufacturers prioritize?

Focus on regional expansion, innovate formulations, strengthen brand recognition, and monitor regulatory trends to stay competitive.

References

[1] Market Research Future, "Antihistamines Market Analysis & Forecast," 2022.

[2] World Allergy Organization, "Global Allergy Statistics," 2021.

[3] IQVIA, "Pharmaceutical Sales Data," 2022.

[4] Company Annual Reports (UCB Pharma, Johnson & Johnson, Sanofi), 2022.

[5] Industry Articles and Market Reports, 2022-2023.