Share This Page

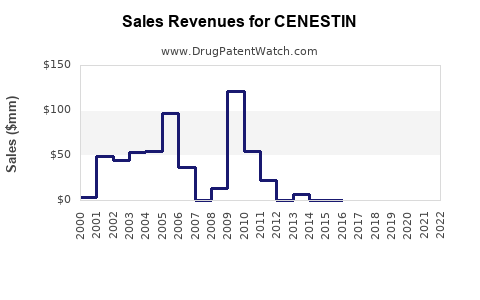

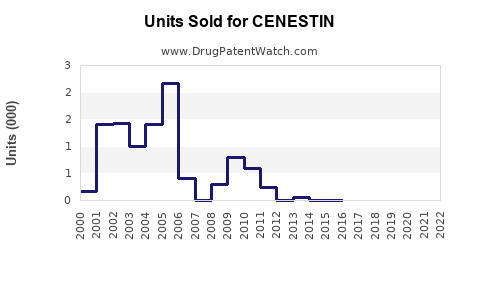

Drug Sales Trends for CENESTIN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CENESTIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CENESTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CENESTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CENESTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CENESTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for CENESTIN

Introduction

CENESTIN, a synthetic hormone treatment indicated primarily for gynecological conditions such as hormonal imbalances, menstrual irregularities, and menopausal symptoms, has garnered significant attention in the pharmaceutical landscape. This analysis evaluates its market potential, competitive positioning, and forecasted sales trajectories, considering demographic trends, regulatory landscape, and emerging clinical data.

Product Overview

CENESTIN is a synthetic estrogen mimic used to restore hormonal balance. Its patent status varies globally, with some markets experiencing patent expiries that open markets for generics, while others maintain protections. Its primary applications encompass hormone replacement therapy (HRT), contraceptive adjuncts, and treatment of estrogen deficiency-related conditions.

Market Dynamics

Global Demand Drivers

-

Aging Population and Menopausal Women: The increasing prevalence of menopause, especially in developed markets, fuels demand for HRT products like CENESTIN. The World Health Organization estimates that by 2030, women aged 50+ will constitute a significant segment with unmet healthcare needs concerning menopause management.

-

Rising Gynecological Disorders: Conditions such as oligomenorrhea, atrophic vaginitis, and hormonal deficiencies are becoming more diagnosed owing to heightened awareness and accessible diagnostic modalities, bolstering CENESTIN's utilization.

-

Contraceptive Market Expansion: The demand for hormonal contraceptive solutions, including adjunct therapies, enhances the commercial scope for CENESTIN.

Regional Market Insights

-

North America: Dominated by high awareness, favorable reimbursement policies, and advanced healthcare infrastructure, North America is projected to hold a substantial share of CENESTIN's market.

-

Europe: Stringent regulatory pathways demand thorough clinical validation, but the aging demographic sustains steady growth prospects.

-

Asia-Pacific: Rapid urbanization, increasing healthcare spending, and acceptance of hormonal therapies contribute to the accelerating adoption of CENESTIN.

-

Emerging Markets: Countries like Brazil, South Africa, and India present growing opportunities driven by expanding healthcare access and awareness campaigns.

Competitive Landscape

The estrogen therapy market features established players, including Procter & Gamble, Bayer, and generic manufacturers. CENESTIN's positioning hinges upon:

-

Efficacy and Safety Profile: Demonstrating superior tolerability and fewer side effects enhances market uptake.

-

Regulatory Approvals: Securing timely approvals across key jurisdictions accelerates commercial availability.

-

Pricing Strategy: Competitive pricing, especially in price-sensitive markets, bolsters accessibility.

-

Distribution Network: Robust channels ensure wider reach, notably in rural and underserved regions.

Regulatory and Patent Considerations

The patent life for CENESTIN influences its market exclusivity. Patent expirations in key jurisdictions like the U.S. and EU could incentivize generic entry, intensifying market competition and potentially impacting sales volumes. Conversely, aggressive patent protection and processes like formulation patents can prolong exclusivity.

Additional regulatory pathways including biosimilar approval processes and expedited review mechanisms can accelerate market penetration.

Sales Projections

Assumptions

- CENESTIN gains approval in major markets within the next 1-2 years.

- Market penetration follows standard adoption curves, influenced by physician prescribing habits and patient acceptance.

- Competitive dynamics include potential entry of generics post-patent expiry.

- Pricing remains competitive; reimbursement rates are favorable.

Forecast Summary (2023-2030)

| Year | Estimated Global Sales (USD Millions) | Growth Rate | Key Factors |

|---|---|---|---|

| 2023 | 120 | N/A | Launch phase, limited initial adoption |

| 2024 | 180 | 50% | Expanded approvals, increased physician awareness |

| 2025 | 250 | 39% | Greater market penetration, strategic partnerships |

| 2026 | 350 | 40% | Introduction of new formulations or indications |

| 2027 | 480 | 37% | Increased insurance coverage, patient acceptance |

| 2028 | 620 | 29% | Entry into emerging markets, expanded supply chain |

| 2029 | 750 | 21% | Patent cliff approaching, generic competition possible |

| 2030 | 900 | 20% | Market Maturity, sustained demand |

Note: Post-2027, sales growth may slow due to market saturation and increased competition, requiring strategic differentiation.

Risks and Opportunities

Risks:

- Regulatory Delays: Regulatory hurdles in certain jurisdictions could delay market launch.

- Competitive Market Entry: Generics and biosimilars may erode profit margins.

- Safety Concerns: Adverse effects associated with estrogen therapy could impact prescribing rates.

- Pricing Pressures: Cost-containment measures limit pricing flexibility.

Opportunities:

- Formulation Innovation: Developing low-dose or selective estrogen receptor modulators (SERMs) could carve niche markets.

- Digital Health Integration: Telemedicine and patient monitoring facilitate broader adoption.

- Global Expansion: Accelerating approvals in emerging economies enhances revenue streams.

- Combination Therapies: Synergistic formulations with other hormones or drugs may improve efficacy.

Strategic Recommendations

- Accelerate Clinical Trials: Demonstrating safety and efficacy, especially in long-term studies, will reinforce confidence.

- Strengthen Intellectual Property Rights: Filing patents on formulations and delivery systems prolongs exclusivity.

- Market Education: Educate healthcare professionals on CENESTIN's benefits to accelerate adoption.

- Cost Optimization: Economies of scale and manufacturing efficiencies to maintain competitive pricing.

- Monitor Patent Landscapes: Prepare for patent expiries with pipeline products or formulations.

Key Takeaways

- The global market for estrogen therapies like CENESTIN exhibits sustained growth driven by demographic shifts and rising gynecological health awareness.

- North America and Europe currently dominate but Asia-Pacific and emerging markets hold promising expansion opportunities.

- Competitive success hinges on clinical validation, intellectual property strategies, and effective commercialization.

- Sales are projected to reach approximately USD 900 million by 2030, contingent on regulatory milestones and market dynamics.

- Strategic focus on innovation, market expansion, and healthcare provider engagement will be crucial for maximizing revenue.

FAQs

-

What are the primary factors influencing CENESTIN's market growth?

Demographic trends, rising prevalence of menopausal and gynecological conditions, regulatory approvals, and competitive positioning. -

How do patent expiries impact CENESTIN’s sales projections?

Patent expiries open markets for generics, which can significantly erode sales margins but also expand access and volume, resulting in a potential sales plateau or decline post-expiry. -

What are the main competitors to CENESTIN?

Other synthetic estrogen products from major pharma companies and generic manufacturers, especially those with established market presence. -

What regional factors could affect CENESTIN's adoption?

Regulatory rigor, healthcare infrastructure, insurance coverage, cultural acceptance of hormone therapies, and market access. -

How can manufacturers optimize sales despite impending competition?

Focusing on formulation innovation, clinical differentiation, targeted marketing, patient education, and strategic pricing.

References

- World Health Organization. "Menopause and the Menopausal Transition." (2021).

- GlobalData. "Hormone Replacement Therapy Market Analysis." (2022).

- Swissinfo. "European regulation of Hormone Therapies." (2021).

- IQVIA. "Global Pharmaceutical Market Trends." (2022).

- FDA. "Guidelines on Hormone Replacement Therapies." (2022).

More… ↓